Would Shareholders Who Purchased Premier Oil's (LON:PMO) Stock Year Be Happy With The Share price Today?

Premier Oil plc (LON:PMO) shareholders should be happy to see the share price up 27% in the last quarter. But that isn't much consolation for the painful drop we've seen in the last year. During that time the share price has plummeted like a stone, down 79%. So the rise may not be much consolation. The real question is whether the company can turn around its fortunes.

See our latest analysis for Premier Oil

Premier Oil wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Premier Oil's revenue didn't grow at all in the last year. In fact, it fell 24%. That's not what investors generally want to see. The market obviously agrees, since the share price tanked 79%. That's a stern reminder that profitless companies need to grow the top line, at the very least. But markets do over-react, so there opportunity for investors who are willing to take the time to dig deeper and understand the business.

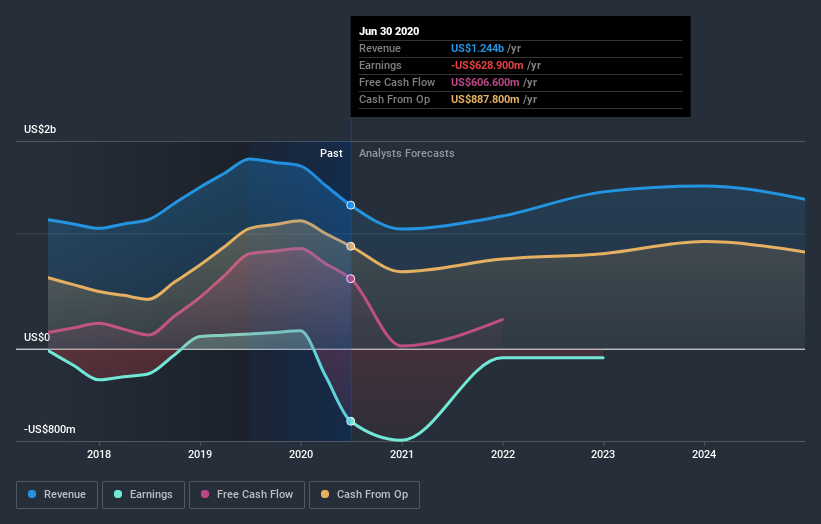

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Premier Oil's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 8.3% in the twelve months, Premier Oil shareholders did even worse, losing 79%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Premier Oil better, we need to consider many other factors. Take risks, for example - Premier Oil has 3 warning signs we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance