Sezzle Inc. (SEZL) Reports Record First-Quarter 2024 Results with Strong Net Income Growth

Underlying Merchant Sales (UMS): Increased by 33.2% year-over-year to $492.7 million.

Total Income: Rose by 35.5% year-over-year to $47.0 million.

Operating Income: Surged 155.3% year-over-year to $13.8 million, with Operating Margin expanding from 15.6% to 29.4%.

GAAP Net Income: Reached $8.0 million in 1Q24, setting a new quarterly high.

GAAP Diluted Earnings Per Share: Increased to $1.34 in 1Q24 from $0.31 in 1Q23.

Total Stockholders' Equity: Grew 116.7% year-over-year to $29.6 million.

FY2024 GAAP Net Income Guidance: Raised to $30.0 million from previously projected $20.0 million.

On May 8, 2024, Sezzle Inc. (NASDAQ:SEZL), a leading purpose-driven digital payment platform, released its first-quarter financial results for 2024. The company announced significant growth in its financial metrics, outperforming the entirety of its 2023 GAAP Net Income within the first quarter alone. The detailed results can be found in Sezzle's 8-K filing.

Sezzle Inc. operates a technology-driven payment platform that enables customers to split purchases into four installments over six weeks, with the first payment due at the time of purchase. This financial model not only facilitates easier budget management for consumers but also drives increased engagement and purchase frequency.

Financial Performance Highlights

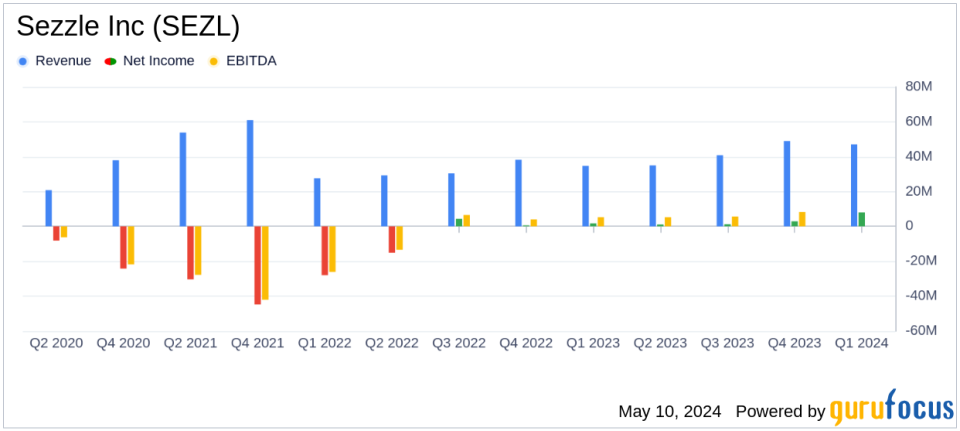

The first quarter of 2024 saw a remarkable 33.2% year-over-year increase in Underlying Merchant Sales (UMS), reaching $492.7 million. This growth was propelled by a rise in consumer purchase frequency from 3.1 times in the first quarter of 2023 to 4.5 times in the same period in 2024. The top 10% of consumers, based on UMS, transacted 53 times per year, highlighting strong customer engagement.

Total Income for the quarter stood at $47.0 million, marking a 35.5% increase from the previous year, with income as a percentage of UMS reaching an all-time high of 9.5%. Despite a 13.3% increase in Total Operating Expenses due to higher transaction volume, these expenses as a percentage of UMS and Total Income saw a significant decrease, reflecting improved operational efficiency.

Operating Income surged by 155.3% year-over-year to a record $13.8 million, with Operating Margin increasing from 15.6% to 29.4%. GAAP Net Income also reached a new quarterly high of $8.0 million, surpassing the full-year 2023's GAAP Net Income of $7.1 million. The GAAP Diluted Earnings per Share for the first quarter was $1.34, compared to $0.31 in the same quarter of the previous year.

Strategic Developments and Updated Guidance

Sezzle's strategic initiatives, including the successful refinancing of its credit facility and the replacement of a previous $100 million facility with a new $150 million facility, have significantly reduced borrowing costs and bolstered liquidity. These moves are expected to accelerate top-line growth and support new strategic initiatives.

"This quarters results are a testament to the Companys commitment and strategic focus on profitable growth," stated Charlie Youakim, Sezzle Chairman and CEO. He also expressed confidence in increasing the FY2024 GAAP Net Income guidance from $20.0 million to $30.0 million.

Furthermore, Sezzle has raised its FY2024 Total Income Growth guidance from 20% to 25% and introduced new guidance on GAAP Diluted Earnings per Share of approximately $5.00, maintaining Total Income Less Transaction Related Costs at 50% of Total Income.

Investor and Market Engagement

Sezzle is actively engaging with the investor community, with plans to participate in several major investor conferences and hosting its Annual Meeting of Shareholders on June 13, 2024. The company also continues to evaluate capital return options for shareholders, including potential dividends and share repurchases.

Sezzle's robust financial performance in the first quarter of 2024, combined with strategic financial management and optimistic future guidance, positions the company well for sustained growth. Investors and stakeholders may look forward to continued progress as Sezzle strengthens its market position and capitalizes on emerging opportunities within the digital payments landscape.

Explore the complete 8-K earnings release (here) from Sezzle Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance