ServiceNow (NOW) Q2 Earnings and Revenues Beat Estimates

ServiceNow, Inc. NOW delivered non-GAAP earnings of 71 cents per share in second-quarter 2019, surpassing the Zacks Consensus Estimate by 10.9%. Further, the figure advanced 44.9% on a year-over-year basis.

Revenues of $833.9 million outpaced the Zacks Consensus Estimate of $831 million and improved 32% from the year-ago quarter. Geographically, North America, Europe, Middle East and Africa (EMEA), and APAC & Other contributed 65%, 26%, and 9%, respectively to revenues.

Meanwhile, non-GAAP revenues (excluding impact of foreign exchange) of $851.95 million surged approximately 35% from the year-ago quarter.

Coming to price performance, shares of ServiceNow have returned 66.9% year to date, outperforming the industry’s rally of 31.2%.

Quarter Details

Non-GAAP Subscription revenues (adjusted for constant currency) advanced 36% from the year-ago quarter to $797.57 million.

Non-GAAP Professional services and other revenues improved 19% (adjusted for cc) from the year-ago quarter to $54.38 million.

Total billings improved 33% on a year-over-year basis (adjusted for constant currency and constant billings duration) to $883.38 million.

Non-GAAP adjusted subscription billings of $827.8 million surged 34% year over year. Professional services and other billings increased 13% to $55.58 million.

ServiceNow maintained consistent renewal rate of 98% during the reported quarter. Fortune 500 companies’ clientele expansion continues to grow and came in at almost 75% at the end of the second quarter.

ServiceNow, Inc. Price, Consensus and EPS Surprise

ServiceNow, Inc. price-consensus-eps-surprise-chart | ServiceNow, Inc. Quote

Additionally, the company completed 39 transactions that generated net new annualized contract value (ACV) exceeding $1 million. Further, the company’s total number of customers contributing more than $1 million to the business reached 766 in the second quarter. The figure surged 33% on a year-over-year basis. Customers contributing $5 million and more in ACV came in at 98, up 72% year over year.

The ongoing digital transformation of organizations, including big private and public companies, and different levels of government agencies, have been acting as tailwinds. ServiceNow’s strength in ACV performance is also a positive.

Management is particularly impressed with growing clout of the company’s solutions among U.S. federal agencies. Notably, management anticipates more federal deal wins across the United States, Australia and further global expansion opportunities on account of the partnership with Microsoft MSFT.

Product-Wise Break-Up of Top 20 New Wins

Out of top 20 new customer additions to the company’s customer base in the second quarter, 11 included adoption of five or more products.

Considering the IT domain, IT Service Management (ITSM), IT Operations Management (ITOM), IT Asset Management (ITAM) and IT Business Management (ITBM) product lines witnessed adoption by 16, 17, eight and eight customers out of these 20 wins, respectively.

Further, the emerging products (EP) segment is comprised of Customer Service Management (CSM), HR Service Delivery, Security Operations and Intelligent Apps product lines. In the reported quarter, out of the top 20 new deals, CSM, HR, Security and IA were part of six, six, nine and five deals, respectively.

Meanwhile, Platform Add-ons and other services, comprising Performance Analytics, Cloud Options, among others, were leveraged by 19 out of the 20 new wins.

Notably, IT, EP and Platform Add-ons contributed 57%, 29% and 14%, respectively to net new ACV.

Operating Details

During the second quarter, non-GAAP gross margin came in at 81%, expanding 100 bps on a year-over-year basis.

Non-GAAP total operating expenses came in $518.49 million, surging almost 31.9% year over year.

The company’s non-GAAP operating margin was 18%, expanding 100 bps on a year-over-year basis. Further, free cash flow margin was reported at 23%, compared with the year-ago figure of 24%.

Balance Sheet & Cash Flow

As on Jun 30, 2019, ServiceNow had cash and cash equivalents and short term investments of $1.653 billion compared with $1.662 billion as of Mar 31, 2019.

During the reported quarter, cash from operations came in at $243.7 million compared with the prior-quarter figure of $360.8 million. The company also generated free cash flow of $193.8 million compared with $313.7 million reported in the prior quarter.

Guidance for Q3

For third-quarter 2019, non-GAAP adjusted subscription revenues are anticipated to lie between $836 million and $841 million, representing year-over-year growth of 33-34%.

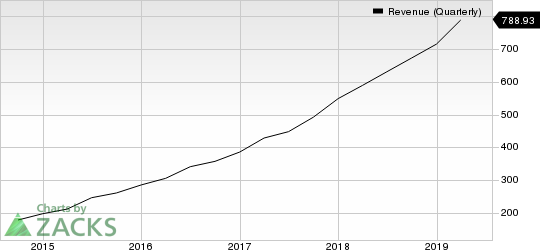

ServiceNow, Inc. Revenue (Quarterly)

ServiceNow, Inc. revenue-quarterly | ServiceNow, Inc. Quote

Non-GAAP adjusted subscription billings are projected within the range of $857-$862 million, representing year-over-year growth of 27-28%.

Further, non-GAAP operating margin is anticipated to be 23%.

Raises View for 2019

ServiceNow revised subscription revenues and billings outlook for fiscal 2019, backed by an impressive pipeline. For full-year 2019, non-GAAP adjusted subscription revenues are now anticipated in the range of $3.289-$3.299 billion from the previous band of $3.280 billion to $3.295 billion, reflecting growth of 36%.

Non-GAAP subscription billings are now anticipated to grow 32% year over year to $3.804-$3.814 billion, an improvement over the previous range of $3.797-$3.812 billion.

However, the company reiterated the margin outlook, owing to increasing investments. Non-GAAP subscription gross margin is expected to be 86%, while operating margin and free cash flow margin are projected to be 21% and 28%, respectively.

Growth in each of the segments has been adjusted for constant currency and constant billings duration.

Conclusion

As businesses, government agencies, among others “cloudify” their infrastructure, ServiceNow platform is well positioned to gain adoption.

Moreover, ServiceNow is well poised to gain from multi-year partnership with Microsoft on account of Azure’s robust cloud computing and security capabilities. The collaboration is expected to boost adoption of the company’s digital workflows from federal agencies, in particular.

Additionally, alliances and integrations with software platforms from companies including Adobe ADBE, Oracle ORCL, SAP, among others; are expected to favor growth prospects.

However, expenses pertaining to the opening of two new data centers in Osaka and Tokyo, aimed at expanding presence in Japan, are likely to limit margin expansion in the near term.

Nonetheless, it should be noted that with operational data centers in Japan (opening scheduled later this year); ServiceNow will be well poised to improve its Global 2000 (or G2K) customer base.

Currently, ServiceNow carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Adobe Systems Incorporated (ADBE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance