ServiceNow Inc (NOW) Q1 2024 Earnings: Surpasses Analyst Revenue Forecasts

Subscription Revenue: $2,523 million in Q1 2024, marking a 25% increase year-over-year, surpassing estimates of $2,585.20 million.

Total Revenue: Reported at $2,603 million, a 24% rise from the previous year, slightly above the estimated $2,585.20 million.

Net Income: Achieved $347 million, significantly exceeding the estimated $654.86 million.

Earnings Per Share (EPS): Recorded at $1.67 diluted, outperforming the expected $3.14.

Current Remaining Performance Obligations (cRPO): Reached $8.45 billion, reflecting a 21% growth year-over-year.

Customer Growth: Total customers with over $1 million in annual contract value grew by 15% year-over-year to 1,933.

Share Repurchase: Repurchased 225,000 shares for $175 million as part of ongoing efforts to manage dilution.

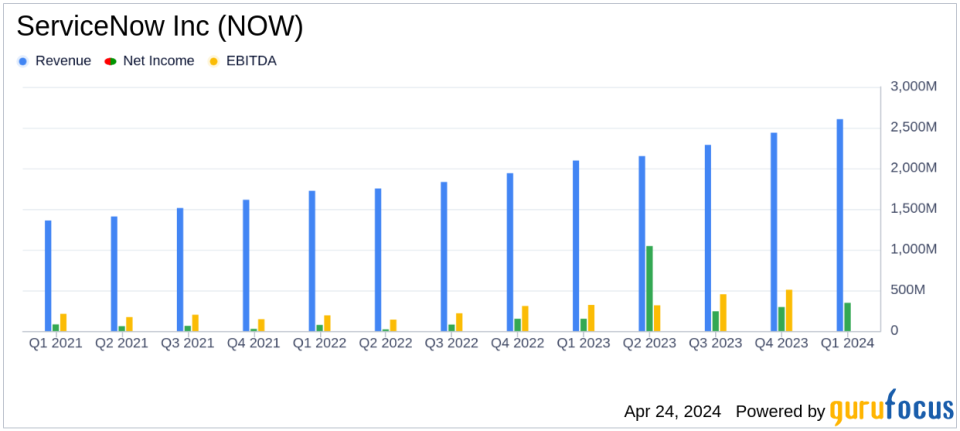

On April 24, 2024, ServiceNow Inc (NYSE:NOW) released its 8-K filing, announcing robust financial results for the first quarter of 2024. The company reported a significant year-over-year growth in subscription revenues, which stood at $2,523 million, marking a 25% increase and slightly surpassing the estimated revenue of $2,585.20 million. This performance underscores the company's strong market position and its effective adaptation to dynamic business environments.

ServiceNow Inc, a leader in digital workflow solutions, continues to enhance enterprise operations globally through its cloud-based platform. The company's strategic expansions and innovations, particularly in AI technology, have positioned it as a first mover in the industry, catering to diverse sectors including IT, customer service, HR, and security operations.

Financial Highlights and Strategic Achievements

The first quarter results reflect a strong start to the year, with total revenues reaching $2,603 million, a 24% increase from the previous year, aligning closely with analyst expectations. The company's current remaining performance obligations (cRPO) grew by 21% to $8.45 billion, indicating robust future revenue potential. Notably, ServiceNow has expanded its customer base, now boasting 1,933 customers with more than $1 million in annual contract value, up 15% year-over-year.

ServiceNow's commitment to innovation is evident in its recent product launches and partnerships, such as the introduction of Now Assist for ITOM AIOps and collaborations with NVIDIA and Hugging Face. These initiatives not only enhance ServiceNow's product offerings but also solidify its market leadership in AI-driven solutions.

Operational and Financial Metrics

The company's operational success is mirrored in its financial metrics. The subscription gross profit margin improved significantly to 83%, reflecting efficient management and scalability of services. ServiceNow also demonstrated strong profitability with an income from operations of $332 million, translating to a 13% margin. Furthermore, the firm maintained robust liquidity, ending the quarter with $2,056 million in cash and cash equivalents.

ServiceNow's strategic financial management is highlighted by its active share repurchase program, with 225,000 shares bought back for $175 million in Q1, aimed at managing dilution and enhancing shareholder value.

Future Outlook and Analyst Day

Looking ahead, ServiceNow provided an optimistic outlook for Q2 and the full year of 2024. The company expects subscription revenues to continue growing, with a projected range of $10,560 to $10,575 million for the full year, reflecting a sustained demand for its innovative solutions. The upcoming Financial Analyst Day on May 6, 2024, will further provide investors with insights into the company's strategic initiatives and financial planning.

ServiceNow's consistent performance and strategic investments underscore its potential for sustained growth. By leveraging advanced technologies and expanding its global footprint, ServiceNow is well-positioned to meet the evolving needs of enterprises worldwide, making it a compelling consideration for investors focused on long-term value creation.

Conclusion

ServiceNow Inc's first quarter results of 2024 not only surpassed revenue expectations but also demonstrated strategic foresight through significant investments in AI and global expansion. As the company continues to innovate and expand its offerings, it remains a key player in the digital workflow sector, poised for continued growth and investor interest.

Explore the complete 8-K earnings release (here) from ServiceNow Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance