How to send your children to private school (without breaking the bank)

With the cost of a private education rising, it is important to give some serious thought to how to save for school fees.

While you may be keen to do the best for your child, you need to find a balance between providing for their education, and managing your other financial objectives.

How much are fees?

The amount you can expect to pay in fees will vary according to a number of factors, such as whether you are looking at primary or secondary, a day school or boarding. You can also expect to pay more depending on the region, and how prestigious the school is.

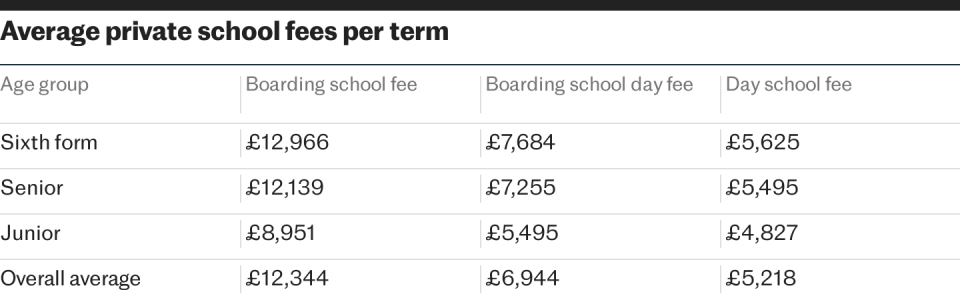

The majority of pupils attend day schools where typical fees are £5,218 per term or £15,655 per year. This is according to the Independent Schools Council (ISC), which also reports the most recent average rise in fees was a jump of 3.1pc in 2022.

Jason Hollands of the investment service Bestinvest, said: “While this was well below inflation last year, we are likely to see school fee inflation accelerate from here as schools face increased cost pressures.”

Further findings from the ISC show day school fees vary by region, with average termly fees of just under £4,500 in the north west, rising to just below £6,250 for day schools in London.

As a guide, the majority of day schools charge between £3,000 and £5,500 per term.

Mr Hollands added: “But for the leading public schools, you could be looking at £35,000 a year for day pupils, and £46,000 for boarding fees.”

And do not forget there will be additional costs on top for things such as uniforms, sports kit, extra-curricular activities and overseas trips.

How much money do you need?

If you have two children, you could easily expect to pay more than £30,000 a year for school fees.

Based on this, for a 40 per cent higher rate taxpayer, that equates to around £50,000 of pre-tax earnings.

Given living costs are on the up and with high inflation and interest-rate rises putting even more pressure on our finances, footing the bill for private school is no mean feat.

Mr Hollands said: “Even families with two high incomes can find it a struggle to meet the costs out of taxed income on a pay-as-you-go basis, and especially if you have more than one child in private education.”

Is it worth it?

With such big sums at stake, you may be questioning first, whether it’s actually achievable, and second, whether it’s a price worth paying.

The key is to think carefully about what that kind of sum means for your finances and long-term plans.

A lot boils down to how much value you place on a private education.

What about bursaries and scholarships?

One way to make the cost of fees more manageable is with a bursary or scholarship. According to the ISC, around a third of pupils get some kind of help with fees.

If your child qualifies for a means-tested bursary, they could expect to get more than half of their fees remitted; some will get a free place.

Another way to get a discount is by getting a scholarship. These are non-means-tested, but require your child to display a particular talent in an area such as academia, sport, music, drama or design.

Getting a scholarship can be a very competitive process, but can often mean a fee reduction of between 10 and 15pc.

Given the amount of financial help on offer, it is well worth looking into your child’s eligibility for support. To find out more, contact the schools’ admissions team.

Check for other fee reductions

It’s also worth seeing whether other discounts are available – and whether you qualify.

This might include reductions for children of parents who teach at the school, and sibling discounts.

Some professions, such as the armed forces or clergy, can also get an allowance to cover the cost.

Further, you may be able to shave a little off the total, if you are able to pay some or all of the fees in a lump sum in advance.

But note that with a sibling policy, for example, the discount may be just 10 per cent, meaning you still need to stump up thousands of pounds a year.

How to fund school fees

Unless you are very lucky, you are unlikely to have tens of thousands of pounds kicking around. This means you are going to have to find the money as you go along.

Sarah Coles, an analyst at investment service Hargreaves Lansdown, said: “This tends to result in parents using monthly payment schemes set up by the schools. But these charge interest which can make the whole process even more expensive, so it’s vital to understand the alternatives.”

Is there an investment strategy you can use?

Without doubt, the best way to save for school fees is to start early. Ms Coles said: “Anything you can save or invest in advance will help, and especially if you can persuade grandparents to chip in. Isas are a sensible place to start, so your school fees fund grows free of tax.”

Say, for example, you start saving an annual lump sum of £7,500 from the day your child is born, using a 5pc annual compound growth rate, you will have built up a nest egg of around £140,000 by the time he or she turns 13, according to Bestinvest.

A longer time-frame means you can afford to take some investment risk as you have the time to ride out any stock market volatility.

Mr Hollands said: “Higher-risk investments, such as equity funds, can be used for costs that are many years away, and cash, or less volatile assets, for earlier years.”

However, a Junior Isa is not a good option for school fees, as these savings cannot be accessed until the child is 18. Instead, these accounts are a good way of investing for further education, or for a deposit for a house.

Bare trusts

If your Isa allowance has already been used, you can invest through a bare trust.

Ms Coles said: “This is where an adult invests on behalf of a child. The child receives the assets at the age of 18, but the trustees can move or withdraw money before then – as long as it is used for the benefit of the child – including for school fees.”

Bare trusts are easy to set up. Most investment companies have a form you can fill in.

The advantage of these trusts is that income and gains are usually treated as belonging to the child, so they’re taxed as the child’s. This means that in most cases, they are tax free, within allowances.

Ms Coles added: “The exception to this is where money is paid into the trust by a parent, and income is £100 or more, in which case it is taxed at the parent’s marginal rate. It’s therefore most suitable for investments which don’t produce an income, or for contributions from grandparents.”

Educational trusts

Grandparents may want to set up an educational trust to cover school fees, with their grandchildren as beneficiaries.

Ms Coles said: “They can transfer investments up to their inheritance tax (IHT) threshold, which is £325,000 per person, into a discretionary trust. This is counted as a ‘potentially exempt transfer’ so will usually be considered to be out of their estate for IHT purposes after seven years.”

Note though, that a trust is a complex situation, with many potential tax aspects, so it is important to seek professional advice.

Remortgaging

Another route you may want to explore is using an asset, such as the family home.

This could involve you remortgaging to an offset mortgage. Ms Coles said: “With this option, you can keep the fee money in the linked account, so you don’t pay interest on it until you need to pay the school. You can also top up the account again if you get any windfalls, in order to bring interest payments down again.”

Taking out a loan

Alternatively, you could take out a loan secured on your property.

Mr Hollands said: “But you need to think very carefully about doing this without a clear plan in place to repay it. You also need to consider the impact of the financing costs over the term of the loan, as this will now reflect a world of higher interest rates than the recent past.

“Risking the family home to cover school fees is not a decision to be taken lightly.”

If you are thinking about this, it would be wise to take out insurance in case of a change of circumstances, such as early death, critical illness or loss of employment.

You need to tread very carefully with this – or any of the approaches listed above. The key is to weigh up all the pros and cons, and if you need further clarity, get professional help.

Making the right choice

If you are set on a private education for your children, the route you take to fund it will depend on your personal circumstances and long-term objectives.

Mr Hollands added: “Families often make big financial sacrifices to send their children to private schools. For some, it can mean downsizing to a smaller home, going without holidays, rarely dining out, and so on. The pressure can be huge.”

Giving your child a private education is a significant financial commitment. You want to make the right decision financially for all concerned.

Recommended

Find the best value private schools near you

This article was first published on April 20 2023 and is kept updated with the latest information.

Yahoo Finance

Yahoo Finance