Shell (RDS.A) Up on Coronavirus Resilience, New Financing

Royal Dutch Shell RDS.A recently provided an update on its first-quarter 2020 guidance and envisioned its post-tax impairment charges between $400 million and $800 million for the period. On a bullish note though, management at this European energy behemoth stated that the company entered into a new credit facility, driving its shares more than 4% on the NYSE. The company further assured that it will face a ‘relatively minor’ impact from the coronavirus-induced soft demand for oil products.

New Credit Line, Resilience Against Coronavirus

Investors were particularly reassured by Shell agreeing to a new $12-billion revolving credit facility. The amount supplements the company’s $10-billion financing obtained in December 2019 to prop up its available liquidity in excess of $40 billion (after including $20 billion cash in hand).

By now, we all know that the oil price is persistently trending in the bear market territory following the coronavirus pandemic’s adverse impact on global energy demand. As a result, the outlook for all industries in the energy sector business seems gloomy. Thus, energy players are restricting their operational activities by trimming capital budgets. However, Shell’s overall demand for its oil products is not likely to be affected by the coronavirus in the first quarter. For the rest of the year, the company announced plans to slash its 2020 capital expense by a minimum $5 billion from the past projection of $25 billion along with material reductions in working capital. It further aims to cut operating costs by $3-$4 billion over the next 12 months. These capex measures are anticipated to enhance Shell's free cash flow generation to $8-$9 billion on a pre-tax basis.

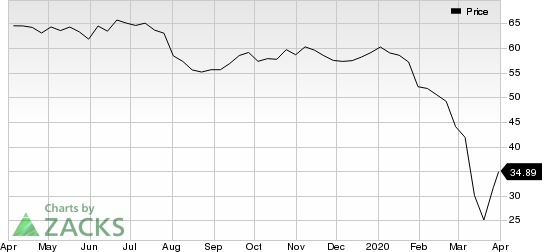

Royal Dutch Shell PLC Price

Royal Dutch Shell PLC price | Royal Dutch Shell PLC Quote

Now let’s delve into some key segmental revisions in first-quarter 2020.

Upstream

The upstream production is projected between 2,650 and 2,720 thousand barrels of oil equivalent per day (boe/d). The year-ago production level was at 2,901 thousand boe/d. However, Shell had earlier predicted its first-quarter upstream volumes to be 2,625-2,775 thousand boe/d.

Downstream

Shell estimated its first-quarter oil product sales in the band of 6,000-7,000 thousand barrels per day, indicating an 8.2% increase from the year-earlier reported number assuming that the upper end of the forecast will be met.

This Netherlands-based company anticipates its refinery availability between 93% and 96%. Moreover, its chemicals sales volumes are predicted between 3,700 and 4,000 thousand tons, suggesting a marginal fall from the year-ago reported figure. Nonetheless, chemicals cracker and intermediate margins will likely see an improvement in the first quarter from the prior-year figure.

Integrated Gas

The company expects first-quarter LNG liquefaction volumes to expand to 8.8-9.2 million tons from its previous year’s quarterly output of 8.74 million tons. Moreover, its segmental production is forecast in the 920-970 thousand boe/d band. In the year-earlier period, Shell produced 851 thousand boe/d.

The Zacks Consensus Estimate for first-quarter bottom line is pegged at 80 cents per share.

This Zacks Rank #4 (Sell) player represents a global group of energy and petrochemical companies. It is involved in all phases of activities in the petroleum industry from exploration to final processing and delivery. The company is scheduled to release first-quarter earnings on Apr 30, 2020. Earnings performance of its peers Chevron CVX, ExxonMobil XOM and BP plc BP are also slated to be announced around the same time. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Chevron Corporation (CVX) : Free Stock Analysis Report

BP p.l.c. (BP) : Free Stock Analysis Report

Royal Dutch Shell PLC (RDS.A) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance