Shoe Zone (LON:SHOE) jumps 19% this week, taking one-year gains to 96%

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But you can significantly boost your returns by picking above-average stocks. For example, the Shoe Zone plc (LON:SHOE) share price is up 96% in the last 1 year, clearly besting the market return of around 12% (not including dividends). So that should have shareholders smiling. In contrast, the longer term returns are negative, since the share price is 38% lower than it was three years ago.

The past week has proven to be lucrative for Shoe Zone investors, so let's see if fundamentals drove the company's one-year performance.

See our latest analysis for Shoe Zone

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Shoe Zone saw its earnings per share (EPS) drop below zero. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. It may be that the company has done well on other metrics.

Unfortunately Shoe Zone's fell 40% over twelve months. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

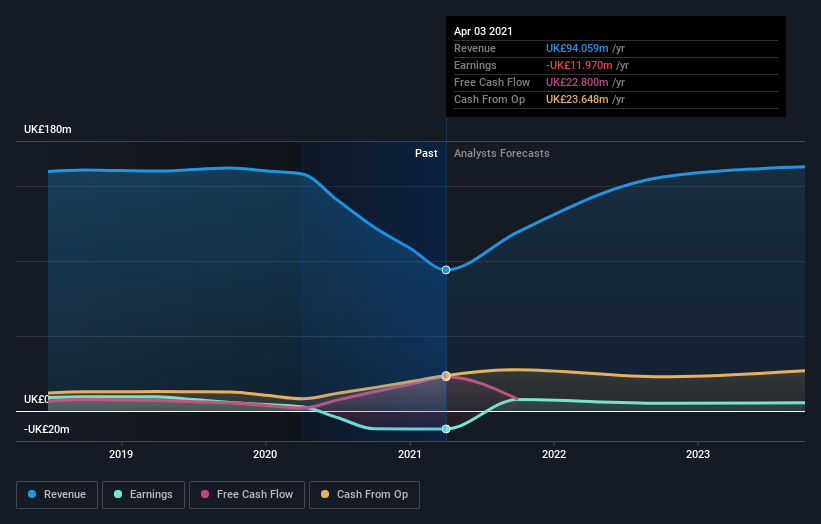

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Shoe Zone will earn in the future (free profit forecasts).

A Different Perspective

It's nice to see that Shoe Zone shareholders have received a total shareholder return of 96% over the last year. There's no doubt those recent returns are much better than the TSR loss of 4% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Shoe Zone better, we need to consider many other factors. For example, we've discovered 3 warning signs for Shoe Zone that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance