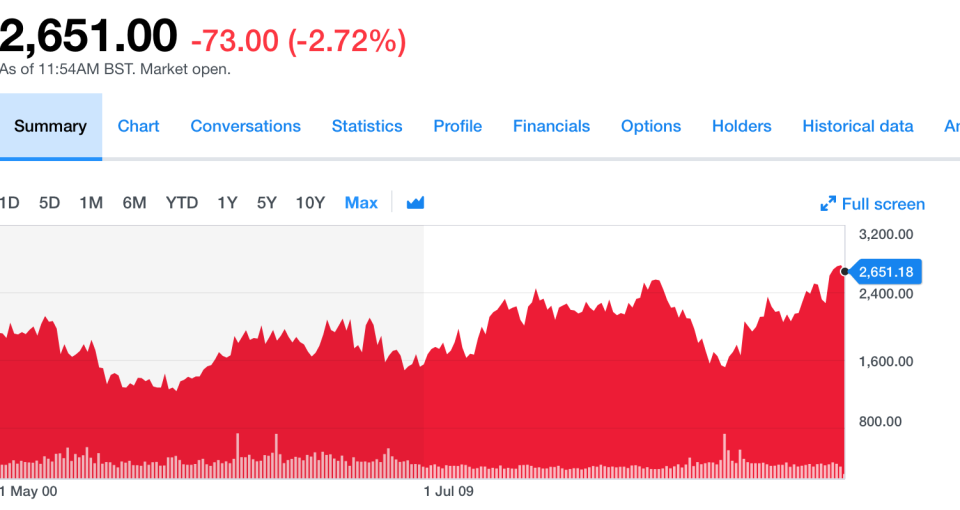

Shell share price hit as $25bn buyback fails to impress investors

Oil company Royal Dutch Shell (RDSB.L) has failed to excite investors with confirmation of its $25bn (£19bn) share buyback.

The boost for shareholders was announced alongside second quarter profits which despite being 30% higher disappointed the City.

In mid-morning trading in London, the shares slipped more than 3%, although have been been boosted of late by the weakness in the pound and a recovery in the oil price to about $75 a barrel from $50 a year ago.

The buying back of shares – which will take place between now and 2020 and is dependent on the oil price – had been expected since Shell (RDSB.L) took over British Gas two years ago.

Chief executive Ben van Beurden said the share buyback was an “important step towards the delivery of our world class investment case.”

“This move complements the progress we have made since the completion of the BG acquisition in 2016 to reshape our portfolio through a $30bn divestment programme and new projects, to reduce net debt and to turn off the scrip dividend.”

“Our financial framework remains unchanged. Our free cash flow outlook and the progress we have made to strengthen our balance sheet gives us the confidence to share our share buyback programme,” he added.

Shell used payments in shares to maintain dividend payouts when oil prices were low or when cash was in tight for almost two years, until the end of 2017. Alongside the results it set the dividend per share at 47cents.

Nicholas Hyett, equity analyst at Hargreaves Lansdown, said: “Having nursed the dividend through the bad times, a resurgent oil price means Shell’s now got the cash to reward shareholders for their loyalty, starting with a $25bn buy-back at $2bn a quarter. It’s been a long time coming.

“The buyback will probably be taken as a sign of confidence, but these numbers are actually a bit disappointing. Earnings are behind market expectations and operating cash flows have gone backward, said Hyett.

Shell’s second quarter profits rose 30% to $4.7bn and said it had completed about $27bn of the sales of assets that it had promised to cut costs and pay down debt.

“A higher oil price is a welcome boost, but it’s not something Shell can control. Debt’s still higher than we, and probably Shell, would like, and will put pressure on the group’s cash in years to come. Add capital spending demands and the promised buyback could yet prove vulnerable to a reversal in the oil price,” said Hyett.

Shell’s slide held back the broader stock market with the FTSE 100 (.FTSE) flat at 7,658, despite rallies in other European stock markets on the back of easing in trade tensions with the US.

Yahoo Finance

Yahoo Finance