The Simple Reason I Won't Buy United States Steel Corporation Stock

Investing is all about making hard choices, one of which is how you're going to spend your time. Comparing United States Steel Corporation (NYSE: X), a steel maker I don't own, to Nucor Corporation (NYSE: NUE), one I have owned for several years, helps to highlight what that means. In the end, I want to own great companies -- which is why I won't buy U.S. Steel stock. Let's dig into that a little bit.

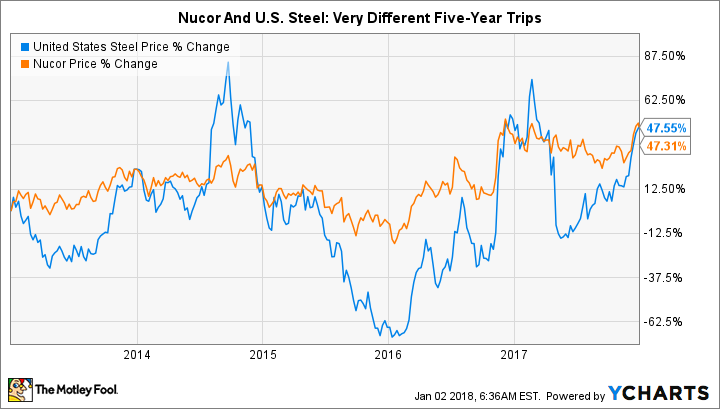

Same return, different path

Over the past five years, shares of U.S. Steel and Nucor have each returned around 50%. In fact, the gains at U.S. Steel have actually edged out Nucor's by a few basis points from time to time. If that's all you look at, U.S. Steel might look like the better investment. But the ride was very different for investors in these stocks.

Image source: Getty Images

Nucor's stock moved roughly sideways through the early part of the trailing-five-year period before starting to head higher after commodity markets began to improve in early 2016. At its worst, the stock was down around 15%, with the high point being the roughly 50% gain it's sitting at right now. To put a financial metric on the stock's price moves, Nucor's beta is 1.58. This suggests it's around 60% more volatile than the overall market (the market's beta is 1).

Now compare that to U.S. Steel's roller-coaster ride. The trip at this company included a series of deep drops and massive advances. And, at the end of it all, it landed in roughly the same place as Nucor. But U.S. Steel's beta of 3 helps show the difference. That's roughly twice as large as Nucor's beta, suggesting that U.S. Steel is a lot more volatile than both the market and Nucor.

I'm not a big fan of roller-coaster rides in real life, and I definitely don't like financial ones. There were periods over this time span when U.S. Steel obviously offered up greater total return potential than Nucor, but as a long-term investor, I would have spent my time fretting about U.S. Steel's stock gyrations.

A deeper look at the companies

So why did I choose Nucor, which I've owned for several years, over U.S. Steel? The answer boils down to a penchant for owning companies that I believe to be financially strong industry leaders. I could go into the historical numbers, but Nucor's stature hasn't changed, so let's just look at some current information.

For one thing, long-term debt makes up about a third of Nucor's capital structure, compared to roughly 50% of U.S. Steel's. The impact of this difference is huge. Interest expenses at U.S. Steel ate up around 40% of the steel maker's third-quarter 2017 EBIT. Interest expense devoured just 10% (or so) of Nucor's EBIT in the same quarter. This isn't a new trend: A heavy debt load weighing down its balance sheet has long been an issue for U.S. Steel. Nucor, on the other hand, has long focused on operating in a fiscally conservative manner.

Then there's the core business. Nucor's operations are centered around electric arc mini mills, which are relatively easy to ramp up and down as demand waxes and wanes. U.S. Steel's business relies heavily on blast furnaces, an older technology that needs high utilization rates to be profitable. Nucor reported a loss in only one year over the last decade through 2016, a tough period for steel makers -- while U.S. Steel lost money in seven of those 10 years.

However, there's more to it than just the types of mills underpinning each business. U.S. Steel's workers tend to be unionized, leaving it with a relatively inflexible pay structure. Nucor's workers aren't in unions and are paid using a profit-sharing plan that rewards them in good years and asks them to share in the pain during hard times. Essentially, Nucor gets a break on the compensation front right when its bottom line needs one. So not only does Nucor have higher EBITDA margins, but those margins have been more stable over time, too.

X EBITDA Margin (TTM) data by YCharts.

And then there's the issue of building for the future. Nucor is always looking for new ways to improve its business, particularly in downturns when acquisitions are cheaper. It used the recent downturn to materially expand its business so it would come out the other side a stronger company. In early 2017, U.S. Steel was basically forced to admit that it didn't invest enough during the downturn and would be playing catch-up with its capital spending during the upturn. That cost the CEO his job, and led to a huge share-price drop.

Stick with the best

I could keep going, but I'm sure you get the idea: U.S. Steel doesn't compare favorably to Nucor, which I consider to be the best steel mill in the United States, if not the world. So why would I bother owning what appears to be a second-tier steel maker when I can simply own the best? That said, Nucor's stock isn't cheap today, so I wouldn't suggest running out and buying it now -- but put it on your wishlist. Steel is a cyclical industry, and there should be a better entry point down the road. Unless something materially changes at U.S. Steel, however, I would avoid its stock for the foreseeable future.

More From The Motley Fool

Reuben Gregg Brewer owns shares of Nucor. The Motley Fool recommends Nucor. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance