Shell (RDS.A) Sells Stakes in Mukhaizna Field to Indian Oil

Royal Dutch Shell plc RDS.A recently divested its entire stake in Oman’s Mukhaizna oilfield to India’s largest oil company, Indian Oil Corporation. The European oil giant sold its entire 17% interest in the oil field to IOCL Singapore PTE Ltd — a wholly-owned subsidiary of Indian Oil — for a total consideration of $329 million.

The majority stakeholder in the Mukhaizna field is Occidental Mukhaizna LLC, a subsidiary of Occidental Petroleum Corporation OXY, which owns 45% stake. Other partners in the field include Oman Oil Company, Liwa Energy Limited, TOTAL E&P Oman, a subsidiary of TOTAL S.A. TOT, and Partex (Oman) Corporation, each holding 20%, 15%, 2% and 1% stakes, respectively.

Mukhaizna oilfield, being the largest oilfield in Oman, accounts for 13 per cent of the total oil production of 120,000 barrels per day in the nation. The deal marks the first upstream acquisition of Indian Oil in Oman that is likely to enhance its global footprint and growth opportunities in the Middle East region, along with bolstering India’s energy security.

The move will help Shell proceed with its $30 billion divestment program. The deal provides the company with a major uplift in its drive to decrease debt, following the acquisition of BG Group for $47 billion. The divestment is expected to reduce the company’s cost and enhance cash flow, as well as return to capital. The deal will also help the company to upgrade and streamline its upstream portfolio.

With Shell already wrapping up divestment deals worth more than $23 billion, it remains focused to meet its target by 2018. Further, the company announced asset disposals amounting to around $2 billion and talks for prospective transactions of additional $5 billion divestment deals are already in advanced stages.

Headquartered in Netherlands, Shell is one of the largest integrated energy companies engaged in the production, refining, distribution, and marketing of oil and natural gas. The company has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

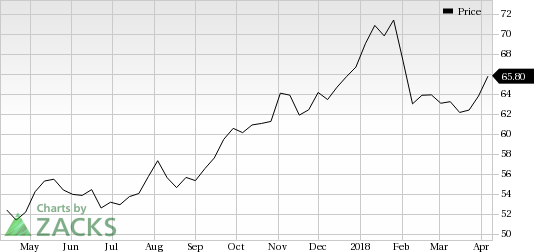

Royal Dutch Shell PLC Price

Royal Dutch Shell PLC Price | Royal Dutch Shell PLC Quote

Meanwhile, one can consider PetroChina Company Limited PTR, which is a Zacks #2 (Buy) Ranked player in the same industry. PetroChina’s revenues and earnings are expected to witness a year-over-year increase of 7.17% and 48.03%, respectively, in 2019.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PetroChina Company Limited (PTR) : Free Stock Analysis Report

TOTAL S.A. (TOT) : Free Stock Analysis Report

Royal Dutch Shell PLC (RDS.A) : Free Stock Analysis Report

Occidental Petroleum Corporation (OXY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance