Sierra Bancorp And Two Other High Yield Dividend Stocks

In recent trading sessions, U.S. stocks have shown mixed responses as investors anticipate the release of first-quarter GDP data and assess a robust earnings season. This backdrop of economic indicators and corporate performance sets a critical stage for evaluating dividend stocks like Sierra Bancorp, which can offer investors potential stability and steady income streams in fluctuating markets.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.53% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.04% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.03% | ★★★★★★ |

Camden National (NasdaqGS:CAC) | 5.51% | ★★★★★★ |

Evans Bancorp (NYSEAM:EVBN) | 5.06% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.89% | ★★★★★★ |

Bank of Marin Bancorp (NasdaqCM:BMRC) | 6.48% | ★★★★★★ |

LCNB (NasdaqCM:LCNB) | 5.77% | ★★★★★★ |

Hope Bancorp (NasdaqGS:HOPE) | 5.11% | ★★★★★★ |

Ennis (NYSE:EBF) | 5.08% | ★★★★★★ |

Click here to see the full list of 206 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

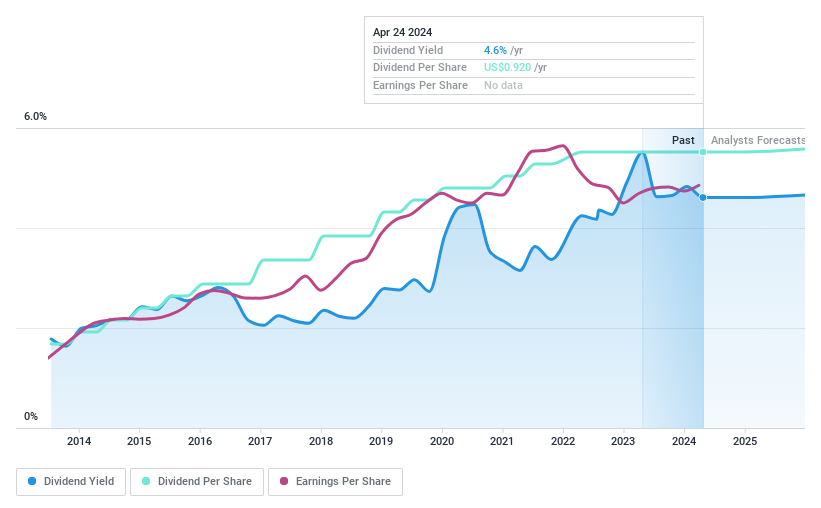

Sierra Bancorp

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sierra Bancorp, operating as the bank holding company for Bank of the Sierra, offers retail and commercial banking services in California, with a market capitalization of approximately $295.35 million.

Operations: Sierra Bancorp generates its revenue primarily through banking services, amounting to $141.85 million.

Dividend Yield: 4.5%

Sierra Bancorp offers a stable dividend, maintaining consistent payments over the past decade and showing growth in dividends during that period. The company's recent financial performance indicates resilience, with a slight increase in net interest income and net income in Q1 2024 compared to the previous year. However, it faces challenges such as increased charge-offs and delayed SEC filings which could impact future stability. Despite trading below estimated fair value, its dividend yield of 4.49% is slightly lower than top US dividend payers.

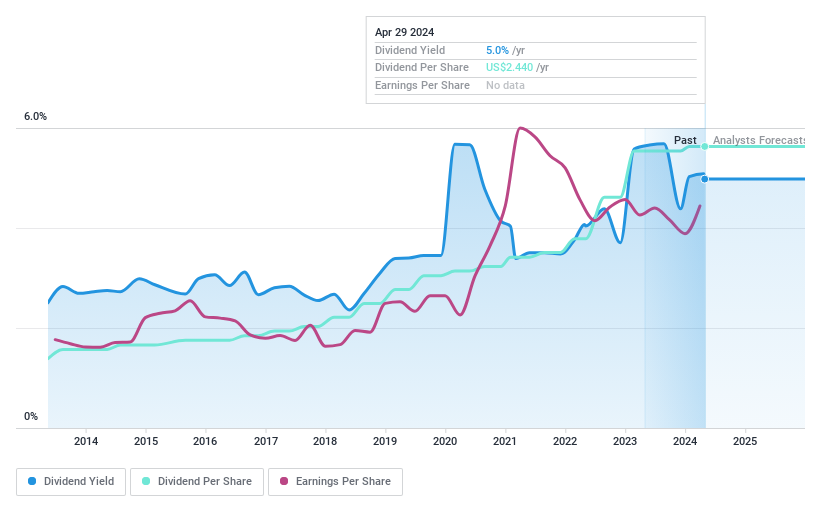

Northrim BanCorp

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Northrim BanCorp, Inc., serving as the bank holding company for Northrim Bank, offers commercial banking products and services to businesses and professional individuals with a market capitalization of approximately $269.59 million.

Operations: Northrim BanCorp, Inc. generates its revenues primarily through two segments: Community Banking, which brought in $106.27 million, and Home Mortgage Lending, contributing $24.08 million.

Dividend Yield: 5%

Northrim BanCorp reported a robust increase in net interest income and net income for Q1 2024, signaling potential financial health. The company's dividend yield of 4.98% ranks in the top 25% of US dividend payers, reflecting its attractiveness to investors seeking reliable income streams. Despite this, there is insufficient data to confirm if future dividends are sustainable based on earnings or cash flows. Additionally, Northrim has actively repurchased shares, enhancing shareholder value but also using resources that could support dividend payments. New leadership under CEO Mike Huston may influence strategic directions impacting dividends and overall company performance.

Dive into the specifics of Northrim BanCorp here with our thorough dividend report.

Upon reviewing our latest valuation report, Northrim BanCorp's share price might be too pessimistic.

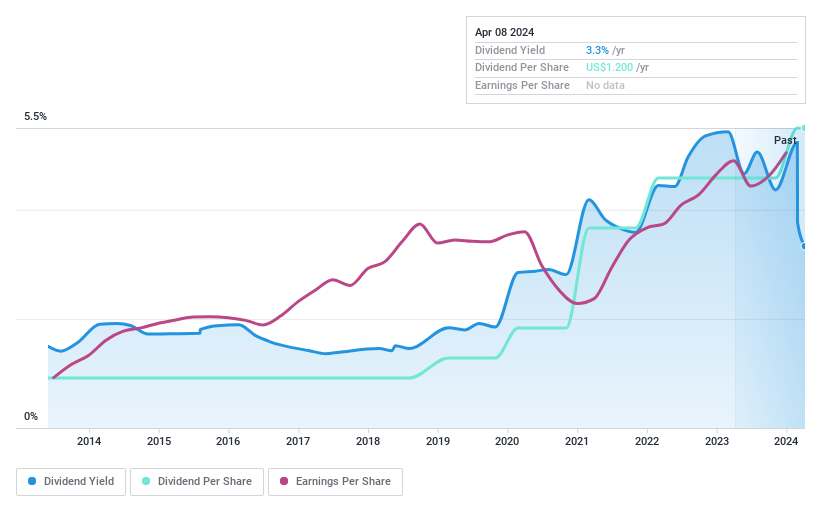

CompX International

Simply Wall St Dividend Rating: ★★★★★☆

Overview: CompX International Inc., primarily operating in North America, manufactures and sells security products and recreational marine components, with a market capitalization of approximately $422 million.

Operations: CompX International Inc. generates its revenue from two main segments: marine components, which brought in $40.11 million, and security products, which accounted for $121.18 million.

Dividend Yield: 3.5%

CompX International has demonstrated a consistent ability to pay and increase dividends, evidenced by a recent $0.05 raise in its quarterly dividend to US$0.30 per share. Over the past decade, both the amount and stability of dividends have been commendable, supported by a 54.5% payout ratio from earnings and a 59.9% cash payout ratio, indicating sustainability from both profit and cash flow perspectives. Despite trading at 67.6% below estimated fair value and enduring high share price volatility recently, CompX's financial performance remains strong with an annual earnings growth of 8.3%, further reinforcing its dividend reliability amidst market fluctuations.

Summing It All Up

Gain an insight into the universe of 206 Top Dividend Stocks by clicking here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:BSRR NasdaqGS:NRIM and NYSEAM:CIX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance