Self-employed and coronavirus: what help is the Government providing and when will it be available?

A few five-minute phone calls were all it took for Ed Barker, a freelance musician, to lose thousands of pounds worth of work and see his diary wiped clean for the foreseeable future.

Mr Barker, 35, a saxophonist who has accompanied George Michael, is concerned about how he and many others within his industry will continue paying the bills now that his income has fallen by more than 80pc.

Chancellor Rishi Sunak is expected to announce a rescue package for Britain’s five million self-employed workers imminently after accusations that this group had been left behind by the Government’s coronavirus planning. But what form this support will take and who may be exempt remains unclear. Here is what we know so far.

What could the rescue package look like?

Britain could follow the example of Denmark and Norway by promising to pay contractors a proportion of their income calculated using their earnings over the past few years. In Norway self-employed people have been guaranteed 80pc of their usual monthly incomes, based on providing several years of tax returns.

Alternatively it could adopt a French-style model and offer a flat payment for anyone whose earnings drop by more than 70pc. Or it could take an entirely different approach.

What’s causing the hold-up?

Mr Sunak has said the delay is down to the extra complexity involved in working out how to create a fair system for the self-employed. It is likely that any resolution will have exemptions to avoid putting large payouts into the pockets of wealthy contractors.

Those who have only recently become their own boss have raised concerns that a compensation scheme based on recent earnings could disadvantage them if they are only just starting to build up their business and income.

What is available at the moment?

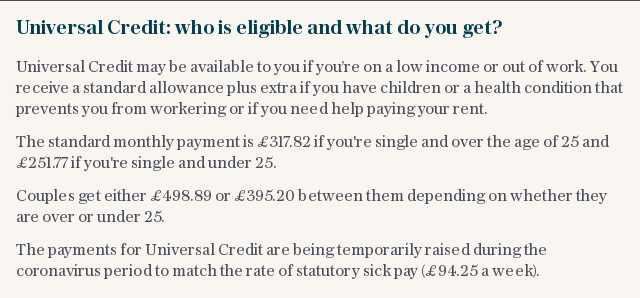

Currently freelancers and contractors whose work dries up because of coronavirus will only be eligible for benefits paid at the same rate as statutory sick pay (£94.25 a week). That means the average self-employed person would be having to survive on just a quarter of their typical income, official figures show.

By contrast, PAYE employees in the same scenario who are placed in furlough will continue to receive 80pc of their salary.

“The difference in treatment is completely unjust,” said Mr Barker. “The Government was quick to announce huge payouts for employees but we have been left waiting much longer for a resolution and lots of people are struggling mentally not knowing if they’ll receive any help.”

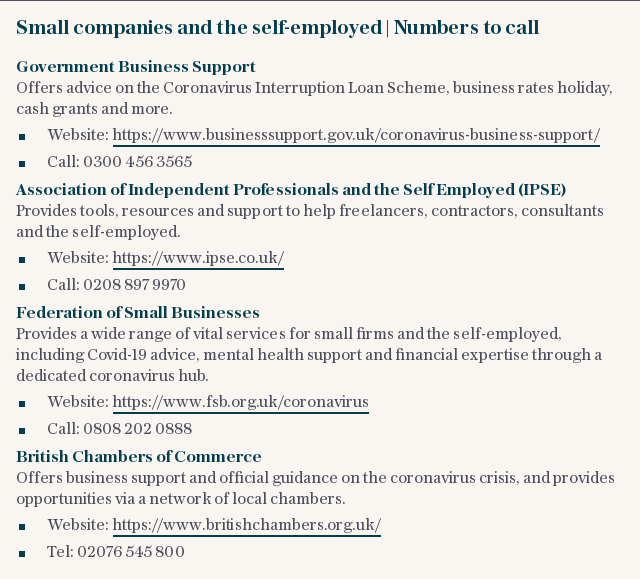

Self-employed people are able to delay payments for their self-assessment tax return, due in July, until January 2021. Those who have set themselves up as a business may benefit from some of the other measures introduced by the Government to minimise the economic impact of coronavirus. These include cash injections of £10,000 for Britain’s smallest businesses, relief from having to pay business rates and the opportunity to apply for loans which are interest free for a year.

How are the current measures lacking?

Many contractors risk falling through the gaps in current provisions because of exemptions on who is eligible for the benefits.

Anyone with personal savings of £16,000 or more – anything invested in a business does not count – is not entitled to any support via Universal Credit. They will have to wait until they have burned through their savings buffer in order to qualify.

Even if they do qualify they could find themselves waiting for five weeks for their first payment because of the time taken to process new applications for Universal Credit.

Are you a self-employed person concerned about how coronavirus will affect you? Send us your questions by emailing yourstory@telegraph.co.uk and our experts will be answering them via a live Q&A at 1pm GMT on Friday 27 March.

Yahoo Finance

Yahoo Finance