Shareholders in VGI Partners (ASX:VGI) are in the red if they invested a year ago

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in VGI Partners Limited (ASX:VGI) have tasted that bitter downside in the last year, as the share price dropped 27%. That's well below the market return of 29%. VGI Partners may have better days ahead, of course; we've only looked at a one year period. Shareholders have had an even rougher run lately, with the share price down 25% in the last 90 days.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for VGI Partners

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

The last year saw VGI Partners' EPS really take off. The rate of growth may not be sustainable, but it is still really positive. As you can imagine, the share price action therefore perturbs us. So it's worth taking a look at some other metrics.

We don't see any weakness in the VGI Partners' dividend so the steady payout can't really explain the share price drop. From what we can see, revenue is pretty flat, so that doesn't really explain the share price drop. Of course, it could simply be that it simply fell short of the market consensus expectations.

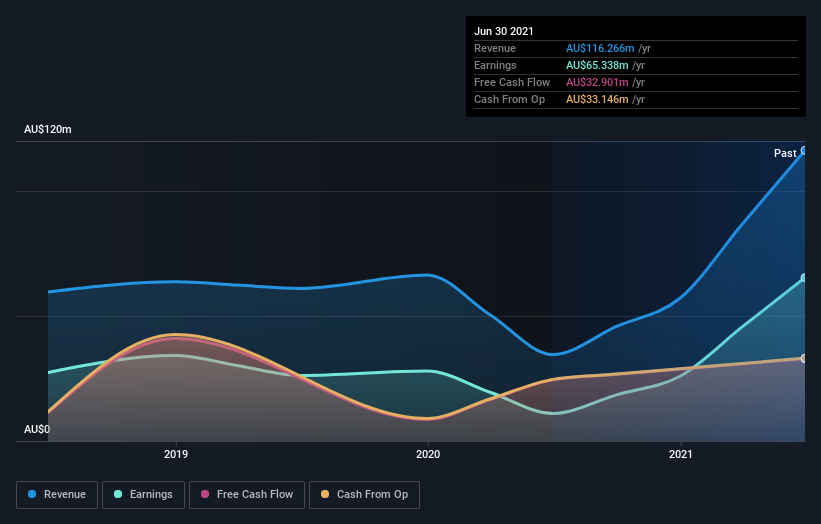

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of VGI Partners, it has a TSR of -21% for the last 1 year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Given that the market gained 29% in the last year, VGI Partners shareholders might be miffed that they lost 21% (even including dividends). While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Notably, the loss over the last year isn't as bad as the 25% drop in the last three months. This probably signals that the business has recently disappointed shareholders - it will take time to win them back. It's always interesting to track share price performance over the longer term. But to understand VGI Partners better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with VGI Partners (including 1 which can't be ignored) .

We will like VGI Partners better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance