The shares have halved and the outlook is toxic – but we're standing by this complicated investment

Even though we are sitting on a paper gain of almost 25pc following our tip in November 2019, the nagging feeling that in the case of IP Group this column is making a bit of a mess of it will not go away. The shares stand at barely half their peak, the chart looks terrible and an environment of rising interest rates is all wrong for a play on long-term growth companies.

Investors of a nervous disposition may still feel it is right to sell now, or at least take sufficient profits to cover their initial investment. But sticking with the shares could yet pay off for the truly patient (and brave) portfolio builder.

IP Group still meets many of the criteria this column seeks as it looks to negotiate the current market squalls: the company has net cash on its balance sheet and the shares trade at a big discount to net asset value – so big in fact that management is running a share buyback scheme. According to the latest annual results, NAV, or book value, per share was 167p and the share price is less than half that.

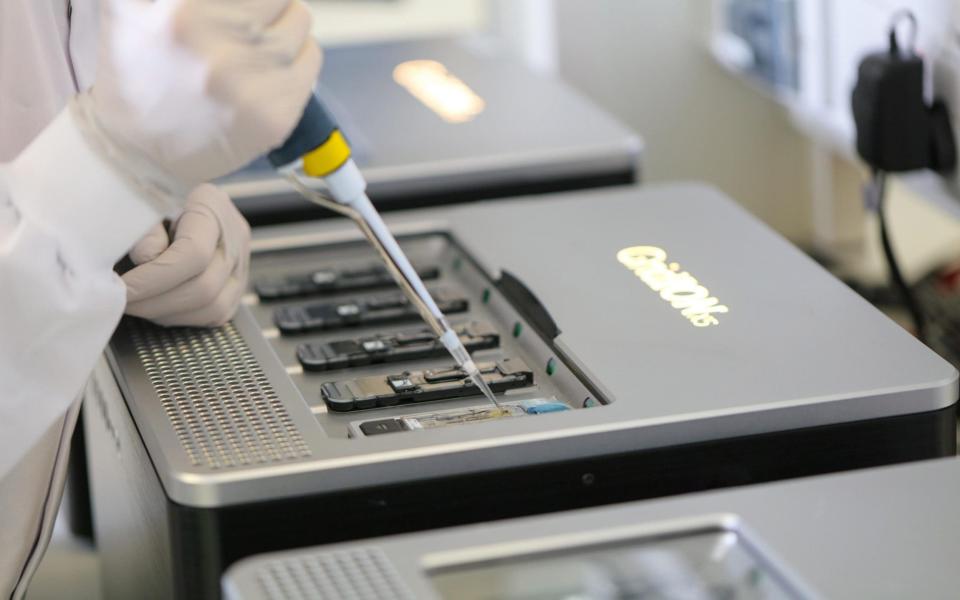

Since then, shares in its quoted holdings such as Oxford Nanopore, the gene sequencer, have fallen, and that will have dragged the NAV down too, although an increase in the value of IP Group’s stake in First Light Fusion will have partially offset that decline.

This remains the key risk with the stock: that the discount to NAV closes because the NAV goes down, rather than because the shares go up.

It could still happen, which is why some investors may wish to take evasive action. Rising interest rates mean rising “discount rates” – the degree to which the present value of future earnings falls – and the higher the discount rate goes, the lower the theoretical valuation of the long-term cash flows from its portfolio of early stage companies.

In addition, the quoted holdings could remain under pressure, especially as the combination of rising interest rates and sticky inflation often works against growth stocks, at least if history is any guide.

The bull case rests with the huge potential of the portfolio of investments, be they quoted or privately held companies, which cover technology, biotechnology and clean technology.

IP Group has 44 “focus” company investments and stakes in 56 others. The 20 biggest holdings by value represent four fifths of the portfolio’s book valuation and after the Oxford Nanopore float last year key private names to watch include cybercrime prevention specialist Featurespace, drug developer Istesso and First Light Fusion, which is working on a gas gun reactor in the field of fusion power.

A major breakthrough here, or at any of the other investments, could boost NAV and the share price, although this will naturally take time. Nonetheless, IP Group still has huge long-term potential and the shares are worth holding.

Questor says: hold

Ticker: IPO

Share price at close: 72.4p

Update: Dunelm

Another name where this column has yet to really cover itself in glory is the retailer Dunelm. No sooner had the decision been made to avoid the stock at 870p in April 2019 than it shot towards £15, buoyed by the wave of online shopping that accompanied lockdowns. We unfortunately chose that moment to tip the shares. After making the full round trip, they are now back below the levels of three years ago.

Dunelm has undeniably suffered a severe crash in valuation as the shares now trade on barely 10 times forecast earnings and yield 12pc (taking 2021’s special dividend into account). That discount to the wider London market on an earnings basis is in stark contrast to the huge premium attributed to the stock during the pandemic as the company’s strong online offering helped it to benefit from the boom in home improvements.

Analysts expect pre-tax profits to be no higher in the year to June 2024 than in the year to June 2022 and there remains the risk that inflation and sagging consumer confidence take their toll on this well run, well positioned retailer’s numbers, even as it gobbles up market share and, to date, continues to produce strong gross margins. But to sell now would be to risk a hat-trick of poorly timed calls. We’ll hold.

Questor says: hold

Ticker: DNLM

Share price at close: 813.5p

Russ Mould is investment director at AJ Bell, the stockbroker

Read the latest Questor column on telegraph.co.uk every Sunday, Tuesday, Wednesday, Thursday and Friday from 5am.

Read Questor’s rules of investment before you follow our tips.

Yahoo Finance

Yahoo Finance