Would Shareholders Who Purchased Amigo Holdings' (LON:AMGO) Stock Year Be Happy With The Share price Today?

Amigo Holdings PLC (LON:AMGO) shareholders should be happy to see the share price up 12% in the last quarter. But that hardly compensates for the shocking decline over the last twelve months. Specifically, the stock price nose-dived 88% in that time. So the rise may not be much consolation. The important thing is whether the company can turn it around, longer term.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Amigo Holdings

Because Amigo Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In just one year Amigo Holdings saw its revenue fall by 2.8%. That's not what investors generally want to see. The share price fall of 88% in a year tells the story. Holders should not lose the lesson: loss making companies should grow revenue. But markets do over-react, so there opportunity for investors who are willing to take the time to dig deeper and understand the business.

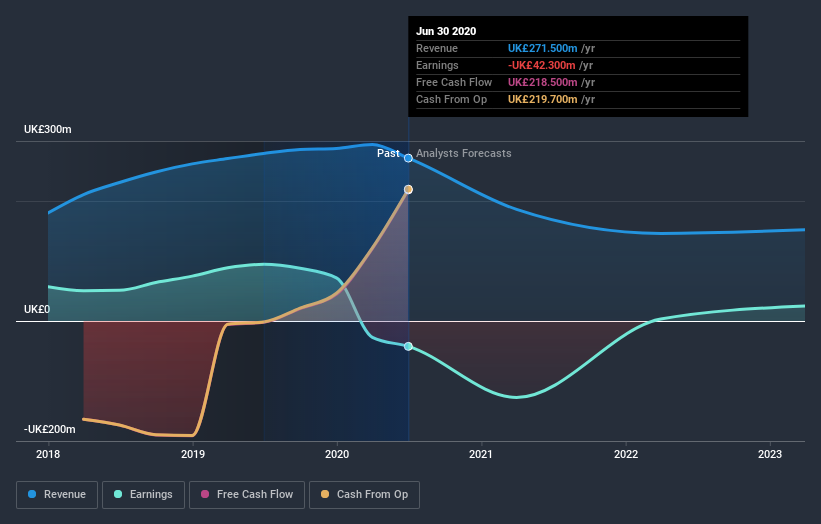

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on Amigo Holdings

A Different Perspective

We doubt Amigo Holdings shareholders are happy with the loss of 88% over twelve months. That falls short of the market, which lost 12%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. It's great to see a nice little 12% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 4 warning signs for Amigo Holdings that you should be aware of before investing here.

Amigo Holdings is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance