Sensata (ST) Buys Sendyne to Boost Electrification Portfolio

Sensata Technologies Holding plc ST recently inked a definitive agreement to acquire Sendyne Corp. for an undisclosed amount to augment its electrification component portfolio. The transaction is likely to unlock new business opportunities and generate a steady revenue stream for Sensata while reinforcing its electrification strategy.

Since its inception in 2010, Sendyne has carved a niche market to develop chips and modules for electric vehicles, charging stations and storage systems. Leveraging patented technologies, its rich portfolio of sensors and control panels for precise current and voltage measurement enable superior EV performance and battery life. Sendyne’s products also help to detect potential electrical hazards and optimize operations to reduce costs.

The buyout will enable Sensata to gain additional mileage within the fast-growing end markets for clean energy solutions and offer a comprehensive bouquet of products for electrification and replacement of combustible applications. The deal will help realize synergistic benefits with accelerated growth opportunities in various industrial applications. Sendyne is also likely to benefit from the rich resources of Sensata to better serve its existing pool of customers in order to address the growing demand in the e-mobility markets.

Known as the pioneer in mission-critical solutions, Sensata has a diversified portfolio of personalized and unique sensor-rich applications from automotive braking systems to aircraft flight controls that are utilized ubiquitously. These sensors are specifically designed to address complex engineering and operating performance requirements that help customers solve significant challenges in industrial, heavy vehicle and off-road as well as aerospace industries. With more than 1.1 billion Sensata devices shipped annually across the globe, it focuses on producing cleaner, safer, connected and efficient equipment.

Sensata also has a rich portfolio of high-voltage protection and battery management systems. Its sensing solutions business has a strong product portfolio and greater scale to capitalize on attractive opportunities in the multi-billion global automotive sensor market. Moreover, the company believes that its evolving portfolio and accretive customer base, courtesy of its opportune acquisitions like Sendyne, serve as the cornerstone for healthy long-term growth across a diverse set of markets.

In addition, the company offers a streamlined set of products, which helps in eliminating redundant costs and gives greater pricing flexibility. It invests in cutting-edge technology that enables hybrid and electric vehicles to be more efficient, cost-effective, robust and safe. Sensata is expanding its electrification ecosystem to facilitate the seamless transition to electric vehicles as it aims to be a leading provider of sensor-rich hardware and software solutions.

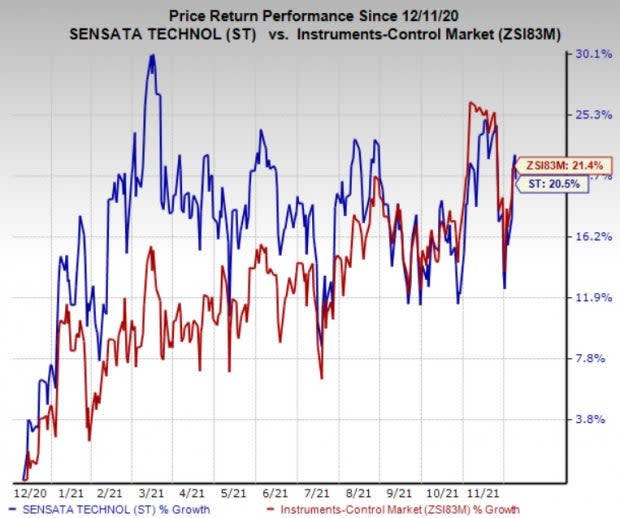

The stock has gained 20.5% over the past year compared with the industry growth of 21.4%. We remain impressed with the inherent growth potential of this Zacks Rank #3 (Hold) stock.

Image Source: Zacks Investment Research

Transcat, Inc. TRNS, carrying a Zacks Rank #2 (Buy), is a solid pick for investors. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Transcat has a long-term earnings growth expectation of 8% and delivered an earnings surprise of 37.2%, on average, in the trailing four quarters. Earnings estimates for the current year for the stock have moved up 39.4% over the past year. Shares of Transcat have moved up a stellar 170.2% over the past year.

Watts Water Technologies, Inc. WTS carries a Zacks Rank #2. The stock has a long-term earnings growth expectation of 8% and delivered an earnings surprise of 14.6%, on average, in the trailing four quarters.

Earnings estimates for the current year for the stock have moved up 42.6% over the past year. Watts Water aims to continuously launch smart and connected products, which are likely to provide it with a competitive edge in the marketplace.

Sierra Wireless, Inc. SWIR carries a Zacks Rank #2. It has a long-term earnings growth expectation of 12.5% and delivered an earnings surprise of 34.2%, on average, in the trailing four quarters.

Over the past year, Sierra Wireless has gained 16%. The company continues to launch innovative products for business-critical operations that require high security and optimum 5G performance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sierra Wireless, Inc. (SWIR) : Free Stock Analysis Report

Sensata Technologies Holding N.V. (ST) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report

Transcat, Inc. (TRNS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance