Shares surge at Google's Alphabet as it crushes forecasts

Google owner Alphabet batted off recent clashes with European regulators to post second quarter results which topped expectations, sending its shares surging in after-hours trade.

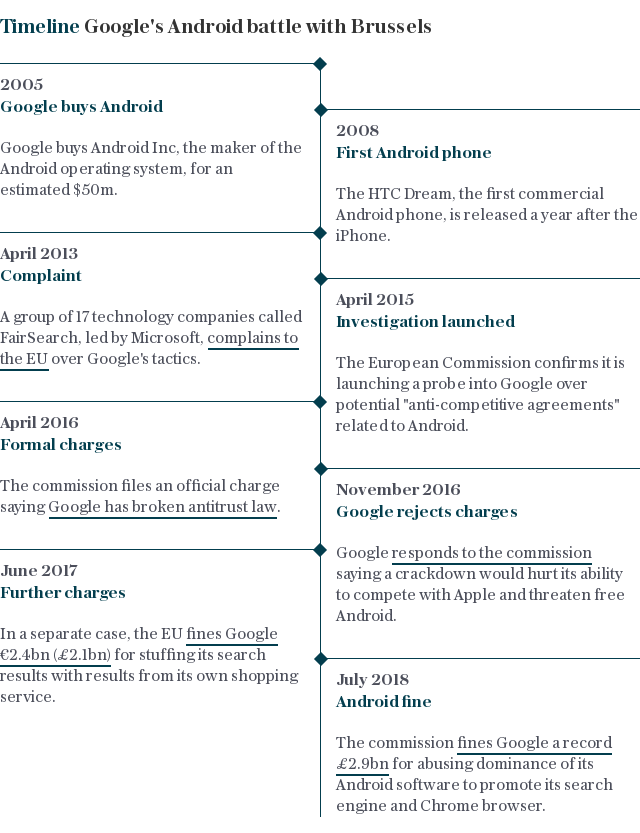

Excluding the €4.34bn (£3.9bn) fine handed down from the European Commission last week, Alphabet's earnings per share came in at $11.75 (9p), up from $8.90 a year earlier.

Revenue jumped 26pc to $32.7m, a substantial beat on the $25.6m analysts had been expecting, driven by a 24pc rise in advertising revenue and a 37pc increase in 'other revenue', which includes its cloud division.

Shares rocketed more than 4pc in after-hours trade, as the market welcomed the strong results, perhaps having tempered expectations in the wake of the disappointing update by Netflix last week as it kicked off the FANGs earning season.

The results are likely to see Alphabet gain on Amazon and Apple in the race to become the first trillion dollar company, having closed this evening with a market capitalisation of $841bn. It has been trailing its tech rivals over the past year in terms of share price growth, coming as the biggest laggard among the FANG stocks, with stock up just 16pc since the start of the year, behind Amazon’s 54pc growth and Netflix’s 88pc increase.

Ahead of the results, some analysts had cautioned over the rising costs at the US search engine giant, specifically its traffic acquisition costs, or how much it pays to have traffic directed to its properties.

However, instead of the 29pc increase, expected by some analysts, those costs were up just 12pc on the year, and the costs as a percentage of advertising revenue was down on the first quarter, at 23pc from 24pc, showing they may be moderating in line with guidance provided last quarter.

The lower-than-expected growth in TAC meant Google’s operating margin came in above expectations.

It will come as a relief to investors, who had been wary over the TAC rate, especially in light of the recent European Commission ruling which could mean Google will have to pay more to attract users to its search engine, if its exclusive contracts, which mean Android smartphone manufacturers have to pre-install its apps, are terminated.

As expected, Alphabet's capital expenditure remained elevated, almost doubling from last year to $5.5bn, as it continues to pump cash into its cloud division.

This spend comes as it attempts to ward off greater competition from rivals, and follows Microsoft last week saying it had made headway in increasing its market share in the cloud space. This had prompted some to suggest Amazon and Microsoft were establishing a “duopoly” for cloud computing services.

Alphabet said it focused spend on its cloud division to "prepare for the long-term", and said it had made the most hires in its cloud division in the recent quarter.

When asked whether there was a larger trend towards more cloud take-up, Google chief executive Sundar Pichai said that he believes "there is an inflection point and that's why it feels far from a zero sum game".

"I think all the major players are definitely seeing traction," he added.

Goldman Sachs analysts had suggested Alphabet could benefit from the introduction of the General Data Protection Regulation regime in May, which restricts how companies can use data, as the laws may have driven advertising budgets towards the search engine giant.

The analysts said, after having spoken with several “large ad partners”, that Alphabet could expect to see some growth in Europe, as “advertisers leveraged fewer 3rd-party data sources and preferred to leverage larger platforms that could ensure compliance with GDPR”.

Alphabet said it was "too early to tell" what the impact had been on its operations, but said it had been a "big change" for a lot of its partners as well as for regulators.

Yahoo Finance

Yahoo Finance