Shareholders Of Primary Health Properties (LON:PHP) Must Be Happy With Their 72% Return

When we invest, we're generally looking for stocks that outperform the market average. And in our experience, buying the right stocks can give your wealth a significant boost. For example, long term Primary Health Properties PLC (LON:PHP) shareholders have enjoyed a 38% share price rise over the last half decade, well in excess of the market return of around 15% (not including dividends).

See our latest analysis for Primary Health Properties

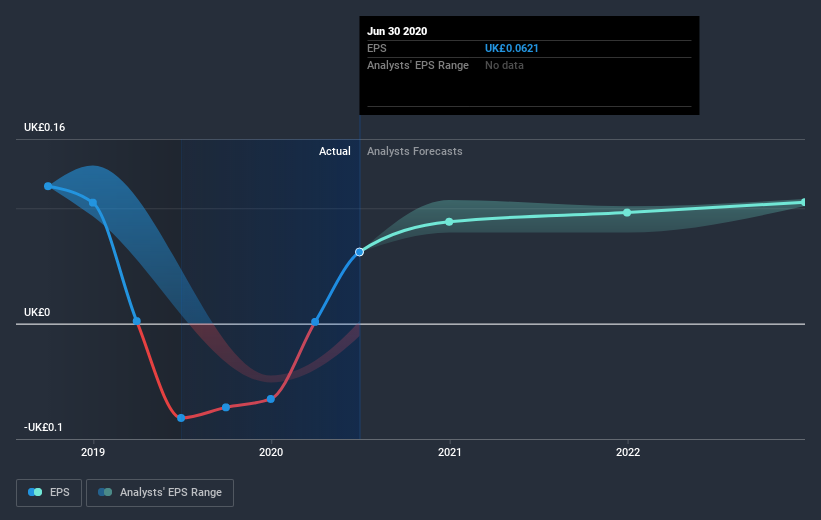

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last half decade, Primary Health Properties became profitable. That would generally be considered a positive, so we'd expect the share price to be up.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Primary Health Properties' TSR for the last 5 years was 72%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

The total return of 2.5% received by Primary Health Properties shareholders over the last year isn't far from the market return of -2.5%. The silver lining is that longer term investors would have made a total return of 11% per year over half a decade. If the stock price has been impacted by changing sentiment, rather than deteriorating business conditions, it could spell opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 4 warning signs for Primary Health Properties you should be aware of, and 1 of them is a bit concerning.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance