Semtech (SMTC) to Release Q4 Earnings: What's in the Offing?

Semtech Corporation SMTC is scheduled to release fourth-quarter fiscal 2023 results on Mar 29.

For the fiscal fourth quarter, SMTC expects net sales between $145 million and $155 million. The Zacks Consensus Estimate for sales is pegged at $150.06 million, indicating a 21.2% decline from the prior-year quarter's reported figure.

SMTC anticipates non-GAAP earnings per share of 44-52 cents. The consensus mark for the metric is pegged at 48 cents, implying a 31.4% fall from the prior-year quarter's reported figure. The bottom line has been unchanged over the past 30 days.

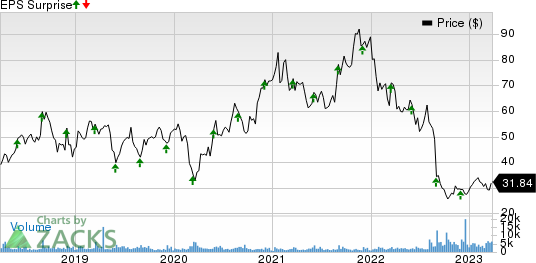

Semtech’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 3.06%.

Semtech Corporation Price and EPS Surprise

Semtech Corporation price-eps-surprise | Semtech Corporation Quote

Factors to Note

Semtech is expected to have continued benefiting from solid momentum in its low-power, high-range (LoRa) technology.

In the to-be-reported quarter, Sindcon (Singapore) IoT Technology and IoT Kreasi Indonesia teamed up with Semtech to leverage the latter’s LoRa devices and LoRaWAN standard.

As an end-to-end Internet of Things (IoT) solutions provider for smart buildings, Nordic Propeye incorporated SMTC’s LoRa devices and LoRaWAN standard for lowering energy consumption in its HVAC optimization solution.

The addition of multi-band features to the LoRa Edge device-to-cloud geolocation platform LoRa Edge is likely to have aided Semtech in gaining traction in the logistics industry.

The introduction of LoRa Developer Portal to accelerate the development of IoT devices connected with the LoRaWAN standard is anticipated to have driven the company’s momentum among developers.

In addition to LoRa technology, increasing demand for its BlueRiver technology is likely to have aided SMTC’s performance in the quarter under review.

Consistent strength in Semtech’s 10-gig and 2.5-gig PON platforms is likely to have propelled the PON business in the fiscal fourth quarter.

Apart from these, growing momentum in the company’s wireless business is expected to have been a tailwind.

Solid momentum in 4G and 5G-base station deployments is likely to have driven Semtech’s wireless base station business in the quarter to be reported.

The company’s acquisition of Sierra Wireless is anticipated to have contributed well to IoT Cloud services recurring revenues in the fiscal fourth quarter.

However, global supply-chain challenges, COVID-related uncertainties, and inflation and recession fears are anticipated to have been headwinds in the quarter under review.

Softness in the consumer end markets is expected to have negatively impacted Semtech’s performance in the fiscal quarter to be reported.

What Our Model Says

Our proven model does not conclusively predict an earnings beat for Semtech this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Semtech has an Earnings ESP of +0.70% and a Zacks Rank #4 (Sell) at present.

Stocks to Consider

Here are some stocks worth considering, as our model shows that they have the right combination of elements to beat on earnings this reporting cycle.

Amphenol APH currently has a Zacks Rank #3 and an Earnings ESP of +2.59%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Amphenol shares have gained 3.7% in the past year. The long-term earnings growth rate for APH is projected at 8.9%.

Corning GLW has an Earnings ESP of +5.91% and a Zacks Rank #3 at present.

Corning shares have lost 13.4% in the past year. The long-term earnings growth rate for GLW is projected at 7.4%.

TE Connectivity TEL has an Earnings ESP of +1.20% and a Zacks Rank #3 at present.

TE Connectivity shares have lost 5.1% in the past year. The long-term earnings growth rate for TEL is projected at 6.9%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amphenol Corporation (APH) : Free Stock Analysis Report

Corning Incorporated (GLW) : Free Stock Analysis Report

Semtech Corporation (SMTC) : Free Stock Analysis Report

TE Connectivity Ltd. (TEL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance