Are share price falls of almost 20pc enough to disqualify a fund from being a ‘wealth preserver’?

In a turbulent few years for shares and other assets, it’s not surprising that many private investors have sought refuge in funds whose purpose is specifically to preserve wealth.

This column has tipped such funds for readers who want investments that won’t give them sleepless nights. But how well have they met such needs?

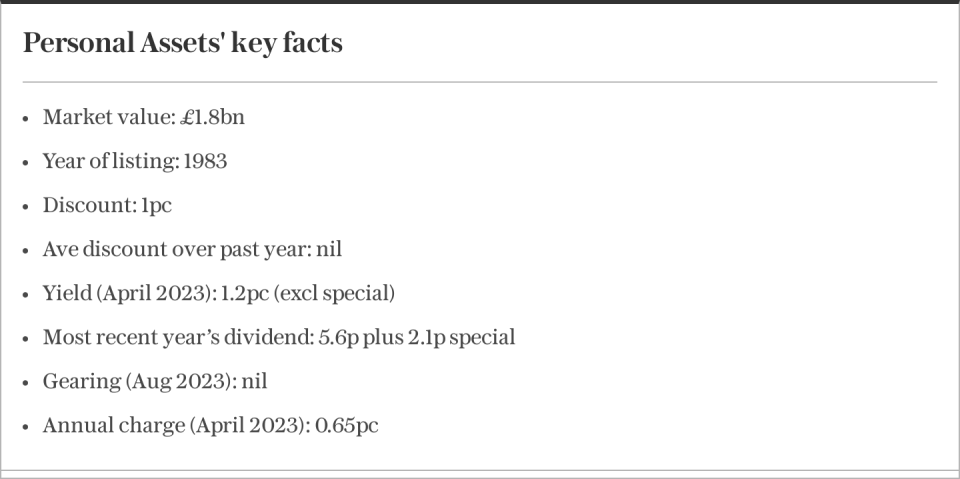

As this column is devoted to investment trusts we’ll confine ourselves to funds quoted on the stock market, where Ruffer Investment Company, Capital Gearing and Personal Assets are the three most obvious wealth preservation trusts.

We have also tipped BH Macro, Caledonia Investments and RIT Capital Partners (later sold), although these are not out-and-out wealth preservation funds: Caledonia and RIT hold a variety of assets with a view to reducing risk, while with BH Macro it’s more the case that the fund, which employs complex “hedge fund” style strategies, aims to rise when markets fall.

Despite this we suspect some readers regard these three trusts as solid wealth preservation options. Since we covered the six trusts in the spring of last year, four have recorded double-digit share price declines. RIT Capital Partners and BH Macro have fallen the most, by 17.9pc and 17.1pc respectively since our update in May 2022.

Ruffer and Capital Gearing, on which we wrote updates in the same column, have since fallen by 13.7pc and 10.1pc respectively. The other two have also fallen, but more modestly.

Caledonia has lost 4.9pc since our update in April 2022 and Personal Assets is 4pc lower than at the time of our last coverage in June last year. We also asked Stifel, the broker, to find out what had been the biggest peak-to-trough falls in the share prices.

Such falls, called “drawdowns” in City jargon, are the theoretical losses of the unluckiest possible investors, those who had bought at the highest level and then sold at the lowest.

Over the past 10 years, Stifel said, the biggest share price drawdown had been suffered by Caledonia: a fall of 39pc from peak to following trough. RIT was marginally better at 38pc and BH Macro’s figure was 34pc.

These numbers are enough in our view to show that none of these trusts, whatever their other merits, should be seen as wealth preservation funds.

But even the other three suffered some big falls. Ruffer’s biggest share price drawdown over the past 10 years has been 19pc, Capital Gearing’s 15pc and Personal Assets’ 12pc.

It’s notable how these share price falls are not always mirrored by the trusts’ net asset values (NAVs). That 34pc fall in BH Macro’s share price coincided with a decline in NAV of only 7pc, while Ruffer’s 19pc share price fall took place while the NAV lost 13pc.

The 39pc share price fall at Caledonia contrasted with a 13pc decline in NAV and RIT’s 38pc fall in share price took place while the NAV lost 16pc.

The gap between the two figures was less marked at Personal Assets and Capital Gearing, which attempt to control their discount: at the former the largest share price fall of 12pc was close to the change in NAV of 10pc while the latter’s biggest drawdown of 15pc coincided with a 10pc fall in NAV.

What these figures suggest is that in the case of wealth preservation funds the investment trust structure is a double-edged sword: the fact that trusts, unlike ordinary, “open-ended” funds, cannot face a run on their assets allows them to take a longer-term view and to hold illiquid investments, but the fact that share prices can diverge so markedly from net asset values reintroduces the very volatility that the funds seek to avoid.

Can we continue to recommend them for readers who want to preserve wealth? Yes, but with an important caveat: you must be willing and able to hold on through periods of underperformance and widening discounts.

Such periods invariably come to an end but, even more importantly, these trusts really come into their own in the event of a market crash, as they will hold up far better than other funds. We maintain a hold rating on Ruffer, Capital Gearing, Personal Assets, BH Macro and Caledonia.

Questor says: hold

Tickers: RICA, CGT, PNL, BHMG, CLDN

Shares prices at close: 271p, £46.10, 468.5p, 353.5p, £34.80

Questor on Twitter

Readers who used to follow us @DTquestor may be wondering what has happened to the account. It still exists but its name has changed to @TeleQuestor. If you go there instead, you should find that you are already following us and we will aim to tweet each column from there. Apologies for any confusion.

Read the latest Questor column on telegraph.co.uk every Tuesday, Wednesday, Thursday and Friday from 6am

Read Questor’s rules of investment before you follow our tips

Yahoo Finance

Yahoo Finance