Shareholders Will Likely Find Cohort plc's (LON:CHRT) CEO Compensation Acceptable

Performance at Cohort plc (LON:CHRT) has been rather uninspiring recently and shareholders may be wondering how CEO Andy Thomis plans to fix this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 20 September 2021. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. We think CEO compensation looks appropriate given the data we have put together.

Check out our latest analysis for Cohort

Comparing Cohort plc's CEO Compensation With the industry

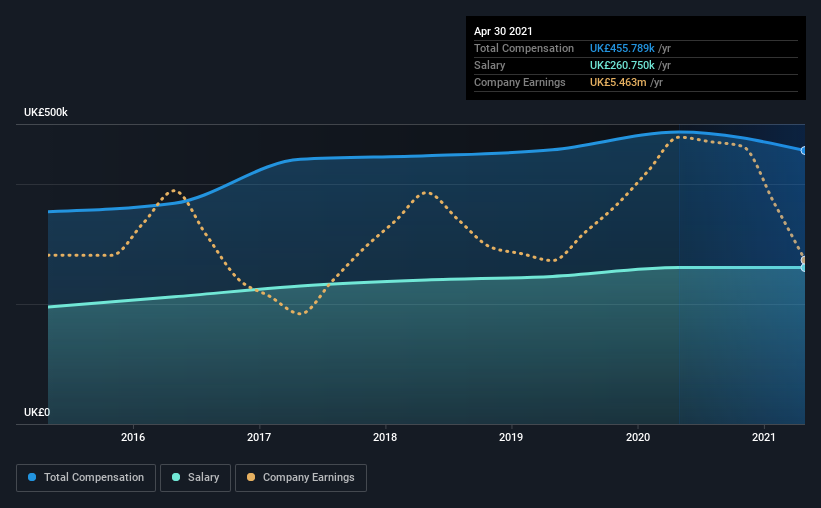

According to our data, Cohort plc has a market capitalization of UK£234m, and paid its CEO total annual compensation worth UK£456k over the year to April 2021. We note that's a small decrease of 6.4% on last year. Notably, the salary which is UK£260.8k, represents a considerable chunk of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations ranging from UK£144m to UK£578m, the reported median CEO total compensation was UK£669k. This suggests that Andy Thomis is paid below the industry median. What's more, Andy Thomis holds UK£1.2m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2021 | 2020 | Proportion (2021) |

Salary | UK£261k | UK£261k | 57% |

Other | UK£195k | UK£226k | 43% |

Total Compensation | UK£456k | UK£487k | 100% |

On an industry level, around 54% of total compensation represents salary and 46% is other remuneration. Our data reveals that Cohort allocates salary more or less in line with the wider market. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Cohort plc's Growth

Over the last three years, Cohort plc has shrunk its earnings per share by 11% per year. Its revenue is up 9.3% over the last year.

Few shareholders would be pleased to read that EPS have declined. The fairly low revenue growth fails to impress given that the EPS is down. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Cohort plc Been A Good Investment?

Boasting a total shareholder return of 50% over three years, Cohort plc has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean these strong returns may not continue. These concerns could be addressed to the board and shareholders should revisit their investment thesis to see if it still makes sense.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 2 warning signs for Cohort that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance