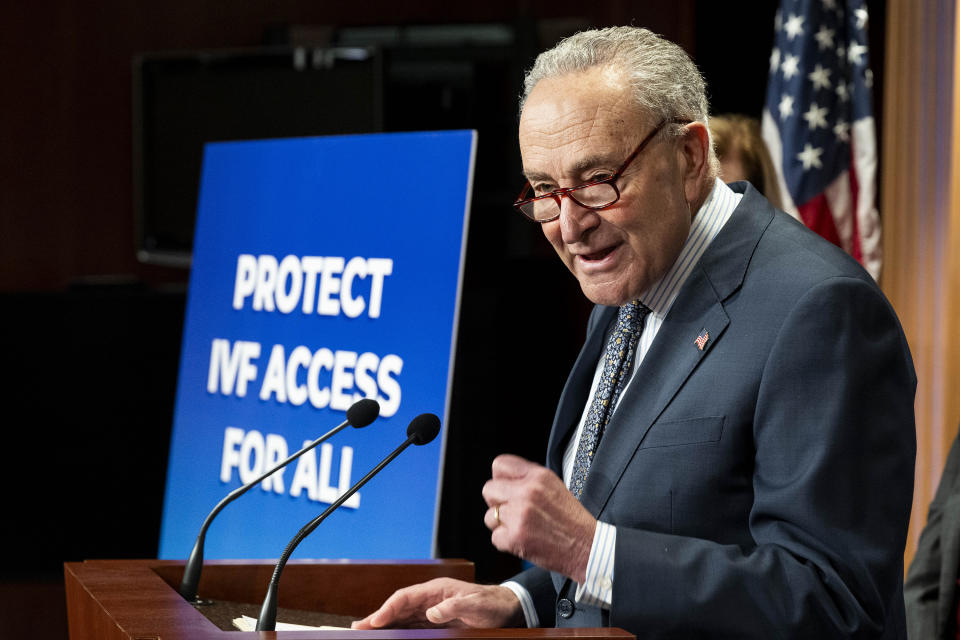

Sen. Schumer expresses concern over Capital One merger with Discover

Senate Majority Leader Chuck Schumer is voicing concern that Capital One’s planned acquisition of Discover could cause inflated costs for credit card users in New York City and beyond.

“First, many cardholders may not even know these companies might become one — and they should,” the New York Dem worried in a Sunday statement. “Second, less competition in the credit card marketplace could mean higher interest rates for these cardholders, bigger fees, higher penalties and so much more.”

Capital One announced plans to absorb Discover in February. According to Capital One, the financial giants’ combined resources will amount to more sales for merchants and better deals for consumers and small businesses. The deal combines the nation’s fourth and sixth largest charge card providers. Capital One is shelling out $35 billion to create a company that could top JPMorgan Chase and Citigroup as the country’s biggest credit card loans provider.

Schumer’s press releases included a copy of a letter he sent to Capital One and Discover executives asking for transparency before the deal is consummated — though his office says he didn’t get a response. Among the senator’s inquiries was whether the newly formed company plans to fire employees. Schumer also wants a breakdown of interest rates charged to consumers over the past decade with regards to race and where they live. He asked for a reply no later than April 21.

“Please share any strategy documents or presentations (whether prepared internally or by third parties) that explain the rationale for this transaction,” he requested at the end of his note.

Discover, which touts creative reward programs, rang up its first credit card purchase in 1985. The card is accepted in 70 million locations and claims more than $112 billion in total banking loans.

Capital One, which works with Visa and Mastercard, is universally accepted and provides cash at more than 70,000 ATMs. The Virginia-based company launched in 1994.

Capital One couldn’t immediately be reached for comment Sunday. If approved by regulators, its deal with Discover is expected to be completed by early 2025.

Yahoo Finance

Yahoo Finance