SentinelOne's (S) Strong Cybersecurity Portfolio Aids Prospect

SentinelOne S recently emerged as a frontrunner in the MITRE Engenuity’s ATT&CK Evaluations for Managed Security Services Providers (MSS), solidifying its position at the forefront of the cybersecurity landscape.

During the evaluation, SentinelOne’s Managed Detection and Response (MDR) team achieved exceptional capabilities by detecting all 15 major steps of simulated attacks inspired by menuPass and ALPHV BlackCat with 100 percent accuracy.

Powered by SentinelOne’s AI-driven Singularity Platform, SentinelOne’s MDR team identified threats within an average of 3.3 minutes, significantly outperforming competitors while reducing alert fatigue with up to 10 times fewer notifications.

The achievement underscores SentinelOne’s capability to deliver robust real-world protection with a superior signal-to-noise ratio, significantly minimizing alert fatigue while delivering comprehensive threat analyses.

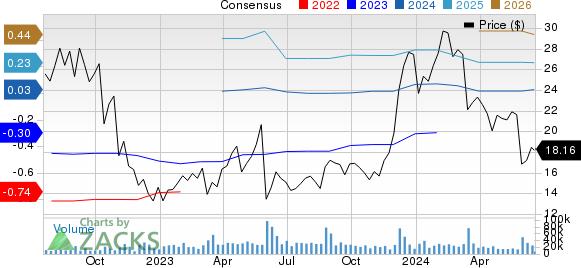

SentinelOne, Inc. Price and Consensus

SentinelOne, Inc. price-consensus-chart | SentinelOne, Inc. Quote

Expanding Portfolio Aids Growth

SentinelOne’s commitment to enhancing autonomous AI-driven MDR solutions and achieving advanced cyber threat detection and response capabilities is noteworthy.

Strengthening cyber security capabilities will enable the company to capitalize on growth opportunities present in the cyber security market, which, as per Mordor Intelligence report, is expected to reach $182.84 billion in 2024 and reach $314.28 billion by 2029, indicating a CAGR of 11.44% between 2024 and 2029.

Further bolstering its capabilities, SentinelOne recently partnered with Advantage to integrate PurpleAI into its MDR service, enhancing enterprise cybersecurity with advanced AI-driven threat detection and response capabilities.

SentinelOne’s portfolio is helping it to expand its clientele. The company is enhancing end-to-end threat detection and automated response solutions through partnerships with Secureworks SCWX, and ServiceNow NOW and Amazon AMZN.

SentinelOne is gaining strong momentum across its global go-to-market program on the back of Secureworks collaboration. The program leverages the integration of Secureworks Taegis XDR and SentinelOne’s Singularity Complete solution to streamline risk management, enhance threat detection and make advanced cybersecurity solutions more accessible to enterprises.

The partnership with ServiceNow, aiming to unify security and IT teams for more effective cyberattack responses, remains noteworthy. The SentinelOne App seamlessly syncs threats into ServiceNow Incident Response for security operations and incident response.

The company recently launched Singularity Cloud Workload Security for Serverless Containers to protect containerized workloads on AWS Fargate for Amazon ECS and Amazon EKS with real-time, AI-powered defense.

Conclusion

The stock has declined 37.3% against the Zacks Computer & Technology sector’s growth of 16.3% year to date. The underperformance can be attributed to persistent macroeconomic uncertainty and stiff competition.

Nevertheless, SentinelOne is benefiting from the continued adoption of its AI-powered security solutions, which are contributing to its growth prospects continuously and driving top-line growth.

SentinelOne expects second-quarter fiscal 2025 revenues to be $197 million, indicating growth of nearly 32% year over year.

The Zacks Consensus Estimate for fiscal second-quarter revenues is pegged at $197 million, suggesting 31.84% growth year over year. The consensus mark for loss is pegged at 1 cent per share, unchanged in the past 30 days.

S is trading at a discount with a forward 12-month P/S of 6.36X compared with the Zacks Internet Service industry’s 6.94X.

SentinelOne carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

SentinelOne, Inc. (S) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

SecureWorks Corp. (SCWX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance