Do Singapore Shipping's (SGX:S19) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Singapore Shipping (SGX:S19). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Singapore Shipping with the means to add long-term value to shareholders.

View our latest analysis for Singapore Shipping

Singapore Shipping's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Over the last three years, Singapore Shipping has grown EPS by 4.4% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

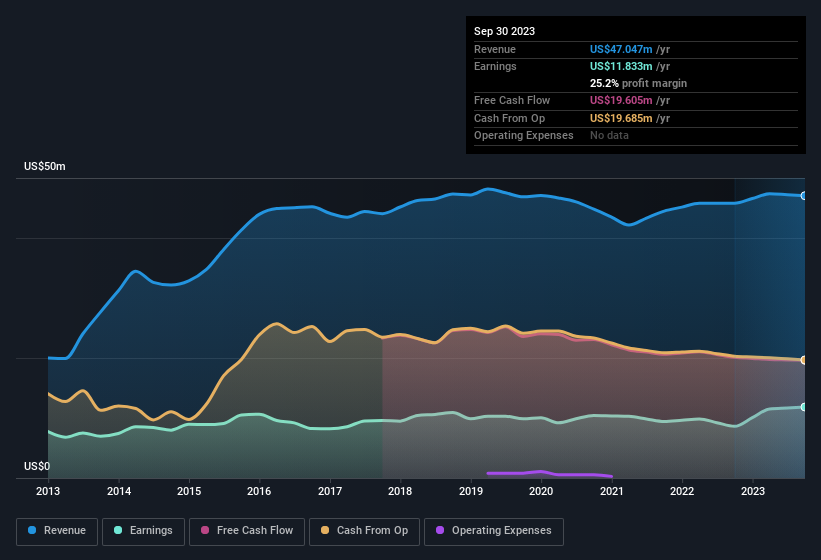

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Singapore Shipping maintained stable EBIT margins over the last year, all while growing revenue 2.7% to US$47m. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Singapore Shipping isn't a huge company, given its market capitalisation of S$95m. That makes it extra important to check on its balance sheet strength.

Are Singapore Shipping Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

With strong conviction, Singapore Shipping insiders have stood united by refusing to sell shares over the last year. But more importantly, Executive Chairman Chio Kiat Ow spent US$117k acquiring shares, doing so at an average price of US$0.25. It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Singapore Shipping will reveal that insiders own a significant piece of the pie. In fact, they own 52% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. With that sort of holding, insiders have about US$49m riding on the stock, at current prices. That's nothing to sneeze at!

Is Singapore Shipping Worth Keeping An Eye On?

As previously touched on, Singapore Shipping is a growing business, which is encouraging. On top of that, we've seen insiders buying shares even though they already own plenty. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. What about risks? Every company has them, and we've spotted 2 warning signs for Singapore Shipping you should know about.

The good news is that Singapore Shipping is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance