Shops and pubs face quadruple tax bill next year

Shops, pubs and restaurants are facing a quadrupling of their tax bills next year, after the latest inflation data suggested business rates would rise by almost £2bn.

Estimates compiled by advisory group Altus showed that retail stores will be struck by a £15,300 business rates bill for an average site from next April.

This is compared to £3,600 for the current year, subject to caps on tax reliefs. For a restaurant, the bill is poised to jump to £21,600 from £5,000, while at pubs, it is expected to hit £16,800, from £3,900.

The latest estimates come after the UK released inflation data, showing the headline rate of inflation stood at 6.7pc in September.

The multiplier, which is applied to the rateable value of properties to calculate the tax due, typically rises each April in line with the previous September’s inflation rate.

Altus said the 6.7pc inflation figure meant that gross business rates bills would rise by £1.95bn in England next April, without an intervention by the Chancellor. Scotland, Wales and Northern Ireland set their own business rates.

06:41 PM BST

See you tomorrow

That’s all from us today. I’ll leave you with the latest headlines:

06:15 PM BST

Company that sold facial recognition database featuring Britons escapes fine

A company that sold a facial recognition database featuring information on British citizens has escaped being fined because of a loophole in UK data protection law.

Technology reporter Gareth Corfield has the story:

Judges have ruled that Clearview AI broke no law when it sold its database to police forces because the buyers were non-UK and therefore outside of jurisdiction.

US-based Clearview had been fined £7.5m by the Information Commissioner’s Office (ICO) in 2022 over the sale of its database, which is made up of billions of photos scraped from social media.

The ICO believes that a “substantial amount of data from UK residents” is on the database.

However, a London tribunal has now overturned the fine. Tuesday’s ruling saw the May 2022 fine struck down because Clearview only advertised its database for sale to law enforcement agencies based outside the UK and EU.

Judges said the GDPR data law therefore did not apply because there is an exemption for foreign law enforcement.

Clearview’s general counsel Jack Mulcaire said: “We are pleased with the tribunal’s decision to reverse the UK ICO’s unlawful order against Clearview AI.”

An ICO spokesman said it would “carefully consider [its] next steps.”

06:12 PM BST

Amazon to launch delivery drones in the UK next year

Amazon is to launch drone deliveries in the UK next year, more than a decade after Jeff Bezos first promised packages by air.

The online retail giant said customers in the UK would from next year have the option to get packages weighing under five pounds delivered by its “Prime Air” service within an hour.

Amazon declined to confirm where the programme would launch, although said it would start with a single site and expand. It said customers would be able to choose from “thousands of items” weighing five pounds or less.

Baroness Vere, the aviation minister, said the pilot would “build our understanding how to best use the new technology safely and securely”.

Amazon already offers limited drone package deliveries in two cities in California and Texas. It said the project would expand to another US city, as well as to Italy, by the end of 2024.

Senior technology reporter Matthew Field reports...

06:08 PM BST

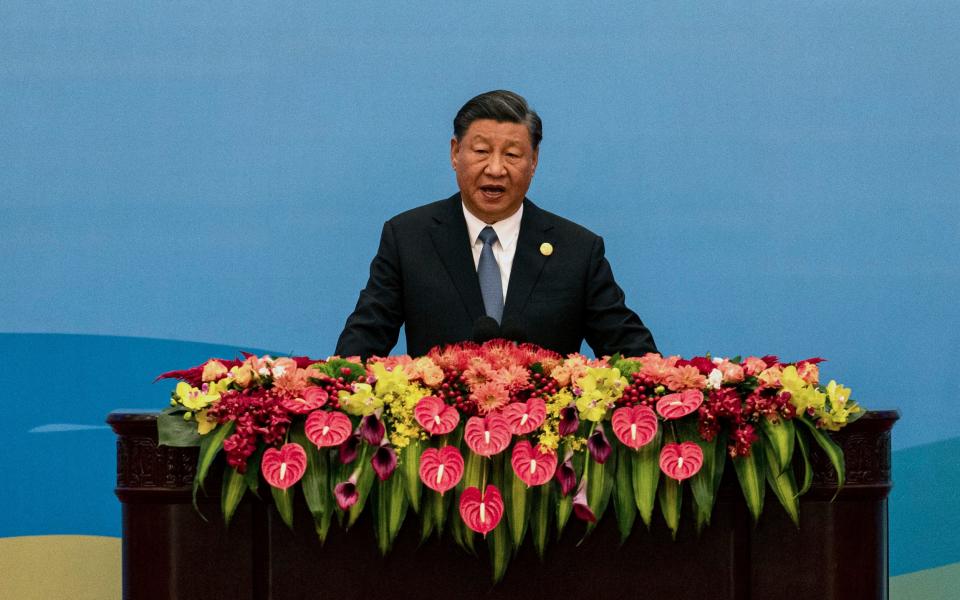

China's economy grows faster than expected after Beijing stimulus

China’s economy grew faster than expected in the third quarter after the government provided stimulus to support the country’s troubled construction and finance sectors.

Deputy economics editor Tim Wallace reports:

GDP in the world’s second-largest economy grew by 4.9pc year-on-year, according to official figures, which was above the 4.5pc economists were expecting.This was down from 6.3pc in the second quarter but analysts believe the latest growth rate signals progress for China’s economy.

In a bid to stimulate growth, President Xi Jinping has relaxed rules on mortgage deposits to boost first-time buyers. He also sought to step up support for the renminbi.

On a quarterly basis, the economy grew by 1.3pc from July to September, accelerating from 0.5pc over the previous three-month period.

Retail spending and consumption drove the improvement in the three months to September, although commercial property continued to drag on the economy.

Country Garden, once China’s biggest property developer, has shaken confidence in the construction industry after warning it could default on its international debts.

Robert Carnell, an economist at ING, said the numbers indicate that “incrementally, China’s economy is making progress.”

He said: “The pockets of weakness are likely to remain drags on growth for some time, but other parts of the economy are taking up the slack, and cautious optimism is probably warranted.”

Mr Carnell has predicted GDP may grow a touch faster than ING’s previous 4.5pc over 2023, but said it will still “struggle” to hit Beijing’s 5pc target.

Xiangrong Yu, economist at Citi, said the latest figures reveal China has an emerging “dual-track economy”.

He said: “The non-property sectors, namely consumer, exporters, industrials and especially hi-tech, could be taking up the slack left by the property downturn at the moment. The improvement is clearly underway, but the overall momentum is still soft and there is a broad-based lack of confidence.

“For the property track, the key question is how much more discomfort is to come and how policymakers will manage the transition.”

Julian Evans-Pritchard at Capital Economics said: “The economy has clearly turned a corner thanks to policy support. And we anticipate a further recovery over the coming quarters.”

However, he cast doubt on the official Government figures, suggesting that Capital Economics’ data “paints quite a different picture”.

He added: “It suggests that [quarterly] growth slowed from 1.3pc in the second quarter to 1pc in the third quarter and that cumulative growth since the end of 2019 is almost six percentage points lower than official figures claim.”

05:47 PM BST

William Hill owner posts 10pc revenue drop amid UK gambling laws reform

The owner of betting chain William Hill has blamed lower revenue on the Government’s plans to overhaul UK gambling rules.

London-listed 888 Holdings, which also owns 888casino and Mr Green, posted a 10pc drop in third-quarter revenue to £405m.

The gambling group said this decline in UK and Ireland was driven by the “ongoing impact of safer gambling changes and refined marketing approach”.

It comes as ministers seek to update Britain’s gambling laws to offer greater protection for customers, including affordability checks on online betting platforms.

Per Widerström, chief executive of 888, said: “This is a business with a very strong foundation for profitable growth. But there are clearly also several areas for improvement which we will focus on to unlock our full potential and drive value creation.”

05:20 PM BST

Airline chief criticised for having shirtless massage during board meeting

AirAsia boss Tony Fernandes has faced criticism for having a shirtless massage during a board meeting.

The 59-year-old, who was also the majority shareholder of Queens Park Rangers Football Club until July this year, posted a picture of himself being pampered, writing that it had been a “stressful week”.

“Got to love Indonesia and AirAsia culture that I can have a massage and do a management meeting,” he added in the now deleted LinkedIn post.

The picture shows Mr Fernandes topless in an office chair while a woman wearing a face mask and apron massages his shoulders.

Foreign reporter Maighna Nanu has the story...

05:10 PM BST

Car dealership Pendragon set to fall into US ownership after second bidder pulls out

Listed car dealer Pendragon is set to be sold to American group Lithia Motors after a rival bidder pulled out.

Industry editor Howard Mustoe reports:

The withdrawal of US car giant AutoNation clears the way for Lithia to complete its £397m deal, which will see it take control of Pendragon’s forecourts and leave the UK business with its Pinewood dealer management software.

Pendragon announced AutoNation’s exit from the race on Tuesday evening, just weeks after the firm’s largest shareholder Hedin also dropped out.

Shares in Pendragon fell by 9pc in response to the development, although they are up more than 70pc since the takeover battle kicked off on September. The business is now valued at around £431m.

Mike Manley, AutoNation’s chief executive, said: “These assets presented AutoNation with a potential opportunity to expand into a new market. However, after further considering the opportunity, we decided not to make a formal offer.”

Lithia had previously launch a full takeover attempt last year, although this was rejected by Hedin.

The earlier attempt required 75pc shareholder approval but Lithia’s scaled back approach needs just over half. This means Hedin, which has a 27pc stake, cannot bloke the deal by itself.

More than a quarter of Pendragon’s shareholders have already agreed to Lithia’s offer.

There has been a flurry takeover activity in the car dealership market of late, with Lookers also set to be acquired by Canadian dealer Alpha Auto for £465m.

This will leave Vertu Motors and Inchcape as as the only car dealers still listed on the London Stock Exchange.

Following Pendragon’s sale, it will be renamed Pinewood Technologies, while Lithia will also set up a joint venture in the US to roll out the Pinewood software.

Shareholders including Schroder Investment Management, Briarwood Capital Partners, Hosking Partners, Farringdon Netherlands, Huntington Management, and former chairman Sir Nigel Rudd have all said yes to the deal, Lithia has said.

05:00 PM BST

Vape maker scraps bright coloured products amid Government crackdown

Vape maker Supreme will stop using bright coloured packaging and use “age-appropriate” flavours in hopes of avoiding a crackdown on its products.

It comes after Health Secretary, Steve Barclay, last week promised to crackdown on the marketing of vapes to children, which he said makes them “look like sweets”.

The company said that its products ranging from disposable vapes to liquids will have plain packaging, while the products themselves will be “plain black, white or grey”.

Supreme will also change the names of flavours to “reduce the shelf appeal for underage vapers”.

The changes will only apply to its own 88Vape brand lines, and not other brands which it sells in the UK through its import business, including ElfBar and Liberty Flights.

Sandy Chadha, chief executive of Supreme, said:

Whilst we believe flavoured vapes are a critical part of many ex-smokers ‘quitting journey’ as they seek to replace that tobacco taste for something more palatable, we are also desperate to ensure that those flavours do not spark any interest in younger people.

We are fully supportive of any further legislation in the sector and believe it is the right thing to do to begin to transition our business by removing or changing anything from within our product set that could be deemed compromising.

As government guidance evolves, we may seek to re-assess this approach.

04:43 PM BST

FTSE 100 closes in the red

The FTSE 100 closed down 1.14pc at 7,588.00, while the FTSE 250 midcap index ended 1.62pc lower at 17,403.46.

It comes after house builders have suffered their worst day on the UK’s main stock markets in five months amid higher inflation and mortgage costs.

Construction and building materials stocks sank by 1.91pc.

Britain’s largest developer, Barratt Developments, shed 5.33pc after warning of an “uncertain” outlook.

04:09 PM BST

Online fashion brand Sosander to launch High Street stores

Online fashion brand Sosander has unveiled plans to open standalone stores on Britain’s high streets.

Retail editor Hannah Boland reports:

The company said its first brick-and-mortar shops will be launched across “affluent towns” early next year.

It is not yet known how many stores Sosander is planning to open but it is understood £7m could be spent on the roll-out.

Ali Hall and Julie Lavington, joint chief executives of Sosandar, said the decision to open stores was the “logical next step” for the business which was founded in 2016.

They said: “We know that the added value of being able to touch and feel our clothes will appeal to our target customers.

“With a clear rollout plan in place and strict criteria around the location of potential stores, we are confident that our stores will enable us to accelerate our market share and increase the awareness of our brand.”

It comes just weeks after Sosandar made its first foray into physical retail as it launched a range at Sainsbury’s earlier this month.

The decision to bolster its high street presence has been “informed by the success of recent partnerships”, the company said.

It will be seen as a vote of confidence in brick-and-mortar stores, which have lost customers due amid a rise in online shopping.

In August, the Retail Sector Council said it was critical ministers support regeneration efforts or risk more towns and cities becoming “wastelands”.

Richard Pennycook, the former Co-op chief executive and co-chairman of the Retail Sector Council, said: “If we don’t incentivise regeneration, then these places are getting hollowed out. What are we collectively going to do about that? The last five years in Chester, Northampton, pretty much any large town in the UK, this has been going on.”

Sosandar currently sells products on its website, as well as through M&S and Next online.

Sosandar said it expected to remain profitable even despite investment in new stores.

The company said it expects revenues to grow by 10pc to £47m in its current financial year through to the end of next March, and then by another 17pc the following year to £55m.

04:01 PM BST

Ofgem sets stricter customer services standards for energy suppliers

Ofgem has ordered energy companies to improve their customer services and help support those struggling with bills this winter.

The regulator has introduced new rules requiring energy suppliers to be easily contactable by phone and email, and offer debt repayment plans at the earliest opportunity.

Suppliers are also required to publish their Citizens Advice star ratings, which provides a score on their customer service, by December 14.

03:34 PM BST

Handing over

That is all from me today. My colleague Adam Mawardi will be your guide from here.

I will leave you with an image showing of union members on the picket line outside the MGM Grand Detroit casino, where the mood for industrial action has spread from workers striking over at the industrial city’s Big Three car makers.

03:12 PM BST

House builders drop most in five months amid rising mortgage costs

House builders have suffered their worst day on the UK’s main stock markets in five months amid higher inflation and mortgage costs.

Developer stocks dropped 4.4pc across the FTSE 100 and FTSE 250 after Barratt today warned of an “uncertain” outlook.

It sent Britain’s largest developer to the bottom of the FTSE 100 and dragged down a host of its peers.

Persimmon dropped 7.1pc, while Crest Nicholson fell 5.5pc and Bellway 5.9pc.

The latter had warned on Tuesday that it expects to build 3,500 fewer homes next year as buyer demand wanes.

03:01 PM BST

UK and Germany pledge no return to Russian gas

Britain and Germany have indicated there will be no return to using Russian gas even after the end of the war in Ukraine.

Germany’s ambassador to the UK said the relationship “has come to an end” as he addressed delegates at the Energy Intelligence Forum in London, Bloomberg News reported.

Such a move would be a major upheaval for Europe’s largest economy. Before the war, just over half of gas consumed in Germany was imported from Russia.

Net zero minister Graham Stuart told the gathering of oil and gas executives that “there will be no return” to using gas from Moscow.

Russia provided just 4pc of UK gas and 9pc of Britain’s oil use in 2021, according to a parliamentary report.

02:48 PM BST

Oil prices surge after deadly Gaza hospital explosion

Oil prices have hit their highest level since the outbreak of war between Israel and Hamas following the deadly explosion at a Gaza hospital.

Brent crude, the international benchmark, has gained as much as 3.5pc today to touch $93 a barrel as the blast overnight triggered fears of a wider conflict in the Middle East.

Following the blast, leaders of Jordan, Egypt and the Palestinian Authority cancelled a summit with US President Joe Biden, who has landed in Israel and met with Prime Minister Benjamin Netanyahu.

Crude’s advance accelerated after Iran’s foreign minister called for an oil embargo against Israel.

Oil prices had already risen by more than a quarter since mid-June after supply cuts made by Saudi Arabia and Russia.

Rising petrol prices were the primary driver of inflation in the UK in September, which remained unchanged at 6.7pc.

The average price of petrol rose by 5.1p per litre between August and September, according to the Office for National Statistics, meaning inflation was unchanged at 6.7pc.

Petrol typically cost 153.6 pence per litre in September. In the same month last year, prices fell by 8.7 pence per litre to stand at 166.5 pence per litre.

Warren Patterson, head of commodities strategy for ING Group, said: “Clearly a widening of the conflict would bring more supply risks to a market which is already very tight.

“The most immediate supply risk likely remains around Iranian barrels.”

Gold prices have also surged to their highest point in four weeks as investors sought out safe haven assets.

02:34 PM BST

US stock markets fall at the open

Wall Street’s main indexes opened lower on Wednesday as growing tensions in the Middle East spurred safe-haven demand, with investors also focused on earnings to gauge the impact of inflation and high interest rates on businesses.

The Dow Jones Industrial Average fell 37.40 points, or 0.1pc, at the open to 33,960.25.

The S&P 500 opened lower by 15.85 points, or 0.4pc, at 4,357.35, while the Nasdaq Composite dropped 94.07 points, or 0.7pc, to 13,439.68 at the opening bell.

02:08 PM BST

Airline unveils window seat plan to speed up boarding times

United Airlines says that it will start boarding passengers in economy class with window seats first starting next week in a move that it says will speed up boarding times for flights.

The airline said in an internal memo that it will implement the plan, known as WILMA, from October 26.

United said the scheme will save up to two minutes of boarding time by allowing passengers with window seats to board first, followed by those with middle seats and then those with aisle seats.

United said that multiple customers on the same economy reservation, such as families, will be allowed to board their flight together.

The plan will be implemented on domestic flights and some international flights.

It comes after the company reported that it it earned $1.1bn in the third quarter, but forecast weaker profit the rest of the year amid surging jet fuel prices and the suspension of flights to Tel Aviv.

Shares fell more than 5pc before the market open.

01:55 PM BST

Pampers maker boosts profits after raising prices

Pampers and Gillette maker Procter & Gamble revealed sales and profits grew as it was bolstered by price increases.

The company revealed net sales increased by 6pc in the three months to September to $21.9bn (£18bn) while net earnings increased 16pc to $5.8bn (£4.8bn).

This came as it increased prices across the business by 7pc.

Chief executive Jon Moeller said he company is on track for the higher end of its organic sales and adjusted earnings guidance this financial year. He said:

We delivered very strong results in the first quarter of fiscal year 2024, putting us on track to deliver towards the higher end of our fiscal year guidance ranges for organic sales and core EPS growth.

We remain committed to our integrated strategy of a focused product portfolio of daily use categories where performance drives brand choice, superiority — across product performance, packaging, brand communication, retail execution and consumer and customer value — productivity, constructive disruption and an agile and accountable organisation.

01:36 PM BST

Wall Street poised to fall amid fresh Middle East bloodshed

The main US stock indexes dipped in premarket trading as growing tensions in the Middle East pushed investors away from riskier assets like equities in favour of safe-havens like gold.

A huge explosion at a Gaza hospital killed hundreds of Palestinians, wrecking a diplomatic mission by Joe Biden, who arrived in Israel on Wednesday but was snubbed by Arab leaders who called off an emergency summit.

Oil prices were last up 1.8pc today amid concerns about potential supply disruptions, helping energy firms Chevron, Exxon Mobil and Occidental Petroleum each to a 1pc gain before the opening bell.

Demand for safe-haven assets sent gold prices to near one-month highs.

Electric-vehicle maker Tesla and streaming services company Netflix are scheduled to report quarterly results after markets close.

In premarket trading, the Dow Jones Industrial Average was down 0.2pc, the S&P 500 had fallen 0.4pc and the Nasdaq 100 had fallen 0.5pc.

01:20 PM BST

Independent hotel closures boost Premier Inn owner

The owner of Premier Inn has cheered a boost in sales as the chain said it was benefiting from a wave of independent hotels shutting down across the UK since the pandemic.

Whitbread said there are fewer hotel rooms on the market to meet strong levels of demand.

The company, which also owns food brands including Beefeater and Bar + Block, reported a 14pc jump in accommodation sales and a 10pc rise in food and beverage sales in the UK in the first six months of the financial year, compared with last year.

Revenue per available room for Premier Inn UK - an important measure for hotels of sales performance and how many rooms are being filled - was £71.02, up from £62.39 per room last year.

The stronger performance saw its pre-tax profit grow by 29pc to £395m over the half-year.

There has been a sharp reduction in independent hotels in the UK since the pandemic, with many seeing buildings converted into something else since closing, Whitbread said.

This has led to fewer hotel rooms on the market which has helped fuel demand for the chain.

12:59 PM BST

Morgan Stanley hit by lacklustre in dealmaking

Profits at Morgan Stanley have fallen by nearly a tenth as Wall Street contends with a prolonged slowdown.

Banking correspondent Simon Foy reports:

The bank posted profits of $2.4bn (£2bn) in the three months to September, down from $2.6bn during the same period last year.

It comes as Wall Street lenders continue to be hit by a downturn in dealmaking activity, with Morgan Stanley reporting a drop in revenues in its investment banking and trading arms.

James Gorman, Morgan Stanley’s chief executive, said: “While the market environment remained mixed this quarter, the firm delivered solid results.”

He told analysts that the bank is “seeing increasing evidence of M&A and underwriting calendars that are building”, adding that he expects “momentum to continue this year”.

In May, Mr Gorman announced that he will step down “at some point in the next 12 months”.

12:45 PM BST

North Sea decline leaves Britain ‘subservient to foreign regimes’, says Energy Secretary

Britain will become “subservient to foreign regimes” if it allows the North Sea to decline further, the Energy Secretary will warn today.

Our energy editor Jonathan Leake has the latest:

Claire Coutinho is to raise concerns that the UK’s oil and gas output will halve by 2030, leaving it increasingly dependent on imports.

Speaking at the annual conference of Energy UK, a leading industry trade body, Ms Coutinho will say: “New data from the North Sea Transition Authority (NSTA) in its Wells Report, warns that – without new oil and gas wells in the North Sea – output will halve by 2030.

“The real-world consequence of this would be that this country would be forced to import up to 80pc of our oil and gas by 2030.

“The UK will not only be subservient to foreign regimes, but we risk decimating the same people and communities that we need to come with us on this green transition journey.”

Read why she fears Britain is creating an energy gap that can only be met by increasing imports.

12:30 PM BST

Sunak’s inflation pledge goes down to the wire after petrol price shock

A shock pause in inflation’s downward march has cast fresh doubt over Rishi Sunak’s pledge to halve inflation by the end of the year.

Our economics editor Szu Ping Chan has the details:

The consumer prices index (CPI) was unchanged at 6.7pc in the year to September, defying economists’ predictions of a fall to 6.5pc.

It underscores the challenge in taming price rises – and the risk that the Prime Minister will fail on one of his five key promises to voters.

To achieve his inflation goal, the rate of price rises must slow to 5.3pc by the end of the year.

Read how the promise to halve inflation was always a gamble.

12:01 PM BST

New Heathrow boss pledges 'better' airport for economy

Heathrow’s new boss has pledged to make the airport “even better for our customers and the British economy”.

Thomas Woldbye, who started in his role as chief executive today, said it was “humbling” to lead the airport.

Mr Woldbye was previously the boss of Denmark’s Copenhagen airport.

He has replaced John Holland-Kaye, who was Heathrow’s chief executive for more than nine years.

Heathrow said in a statement Mr Woldbye is spending his first day in the job “meeting colleagues across the airport”.

He will oversee multibillion-pound plans to upgrade facilities over the next three years, including installing a new baggage system in Terminal 2 and 3D security scanners.

11:48 AM BST

Greta Thunberg charged following oil conference protest

Greta Thunberg has been charged with a public order offence after a protest outside a central London hotel on Tuesday, the Metropolitan Police said.

The Swedish environmental campaigner was charged with failing to comply with a condition on public assemblies.

She had been present at a protest outside a Park Lane hotel where the Energy Intelligence Forum oil and gas conference was taking place.

11:40 AM BST

Workers suspend strike action at key Australian gas plants

Chevron workers say they have endorsed a proposed deal on new pay and conditions, averting a planned strike on Thursday at Western Australian plants that pump out more than 5pc of global liquefied natural gas.

Union members at the US energy giant’s facilities agreed to “suspend” their plan to resume industrial action, the Offshore Alliance union said on the eve of the threatened strike.

The alliance said it had cancelled its notification of industrial action after members endorsed three new enterprise agreements with Chevron covering the vast Gorgon and Wheatstone facilities.

Brad Grady, spokesperson for the Offshore Alliance, said: “We hope this can now be put to rest.”

He added that workers had shown “incredible patience” and accused the US firm of seeking to alter the terms of a deal reached last month.

Chevron said it welcomed the “in-principle agreement” with the Australian Workers Union on new enterprise agreements at the gas facilities.

However, gas prices remain higher amid concerns about global supply disruption that could be caused by the conflict in the Middle East.

European benchmark contracts were 4.6pc higher at more than €51 per megawatt hour, while the UK equivalent contract was up 4.3pc to more than 127p per therm.

11:24 AM BST

Unions call for more help amid 'painfully high' inflation

Unions warned that inflation is still “painfully high” as industrial disputes continue to be fuelled by the ongoing cost-of-living crisis.

Unite general secretary Sharon Graham pressed for action from the Government to help workers and their families through another winter of struggling to cope with rising bills.

She said: “As the cost-of-living crisis nears its second winter, millions of people face the prospect - yet again - of choosing between heating and eating.”

TUC general secretary Paul Nowak said: “Bills and prices are still going up - just a bit more slowly than they were a year ago.”

The TUC said its analysis showed the UK has the highest rate of inflation in the G7 group of countries.

Paddy Lillis, general secretary of the shop workers’ union Usdaw, said: “The Chancellor’s assertion yesterday that ‘people have more money in their pockets’ shows that he is totally out of touch with the real lives of workers.”

11:10 AM BST

Ryanair boss says air traffic control 'collapsed their system' in bank holiday chaos

The August bank holiday air traffic control chaos happened as Nats “collapsed their system”, Ryanair boss Michael O’Leary told MPs.

Around 2,000 flights at airports across the UK were cancelled when Nats’s system for automatically processing flight plans failed on August 28.

The company has previously said the problem was caused by a flight plan featuring two waypoints - which use letters and numbers to represent locations - with identical names.

Giving evidence to the Commons’ Transport Select Committee, Mr O’Leary said: “What fundamentally this committee needs to get the bottom of today is why did they collapse their system?”

He added: “We have written confirmation from other ATC (providers).”

Mr O’Leary said the cost to Ryanair of paying for meals, drinks and hotel rooms for affected passengers was £15m.

10:41 AM BST

London rent prices grow at record pace for third straight month

London rent growth has surpassed 6pc in a first for any region in England since records began in 2006.

Our economics reporter Melissa Lawford has the details:

Rents rose in London by 6.2pc year-on-year in September, up from 5.9pc in August and hitting a new record high for the capital for the third month in a row, according to the Office for National Statistics.

This was the fastest pace of rental growth recorded for any English region in at least 17 years.

Nationally, rents rose by 5.7pc across the UK, which means growth has hit a new record high for the seventeenth month in a row.

The market is being driven by an extreme imbalance between supply and demand after workers returned en masse to cities after Covid restrictions eased, just as high mortgage rates and high taxes are pushing landlords to sell or delay plans to invest.

Rent growth in the capital was outpaced only by Wales where rents rose by 6.9pc.

Private rental prices paid by tenants in the UK rose by 5.7% in the 12 months to September 2023 📈

This is up from 5.6% in the 12 months to August 2023.

➡️ https://t.co/vpYmiLrm5W pic.twitter.com/HqXAbC7wab— Office for National Statistics (ONS) (@ONS) October 18, 2023

10:31 AM BST

Pound inches higher as rates expected to remain at 5.25pc

Sterling made slim gains after inflation held steady in September, with the Bank of England expected to leave interest rates at 5.25pc in early November.

The pound was up 0.2pc today against the dollar at more than $1.22 and was up 0.1pc against the euro, which is worth 86p.

The Bank of England kept interest rates on hold in September, following an unexpected drop in the August inflation rate.

Emma Mogford, fund manager at Premier Miton, said policymakers will “wait to see more of the lagged effect of its current policy, rather than increase rates, but the decision hangs in the balance”.

Nick Saunders, chief executive of Webull UK, said the fact inflation had not risen despite the rally in oil prices means “there may not be a need to raise interest rates towards the end of the year as had been feared”.

Julian Jessop, economics fellow at the Institute of Economic Affairs think tank, called for a cut in rates, saying “money and credit are now both shrinking, adding to the risks of recession and ensuring that inflation has a lot further to fall”.

10:09 AM BST

Oil gains after Gaza hospital blast

UK inflation was pushed higher in September by rising fuel prices, which have gained as the price of oil has risen in the wake of a series of shocks.

Prices had already risen by around a quarter since mid-June following supply cuts by Russia and Saudi Arabia as the two producers tried to prop up the market.

The outbreak of conflict between Israel and Hamas has pushed the cost of oil higher amid fears that a wider conflict in the Middle East could disrupt supplies further.

Brent crude, the international benchmark has gained 2.1pc today to take it toward $92 a barrel and its highest level since Hamas’ surprise attack on October 7 killed 1,300 Israelis.

US-produced West Texas Intermediate has risen 2.3pc toward $89 amid concerns that the deadly blast at a hospital overnight could escalate the conflict.

09:54 AM BST

888 takes a kicking as punters win football bets

William Hill owner 888 has revealed revenues slumped 10pc as it took a hit from new gambling rules and saw football results go in favour of punters.

The betting giant reported revenues of £405m for the third quarter, down from £449.4m a year ago.

Its UK & Ireland online business also saw revenues drop 10pc to £157.2m, with the group blaming tougher regulations introduced in the Government’s gambling white paper that was unveiled in April, while the group has also toned down its marketing strategy.

888 added that it had also suffered a lower-than-expected betting net win margin from customer-friendly sports results in September, particularly football.

But its betting shops fared better, with revenues up 1pc at £125.6m, as a boost from investment in new products and gaming cabinets was partially offset by the hit from sports results.

888 added it was “prioritising the safety and wellbeing” of its 500 workers and their families in Israel due to the conflict with Hamas.

It said it had put in place business continuity plans which are “working well with no significant impact on business operations expected”.

New chief executive Per Widerstrom, who took the helm on Monday, said: “Despite the regulatory challenges the group has faced this year, the hard work by the team is already showing signs of results meaning that we head towards the end of the year with positive momentum, and well placed to grow in the coming years.”

09:39 AM BST

Qatar to supply Shell with gas for 27 years

Qatar has agreed to supply energy giant Shell with natural gas for 27 years for use in the Netherlands, its state-owned energy company has announced.

The Gulf emirate will supply 3.5m tonnes of gas a year under the deal, QatarEnergy said, following two agreements with Shell for a share of its huge North Field gas expansion project.

It comes as European countries have scrambled to replace lost deliveries of natural gas from Russia since Moscow’s invasion of Ukraine last year.

Qatari Energy Minister Saad al-Kaabi said:

We are delighted to sign these two long-term LNG sale and purchase agreements with Shell that will further enhance our decades-long relationship and strategic partnership in Qatar and around the world.

These agreements reaffirm Qatar’s commitment to help meeting Europe’s energy demands and bolstering its energy security with a source known for its superior economic and environmental qualities.

The deal with Shell is equal in length to an agreement with France’s TotalEnergies announced earlier this month for a 27-year supply of natural gas.

Under its North Field expansion, Qatar is set to raise its output of liquified natural gas (LNG) by 60pc or more to 126m tonnes a year by 2027.

09:20 AM BST

Gold prices rise amid Gaza hospital bombing

Gold has jumped to its highest level in four weeks as a deadly explosion at a hospital in Gaza raised fears that the Middle East conflict will escalate.

US President Joe Biden has landed in Israel and embraced Prime Minister Benjamin Netanyahu as his efforts to stabilise the region were threatened by the blast which left hundreds dead. Arab leaders pulled out of a meeting planned for the trip.

The threat of escalation continues to provide support for bullion, which has gained about 6pc since Hamas’ surprise attack on Israel earlier this month.

Previously, the metal was trading near a seven-month low, with a steep selloff in Treasuries weighing heavily on the non-yielding asset.

Spot gold climbed as much as 1pc to $1,942.83 an ounce in early trading. Silver was up 1.2pc, while platinum and palladium also gained.

09:04 AM BST

Barratt shares tumble as house builder warns of 'mortgage challenges'

Barratt Homes shares have fallen to the bottom of the FTSE 100 as the UK’s largest house builder prepares to hold its annual general meeting today.

Its stocks have fallen after bosses declined to give full-year profit guidance, saying “the outlook for the year remains uncertain with the availability and pricing of mortgages critical to the long-term health of the UK housing market”.

The company still expects to build between 13,250 and 14,250 homes in its next financial year but revealed forward sales had fallen to 9,221 homes from July 1 to October 8, down from 13,314 in a similar period in 2022.

Its share price has fallen 2.2pc a day after rival builder Bellway warned it will build far fewer homes next year as high borrowing costs weigh on the property market.

Barratt chief executive David Thomas said:

We have continued to trade in line with the expectations set out in our announcement in September. The trading environment remains difficult, with potential homebuyers still facing mortgage challenges.

Against this backdrop, we are focused on driving revenue whilst continuing to manage build activity and carefully control our cost base.

As always, we remain focused on leading the industry in building high quality, energy efficient and sustainable homes for our customers.

08:48 AM BST

FTSE 100 falls as inflation remains stubbornly high

UK shares slipped as the higher than anticipated inflation figures stoked concerns that interest rates could remain higher for longer.

The FTSE 100 index dropped as much as 0.6pc, while the mid-cap index lost as much as 0.8pc.

Sterling has risen 0.1pc after inflation remained at 6.7pc in September.

Precious metal miners added as much as 0.8pc, as investors turn to safe-haven assets like gold after a deadly blast at a hospital in Gaza fuelled fears about the Middle East conflict escalating.

Heavyweight oil and gas sector advanced 0.5pc, as the escalation of the war sparked concerns about potential disruptions in oil supply from the region.

Elsewhere, Whitbread shares advanced 3.5pc to put it at the top of the FTSE 100 after the hotelier announced a share buyback plan of £300m, following a 44pc rise in half-yearly profit.

By contrast, the UK’s largest homebuilder Barratt Developments sunk to the bottom of the blue-chip index as it refrained from providing a full-year profit forecast, citing an “uncertain” outlook in a challenging mortgage market. The stock has lost 2.1pc.

08:34 AM BST

Government borrowing costs rise as inflation unchanged

The yield on benchmark UK bonds has risen as markets predict that the Bank of England will have to keep interest rates higher for longer to tackle inflation.

The 10-year UK gilt yield jumped seven basis points in early trading to 4.58pc - its highest level in more than two weeks - after inflation remained unchanged in September at 6.7pc.

The yield on two-year gilts, which are more susceptible to increases in interest rates, also gained more than seven basis points to 4.91pc.

Rising bond yields mean the Government is promising to pay more to buyers in exchange for holding its debt. Bond yields move higher as prices fall.

08:27 AM BST

Just East serves up boost in outlook as UK and Ireland deliver sales

Just Eat has increased its earnings outlook once again as it returned to growth in orders by value across the UK and Ireland.

Shares in the online food delivery giant have gained 5.9pc in early trading as it reported a 4pc rise in UK and Ireland sales by gross transaction value (GTV), up 5pc on a constant currency basis, in the three months to the end of September, while it said the majority of its business also returned to growth, except for the US.

The group said a fall in full-year sales by value would be at the bottom end of its previous guidance, down 4pc on a constant currency basis, as the North American business continues to suffer tougher trading.

It saw an 18pc plunge in GTV across North America, down 11pc on constant currency, while the business spanning southern Europe, Australia and New Zealand also fell sharply, down 17pc.

Despite this, Just Eat said it is now expecting underling earnings of around €310m (£269m) in 2023, up from the €275m (£239m) previous guidance.

08:20 AM BST

Minister avoids committing to inflation-linked benefits

Treasury minister Andrew Griffith declined to say whether the Government would hike benefits in line with the September measure of inflation, which is typically used as the key measure.

September’s inflation reading will also be important to the Treasury in relation to state finances as inflation-linked benefits, such as universal credit, and tax credits, are expected to rise in April next year by the rate of CPI inflation from this September.

Mr Griffith told Sky News that the Government could not “make promises about spending or indeed tax cuts that can’t be financed and would put more pressure on inflation and, of course, interest rates”.

He said the assessment process is “yet to happen”, adding: “Last year we increased benefits by 10pc to protect people, one of the largest ever increases.”

'How concerned are you about rising interest rates?' - @kayburley

Economic Secretary @griffitha says he ‘is always concerned about the impact on ordinary people. The govt are doing everything they can to minimise the effect on people'.https://t.co/b6WDNv8pOc

📺 Sky 501 pic.twitter.com/KPPDIDAQIV— Sky News (@SkyNews) October 18, 2023

08:05 AM BST

Markets edge lower after inflation holds firm

The FTSE 100 inched downward after inflation held at 6.7pc in September amid rising fuel prices.

The UK’s blue chip index was little changed at 7,673.05 while the FTSE 250 fell 0.1pc to 17,678.90.

08:01 AM BST

Pound steady as inflation unchanged

The pound inched upwards despite inflation remaining unchanged in September at 6.7pc.

Sterling gained 0.1pc against the dollar to be worth just below $1.22 and was unchanged against the euro, which is worth just under 87p.

07:55 AM BST

Inflation will still fall heavily next month, economists say

The drop in the Ofgem energy price cap means that inflation will experience a very large fall next month despite rising fuel prices keeping the figure unchanged in September, according to economists.

The price cap came into effect on October 1, lowering average annual bills from £2,074 to £1,923.

Paul Dales, chief UK economist at Capital Economics, said the price cap “will subtract a huge 1.3ppts from CPI inflation”.

He added: “That means CPI inflation will be pretty close to 5pc in October and on track to fall below the 5.1pc rate that would mean the Chancellor can successfully say inflation has halved this year.”

Yael Selfin, chief economist at KPMG, said: “Base effects from the large fall in Ofgem’s price cap could see headline inflation dropping below 5pc in October.”

07:47 AM BST

Inflation holding steady 'not unusual', says ONS economist

Office for National Statistics chief economist Grant Fitzner said there may be “some disappointment” around the unchanged inflation figure but that it is “not unusual”.

He told BBC Radio 4’s Today programme:

This is not unusual. If you look across Europe, many countries have seen either periods lately of no change or in some cases of actual increases in the headline rate, before they started to resume their falls.

There may be some disappointment out there, but of course, we have seen significant falls in headline inflation over the last six months.

Asked about whether volatility in the Middle East could lead to rises in the wholesale price of energy, Mr Fitzner said:

It can to the extent that it impacts on supply.

The current conflict in Israel and Palestine is in an area of non oil producers but obviously if this conflict spreads that could be disruptive.

07:45 AM BST

Government 'on track' to halve inflation, insists minister

Treasury minister Andrew Griffith insisted the Government was “on track” to hit its pledge to halve inflation this year despite the headline consumer prices index (CPI) remaining flat at 6.7pc in September.

Core inflation, which strips out volatile food and energy prices, dropped from 6.2pc in August to 6.1pc in September.

It is down from a recent high of 7.1pc in May, which was the highest recorded since March 1992.

Rishi Sunak pledged to halve inflation this year, which would mean he would need headline price rises to fall below 5.4pc by December.

Asked if he believed the rate would be lower, the economic secretary to the Treasury told Times Radio:

No, I expected it to be flat.

At the beginning of the year we set ourselves an ambitious target to halve inflation this year. Today’s figures - flat for September - show we are on track for that.

07:36 AM BST

We're likely to see another rate rise after this data, says Quilter Investors

Marcus Brookes, chief investment officer at Quilter Investors, said:

Clearly the UK is not winning any races with this trajectory as inflation still remains incredibly elevated and much more so than peers.

With geopolitical tensions rising, energy and petrol prices are once again on the way up and inflationary pressures risk hitting an economy that has gone through a painful cost of living crisis.

For now, the higher for longer interest rate narrative will continue to persist.

However, while wages are now rising faster than prices, for many the pain is yet to be truly felt and the Bank of England is in a difficult position.

It paused on raising interest rates at its last meeting, but this reading means we are likely to see at least another rate rise.

The question becomes when they have done enough, but with inflation taking so long to come back down to more palatable levels that is a difficult question to answer and risks policy misstep.

We think the Bank of England has done enough and will be led by external factors, such as the Federal Reserve, but they will not want to appear to be doing nothing, especially when inflation remains so high.

07:28 AM BST

We'll be stuck with this interest rate until end of 2024, says FRP

As inflation held steady at 6.7pc, Phil Harris, restructuring advisory partner at FRP, said:

We’re heading into the ‘golden quarter’ of consumer spending and sticky inflation will only exacerbate the challenges that businesses face this winter.

Forecasts suggests we will be stuck with the existing base rate until the end of 2024, keeping the cost of borrowing high at a time when firms are dealing with elevated input costs – including energy.

Wages have also begun to outstrip inflation for the first time in two years. The big question is whether this will spur-on consumer spending or go towards replenishing depleted household savings.

We’re not expecting any significant fiscal stimulus in next month’s Autumn Statement so it is likely that the high levels of insolvencies experienced this year are here to stay.

07:22 AM BST

Petrol prices jumped by 5.1p per litre in September

The average price of petrol rose by 5.1p per litre between August and September, according to the Office for National Statistics, meaning inflation was unchanged at 6.7pc.

Petrol typically cost 153.6 pence per litre in September. In the same month last year, prices fell by 8.7 pence per litre to stand at 166.5 pence per litre.

Similarly, diesel prices rose by 6.3 pence per litre this year to stand at 157.4 pence per litre. Last year, they fell by five pence per litre to stand at 181.6 pence per litre in September 2022.

The largest downward contributions to inflation came from the milk, cheese and eggs, and mineral waters, soft drinks and juices.

Food and non-alcoholic beverage prices fell by 0.1pc between August and September, compared with a rise of 1.1pc between the same two months a year ago.

With our latest CPI inflation figures released this morning, Matt Corder, Deputy Director of Prices Division at ONS, explains what the figures mean for food prices, fuel and more.

Watch to find out, and you can explore the data here ➡️ https://t.co/0N7k3O1qRN pic.twitter.com/tgDk7yl9lj— Office for National Statistics (ONS) (@ONS) October 18, 2023

07:17 AM BST

Inflation rarely falls in a straight line, says Hunt

Chancellor Jeremy Hunt said:

“As we have seen across other G7 countries, inflation rarely falls in a straight line, but if we stick to our plan then we still expect it to keep falling this year.

Today’s news just shows this is even more important so we can ease the pressure on families and businesses.

07:10 AM BST

Rising prices at the petrol pump keeps inflation high

The Office for National Statistics chief economist Grant Fitzner said:

After last month’s fall, annual inflation was unchanged in September.

Food and non-alcoholic drinks prices eased again across a range of items with the cost of household appliances and airfares also falling this month.

These were offset by rising prices for motor fuels and the cost of hotel stays.

The annual rate of core inflation has slowed again this month, driven by a slowdown in the cost of many goods though services prices did rise a little this month.

07:06 AM BST

Shock pause in inflation heaps pressure on the Bank of England

Inflation was unchanged last month, official figures show, indicating the Bank of England may have to keep interest rates higher for longer to bring down price rises.

The consumer prices index (CPI) measure of inflation remained at 6.7pc in September, according to the Office for National Statistics.

Economists had predicted the figure would drop to 6.6pc.

Rising prices at the petrol pump made the largest contribution to inflation, offsetting falls in food and drink prices.

ONS chief economist Grant Fitzner said: “Food and non-alcoholic drinks prices eased again across a range of items with the cost of household appliances and airfares also falling this month.

“These were offset by rising prices for motor fuels and the cost of hotel stays.”

The inflation figure has remained unchanged just as separate data from the ONS showed wages began to outpace price rises for the first time in the three months to July and to August.

The Bank of England has raised interest rates to 5.25pc in a bid to tame inflation which remains more than three times its 2pc target.

Annual inflation was unchanged in September 2023:

▪️ Consumer Prices Index including owner occupiers’ housing costs rose by 6.3% in the 12 months to September, unchanged from August

▪️ Consumer Prices Index (CPI) rose by 6.7%, unchanged from August.

➡️ https://t.co/0N7k3O1qRN pic.twitter.com/2AciOLbg8d— Office for National Statistics (ONS) (@ONS) October 18, 2023

07:03 AM BST

Good morning

Thanks for joining me. Inflation was unchanged in September in a reading that heaps pressure on the Bank of England to raise interest rates again to tackle stubborn price rises.

The consumer prices index stood at 6.7pc last month.

5 things to start your day

1) Shut down Britain’s gas network and roll out heat pumps, Sunak told | Sir John Armitt warns natural gas supply must end by 2050 for UK to hit climate targets

2) Rupert Murdoch under pressure to break up media empire behind the Times | Investor assault comes a month after Murdoch announced he was standing down as News Corp chairman

3) Watering down CMA’s powers will undermine efforts to tackle Big Tech, Lords warn Sunak | Industry leaders oppose current plans and maintain that they ‘risk chilling investment’

4) America takes dead aim at China’s plan for global AI domination | America takes dead aim at China’s plan for global AI domination

5) Musk cuts price of entry-level Tesla in UK by £3,000 | EV makers are increasingly competing on price as the market becomes more crowded

What happened overnight

Shares have fallen in Asia after China reported that its economy grew at a 4.9pc annual pace in the three months to September, down from 6.3pc in the previous quarter.

China’s National Bureau of Statistics said the world’s second-largest economy slowed in the summer as global demand for exports faltered and the ailing property sector sank deeper into crisis.

The Chinese government has acted to help the economy with various policies, raising spending on building ports and other infrastructure, cutting interest rates and easing curbs on home-buying.

But economists say wider reforms are needed to address longer-term problems, such as a fast-aging population and falling productivity, that are hindering growth.

Hong Kong’s Hang Seng shed 0.1pc to 17,755.25 and the Shanghai Composite index dropped 0.6pc to 3,064.76.

The Nikkei 225 in Tokyo also was down 0.1pc at 32,003.18. South Korea’s Kospi added less than 0.1pc, to 2,461.78 and Australia’s S&P/ASX 200 was up less than three points, at 7,060.50.

Bangkok’s SET rose 0.5pc and India’s Sensex was down less than 0.1pc.

Wall Streets delivered a mixed performance after new data showed that shoppers spent more-than-expected at US retailers, fuelling concerns that the economy remains rebust despite high interest rates.

The S&P 500 dipped to close less than 0.1pc lower at 4,373.20 after flipping between small gains and losses through the day.

The Dow Jones Industrial Average added less than 0.1pc to 33,997.65, while the Nasdaq Composite finished 0.3pc lower at 13,533.75.

The yield on the 10-year Treasury climbed to 4.83pc from 4.69pc late Monday.

Yahoo Finance

Yahoo Finance