Sell rules - the key to locking in profits from multibaggers

Every investor loves to own a multibagger - a stock that rises to become many times its original purchase price. The problem is that we often sell these positions too soon, before they have a chance to appreciate in value. If we don’t sell, we sometimes get too complacent and hold on to them for too long, only to watch our profits vaporise as the share price falls further down the line.

The author of Contrarian Investment Strategies, David Dreman, argues that ‘even amongst the professionals, few religiously follow their own sell rules’, while many private investors don’t seem to have any at all. Fortunately, Dreman offers a solution. Let’s take a closer look, and use a recent multibagger, Victoria PLC, as a case study to test Dreman’s approach.

Taking the 'Round Trip'

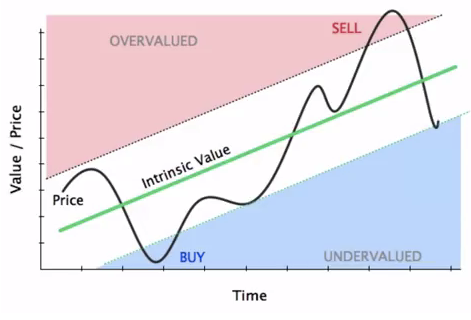

Benjamin Graham, the father of value investing and the tutor of Warren Buffett, argued that Mr Market (an allegory for the stock market) had manic-depressive characteristics, shifting from euphoric moods one day to depression the next. These mood swings are represented on the chart below, where the share price (black line) oscillates around the intrinsic value (ie. true worth) of a stock, which is more stable over time.

At the heart of value investing is the idea that investors should take advantage of Mr Market's mood swings and buy stocks when the share price falls below the intrinsic value. Investors should then sell when the price rises above its intrinsic value. This might sound straight forward, but David Dreman explains that ‘one of your most difficult decisions is when to sell’. It is sometimes tempting to hold onto stocks when they rise above their intrinsic value. Dreman observed that:

'If the stock was originally purchased at $20, with the sell target at $40, and it shot through $40, the manager would often bump the sell price higher. This frequently resulted in the manager taking 'the round trip': riding a stock all the way up, only to ride it all the way down again."

Mechanical Sell Rules to the rescue

To overcome this problem, David Dreman argues that investors should 'rely on mechanical guidelines, which filter out much of the emotional content of the decision.' Indeed, Dreman insists that investors should ‘pick a sell point when you buy a stock. If it reaches that point, grit your teeth, brace yourself, and get rid of it.’

It is crucial to understand that picking a sell point doesn’t necessarily mean selling a stock just because the share price has gone up. Dreman explains that ‘if you are a low price-to-book player, you may find that even after a stock has risen sharply, it still sells at below-market P/BV because its book value has continued to go up.’ He adds that prices may keep rising as stocks retain low valuation ratios (eg. PE or PB ratios).

Selling simply because a company’s share price has risen might lead investors to miss out on greater profits. The stunning recent run in Victoria PLC illustrates this point.

Case Study: Victoria PLC

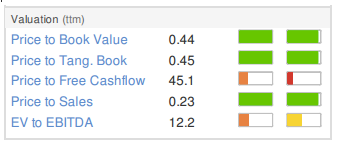

Victoria manufactures and distributes carpets - not exactly the kind of profile you’d expect for a multibagger. The company has been on an takeover spree in recent years, acquiring carpet manufactures like Whitestone Weavers, Abingdon Flooring and Globesign. Back in November 2013, the company traded at around 100p. An investor like Dreman may have decided to invest back then, when the company was cheap across many valuation metrics (see below).

The company enjoyed a handsome rise of 20% between late 2013 and April 2014, when Victoria’s share price reached 120p. Investors could have sold the stock there and then, only to see it rise by more than 800% between April 2014 and now.

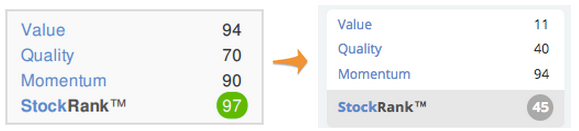

The better approach, to avoid being flushed out would have been to wait for the valuation to normalise. We can use the Stockopedia StockRank as a valuation measure (given that it is a blend of multiple valuation ratios) and look at its trend over time. Investors could have bought Victoria in early 2014, when the StockRank was 97, and held it until the StockRank dropped below 50, in February 2015. This would have enabled investors to benefit from mean reversion - the process whereby a stock’s valuation moves from extreme (ie. above 90) to the average/normal levels (ie. around 50). During the twelve months ending January 2015 Victoria’s share price rose from around 100p to 600p…

Holding beyond the ‘sell point’

The company is no longer exposed to the factors which have driven share price returns in the past. Back in February 2014, Victoria was a good, cheap, improving stock, with strong quality, value and momentum ranks, as you can see from the image below, but over time Victoria’s StockRank has now dropped to 45

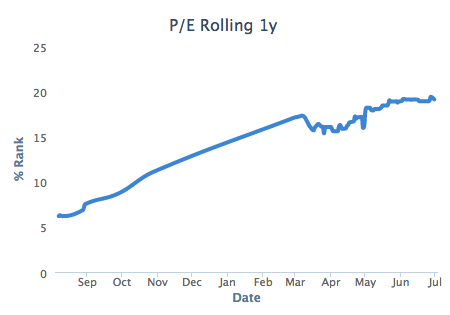

Victoria is starting to look like it has the characteristics of a Glamour Trap - a company with strong momentum (94), but poor value (11) and weakening quality(40). These stocks may be popular in the market, with strong share prices and sentiment. However, deteriorating fundamentals and stretched valuations can’t contradict forever. With a high price and poor earnings, the company may be exposed to downside risks. Indeed, an investor like Drehman would maybe be thinking about selling, as the company’s PE ratio has normalised. The Rolling PE ratio has risen from 6 in August 2014 to 19, where it stands today.

Conclusions

There are many stocks which have performed strongly over the last few years. Investors who hold these stocks should be assessing whether the companies still meet the criteria which led them to invest in the first case. If valuations have reverted back to normal then it's worth taking a long hard look at why they should still be held. Discipline is everything in investing, and sell discipline is the most important of all. Many investors may find it prudent to take a leaf out of David Dreman's book and put his contrarian sell rules in action.

Read More about Victoria on Stockopedia

Discuss Victoria on Stockopedia

Yahoo Finance

Yahoo Finance