Silicon Laboratories Inc (SLAB) Reports Q1 2024 Earnings: A Detailed Financial Analysis

Revenue: Reported at $106 million, slightly surpassing the estimated $105.08 million.

Net Loss: GAAP net loss stood at $56.5 million, significantly deeper than the estimated loss of $31.11 million.

Earnings Per Share: GAAP diluted loss per share was $(1.77), falling short of the estimated $(0.98).

Gross Margin: Maintained at 52% on both GAAP and non-GAAP bases.

Operating Expenses: GAAP operating expenses were $114.2 million, with R&D and SG&A expenses constituting a significant portion.

Leadership Changes: Announced key executive appointments including a new CFO and Senior VP of Worldwide Operations, aiming to bolster strategic growth.

Future Outlook: Expects Q2 revenue between $135 million to $145 million, with non-GAAP diluted loss per share projected between $(0.58) to $(0.70).

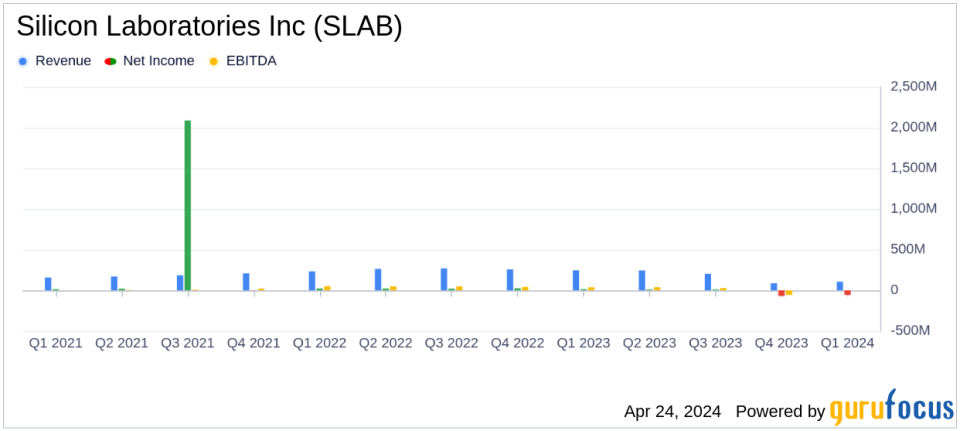

Silicon Laboratories Inc (NASDAQ:SLAB) released its 8-K filing on April 24, 2024, detailing its financial results for the first quarter ended March 30, 2024. The company, a leader in secure, intelligent wireless technology for a more connected world, reported a revenue of $106 million, slightly surpassing the estimated $105.08 million. However, the GAAP diluted loss per share was $(1.77), significantly deeper than the estimated loss of $(0.98) per share.

Silicon Laboratories Inc specializes in developing semiconductors, software, and system solutions for various markets including IoT, Internet infrastructure, industrial control, consumer, and automotive sectors. The company operates primarily through a single segment focusing on mixed-signal analog intensive products, with major revenue contributions from the Industrial & Commercial category.

Financial Performance and Challenges

The first quarter saw Silicon Labs navigating through significant challenges, including end-customer inventory destocking which impacted both the Home & Life and Industrial & Commercial business units. Despite these hurdles, the company achieved a notable sequential revenue growth, attributed to the easing of excess inventory pressures and improved bookings. This performance underscores the resilience and strategic adaptability of Silicon Labs in a volatile market.

However, the substantial GAAP operating loss of $59 million and a GAAP diluted loss per share of $(1.77) highlight ongoing operational challenges. These figures reflect broader industry trends and specific company-related factors such as high R&D and SG&A expenses, which stood at $81 million and $34 million respectively.

Strategic Developments and Outlook

Amidst these financial figures, Silicon Labs is not standing still. The company announced key leadership appointments aimed at driving its strategic growth plans. Notably, Dean Butler will join as the new CFO, bringing a wealth of experience from Synaptics Incorporated, and Bob Conrad will take over as Senior Vice President of Worldwide Operations, signaling a strengthening of the company's operational capabilities.

Looking ahead, Silicon Labs provided an optimistic revenue forecast for Q2, expecting it to be between $135 to $145 million. This anticipation of accelerated growth is supported by continued improvements in bookings and ramping up of design wins.

Detailed Financial Analysis

The balance sheet of Silicon Labs remains robust with total assets amounting to $1,344,153 thousand as of March 30, 2024, though this is a decrease from $1,443,056 thousand at the end of 2023. The company's efforts to manage its operational costs and streamline its asset base are evident from these figures.

From a liquidity perspective, cash and cash equivalents saw a decrease to $191,489 thousand from $227,504 thousand at the end of December 2023. This reduction is part of the broader cash flow management strategy of the company amidst its operational adjustments and investment in growth opportunities.

Conclusion

While Silicon Labs faces significant challenges, marked by a deeper loss per share than anticipated, its strategic initiatives and optimistic revenue outlook for the coming quarter reflect a company that is aggressively positioning itself for future growth. Investors and stakeholders will be watching closely to see if these strategic decisions translate into improved financial performance in the subsequent quarters.

For more detailed analysis and up-to-date information on Silicon Laboratories Inc, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Silicon Laboratories Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance