Semiconductor Stocks' May 7 Earnings Lineup: IPHI, SYNA & More

Semiconductor stocks’ quarterly releases are expected to reflect strong data center markets owing to rapid adoption of cloud computing.

However, weakness in automobile and PC verticals on account of the coronavirus-induced economic crisis and supply chain disruption is likely to have weighed on the business prospects of the semiconductor companies in the quarter under review.

Further, the coronavirus crisis led shut down of semiconductor facilities may have dampened sales. Markedly, STMicroelectronics reported weak first-quarter 2020 results, due to low demand in the automotive and digital segments, and logistical challenges stemming from the pandemic.

Additionally, sequential decline in global semiconductor sales in the first quarter of 2020, might have dented performance of semiconductor companies.

Moreover, the upcoming earnings releases of component suppliers to Apple AAPL, including Qorvo QRVO and Synaptics SYNA, are likely to reflect the negative impact of decline in iPhone sales in the March quarter.

Nevertheless, coronavirus-induced work-from-home wave might have driven sales of processors utilized in enterprise laptops and data center servers. This, in turn, is expected to have benefited the semiconductor companies in the to-be-reported quarter. Markedly, both AMD and Intel gained from robust adoption of high-performance processors in the first quarter.

Also, the semiconductor stocks’ quarterly releases are expected to reflect the positive impact of improving NAND prices owing to supply constraints triggered by coronavirus crisis.

Glimpse of Few Upcoming Quarterly Releases

Given this mixed backdrop, investors interested in the semiconductor companies keenly await quarterly reports from notable companies slated to report on May 7.

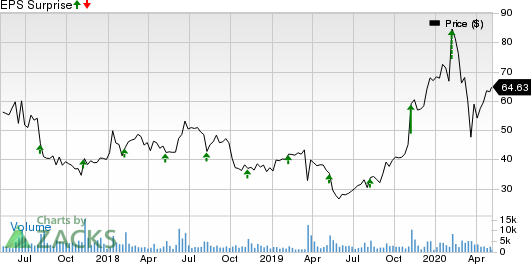

Our proven model predicts an earnings beat for Inphi Corporation IPHI in first-quarter 2020. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat.

Inphi has an Earnings ESP of +20.04% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company’s first-quarter 2020 performance is expected to have benefited from increasing adoption of Pulse-amplitude modulation (PAM) chipset solutions owing to the coronavirus outbreak-induced demand for higher network bandwidth among data centers.

Inphi Corporation Price and EPS Surprise

Inphi Corporation price-eps-surprise | Inphi Corporation Quote

Additionally, strength of the 100-gig COLORZ module and M200 coherent DSP is likely to have contributed to revenues in the quarter to be reported.

The Zacks Consensus Estimate for first-quarter earnings is pegged at 53 cents per share, up 15.2% in the past 30 days. Moreover, the figure suggests an improvement of 60.6% year over year.

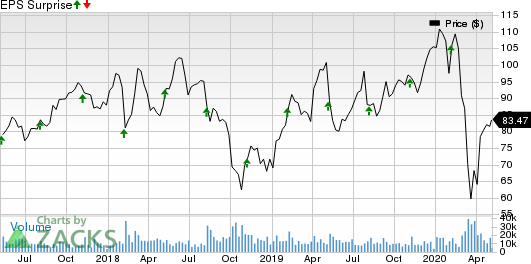

Synaptics’ third-quarter fiscal 2020 results are likely to reflect increased bookings and new OLED touch sensor design wins.

Moreover, a healthy backlog of $284 million, as noted by management in its last earnings call, and strong product sell-in and sell-through patterns might have aided the performance. (Read More: Synaptics to Post Q3 Earnings: What's in the Cards?)

Synaptics has an Earnings ESP of +1.41% and a Zacks Rank #3.

Synaptics Incorporated Price and EPS Surprise

Synaptics Incorporated price-eps-surprise | Synaptics Incorporated Quote

The Zacks Consensus Estimate for earnings stands at $1.42 per share, up 7.6% in the past 30 days. Moreover, the figure indicates an improvement of 71.1% from the prior-year reported figure.

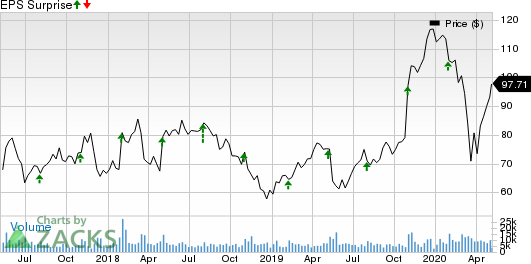

Microchip Technology Incorporated MCHP fourth-quarter fiscal 2020 results are likely to reflect growth in bookings triggered by coronavirus crisis-induced supply chain disruptions.

The company has an Earnings ESP of +0.76% and a Zacks Rank #3.

It is likely to have benefited from growing clout of microcontrollers, primarily the latest META-DX1 suite of Ethernet products in the fiscal fourth quarter.

Further, solid demand for Microsemi’s solutions in Data Center, and Communications end-markets, fueled by coronavirus crisis-induced demand for cloud and networking solutions, may have driven the fiscal fourth-quarter performance. (Read More: Is a Beat in the Cards for Microchip in Q4 Earnings?)

Microchip Technology Incorporated Price and EPS Surprise

Microchip Technology Incorporated price-eps-surprise | Microchip Technology Incorporated Quote

In the past 30 days, the Zacks Consensus Estimate for fiscal fourth-quarter earnings moved up 7.9% to $1.36 per share.

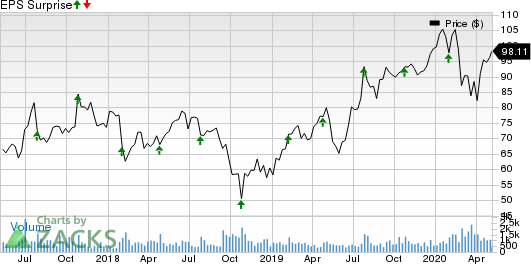

Qorvo’s fourth-quarter fiscal 2020 performance is expected to have benefited from consistent solid demand for Bulk Acoustic Wave (BAW) based multiplexers that enable advanced carrier aggregation, courtesy of robust traction of next-gen higher data rate applications.

However, the global coronavirus pandemic has reduced customer demand and impacted smartphone supply chains. This is likely to have impacted the company’s revenues in the quarter to be reported. (Read More: Factors Setting the Tone for Qorvo's Q4 Earnings)

The Zacks Consensus Estimate for fiscal fourth-quarter earnings is pegged at $1.32 per share, unchanged in the past 30 days. The figure indicates growth of 8.2% from the year-ago quarter.

Qorvo, Inc. Price and EPS Surprise

Qorvo, Inc. price-eps-surprise | Qorvo, Inc. Quote

Qorvo has an Earnings ESP of 0.00% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Power Integrations, Inc. POWI first-quarter 2020 results are likely to reflect growing clout of its rapid-charging solutions for mobile devices and momentum in high-voltage power conversion offerings.

The Zacks Consensus Estimate for first-quarter earnings is pegged at 66 cents per share, unchanged in the past 30 days. The figure indicates growth of 61% from the prior-year quarter.

Power Integrations, Inc. Price and EPS Surprise

Power Integrations, Inc. price-eps-surprise | Power Integrations, Inc. Quote

Power Integrations has an Earnings ESP of 0.00% and a Zacks Rank #3.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microchip Technology Incorporated (MCHP) : Free Stock Analysis Report

Power Integrations, Inc. (POWI) : Free Stock Analysis Report

Synaptics Incorporated (SYNA) : Free Stock Analysis Report

Qorvo, Inc. (QRVO) : Free Stock Analysis Report

Inphi Corporation (IPHI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance