The Shineco (NASDAQ:TYHT) Share Price Is Up 294% And Shareholders Are Boasting About It

Unfortunately, investing is risky - companies can and do go bankrupt. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the Shineco, Inc. (NASDAQ:TYHT) share price has soared 294% in the last year. Most would be very happy with that, especially in just one year! And in the last month, the share price has gained -0.3%. This could be related to the recent financial results that were recently released - you could check the most recent data by reading our company report. Unfortunately the longer term returns are not so good, with the stock falling 4.2% in the last three years.

See our latest analysis for Shineco

Shineco isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Shineco saw its revenue shrink by 46%. We're a little surprised to see the share price pop 294% in the last year. It just goes to show the market doesn't always pay attention to the reported numbers. It's quite likely the revenue fall was already priced in, anyway.

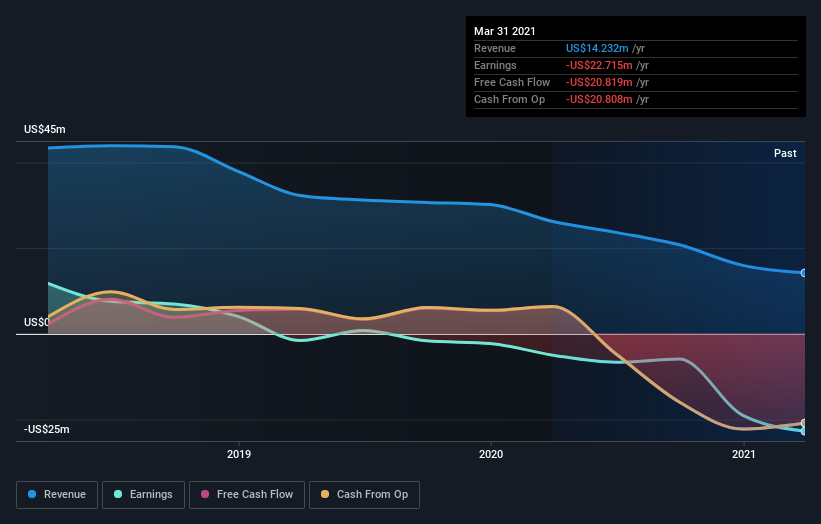

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Shineco stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Shineco rewarded shareholders with a total shareholder return of 294% over the last year. This recent result is much better than the 1.4% drop suffered by shareholders each year (on average) over the last three. We're generally cautious about putting too much weigh on shorter term data, but the recent improvement is definitely a positive. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 4 warning signs for Shineco (1 doesn't sit too well with us!) that you should be aware of before investing here.

But note: Shineco may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance