Series of takeover bids offer hope of big share price rises for these two trusts

There has been a spate of takeover bids for investment trusts in recent months and even when the targets have not been Questor recommendations there are implications for trusts we have tipped.

It’s not hard to see why bids have started to crop up: some trust discounts have widened to the point that outside investors are finding the bargains irresistible.

While they will inevitably have to pay a premium to the prevailing share price, so wide are the discounts in some cases that they are still acquiring trusts’ underlying assets at a discount to their reported value.

“The increased M&A [mergers and acquisitions] activity among investment trusts is definitely noteworthy and the primary reason is the number of wide discounts,” says Andrew Rees of Numis, the broker.

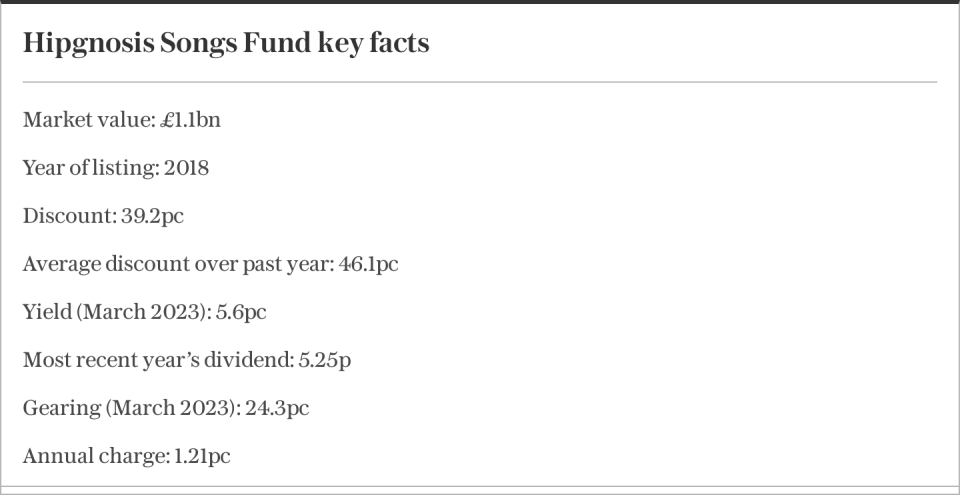

Update: Hipgnosis Songs Fund

This trust, which invests in catalogues of music rights, has been a lacklustre performer so far for Questor: since our tip at 107.25p in 2019 its shares have fallen by 13pc to last night’s 93p, although generous dividends push our total return back into the black.

But things were looking much bleaker in mid-July, when the shares were trading at a record low of 74p and our loss in share price terms was 31pc.

The reason for the shares’ recovery was a bid for a similar trust, Round Hill Music Royalty Fund.

A Los Angeles-based company called Alchemy Copyrights has offered $469m (£375m) for Round Hill and the trust’s board has advised shareholders to accept.

The cash offer at $1.15 a share represents a premium of 67.3pc to the price on the previous day and is higher than the price at which the shares had ever traded, so all shareholders will make a profit on their holding.

Despite that big premium to the previous share price, though, the offer still represents an 11.5pc discount to Round Hill’s net asset value (NAV).

In view of its similarity to Round Hill it was no surprise to see shares in Hipgnosis rise strongly when the bid was announced. Hipgnosis’s NAV is $1.9153; if it traded at that same 11.5pc discount to its NAV the share price would be about 136p – far higher than the current level.

Stifel, the broker, said the bid for Round Hill “helps highlight that there is significant value in the Hipgnosis portfolio also”, while Investec, a rival, speculated about “a potential bid at 125p-135p”.

Apart from the chance of a bid, shareholders in the trust will have an opportunity to vote on its future before the end of the year.

Should they decide that the fund should be wound up, the Round Hill bid suggests that Hipgnosis’s assets could be sold at better prices than those implied by the current share price.

Questor says: hold

Ticker: SONG

Share price at close: 93p

Update: Triple Point Social Housing

This is another trust to have seen its most direct rival fall to a bid, in this case for Civitas Social Housing at 80p a share, a premium of 44pc to the previous share price. The takeover of Civitas has already been completed and the shares no longer trade on the stock market.

The offer price represented a 26.7pc discount to the trust’s NAV at the time. If we apply the same discount to Triple Point Social Housing’s NAV of 111.31p we arrive at a share price of 81.6p.

The current share price is only 55.7p and the gap between the two figures is doubtless due in part to the long-running series of interventions by regulators in the social housing arena and the consequent reputational damage done to the trusts.

Meanwhile Triple Point continues to pay its generous dividend at a targeted level of 5.46p this year, which represents a yield of 9.8pc, so investors are being well rewarded while they wait for improvement in the share price, whether from a bid or otherwise.

Questor says: hold

Ticker: SOHO

Share price at close: 55.7p

Update: Ediston Property Income

Unlike the above trusts, Ediston, tipped here in December 2021, has itself been on the receiving end of an offer, in this case for its assets rather than for the fund itself.

That makes matters more complicated because the trust has first to complete the sale of its assets, then pay any creditors and finally wind itself up and return the remaining money to shareholders.

It said it expected them to receive 72p a share. Unfortunately this figure is still 10pc below the price at which we recommended them, although dividends paid over the period more or less put us back at level pegging.

Read the latest Questor column on telegraph.co.uk every Tuesday, Wednesday, Thursday and Friday from 6am

Read Questor’s rules of investment before you follow our tips

Yahoo Finance

Yahoo Finance