Shaftesbury Capital abandons Fitzrovia portfolio sale due to low bids

West-End landlord Shaftesbury Capital has abandoned plans to sell a portfolio of properties in London’s Fitzrovia district after bids reportedly fell short of expectations.

Now the real estate giant is plotting a move to sell the units individually or in smaller groups, a report in Bloomberg said, in the hopes that this will help generate more cash.

Shaftesbury Capital has been on the hunt for offers for the portfolio that includes a host of restaurants, pubs, stores and apartments said to be valued at £118m at the end of June.

In recent years, higher interest rates have impacted the commercial real estate sector making it more difficult for buyers to snap up large portfolios.

In March last year, Shaftesbury merged with fellow West End landlord Capco, creating a property giant with £4.9bn of property and 2.9m square feet of lettable space across 670 buildings.

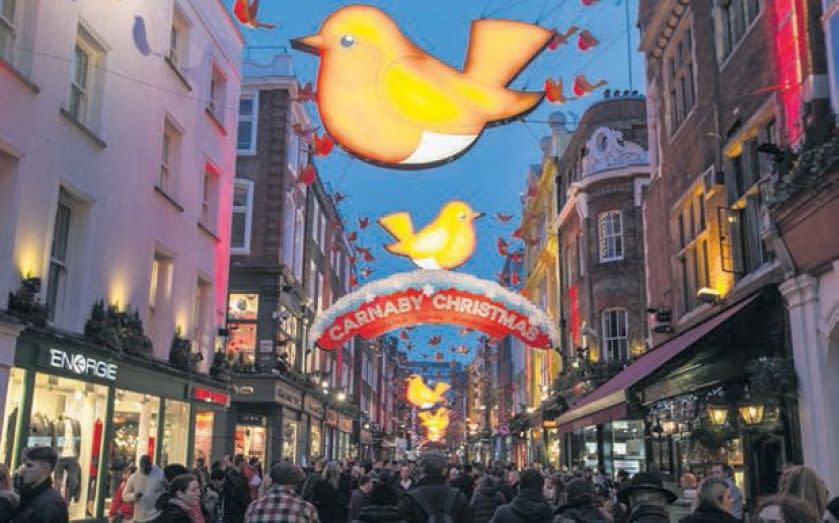

Back in August, the newly formed London property giant, Shaftesbury Capital agreed a new 10-year loan facility with Aviva Investors for £200m, secured against a portfolio of assets within the Carnaby estate.

The major London landlord said the financing highlights the “attractiveness” of the company’s mainly retail and leisure portfolio to a “broad range of institutional capital.”

The loan sits alongside the existing loans the group also took out with Aviva Investors of £130m and £120m which mature in 2030 and 2035 respectively. The average annual cash interest rate of all the loans is 4.7 per cent.

City A.M has contacted Shaftesbury Capital for a comment.

Yahoo Finance

Yahoo Finance