Singapore Technologies Engineering (SGX:S63) Has Announced A Dividend Of SGD0.04

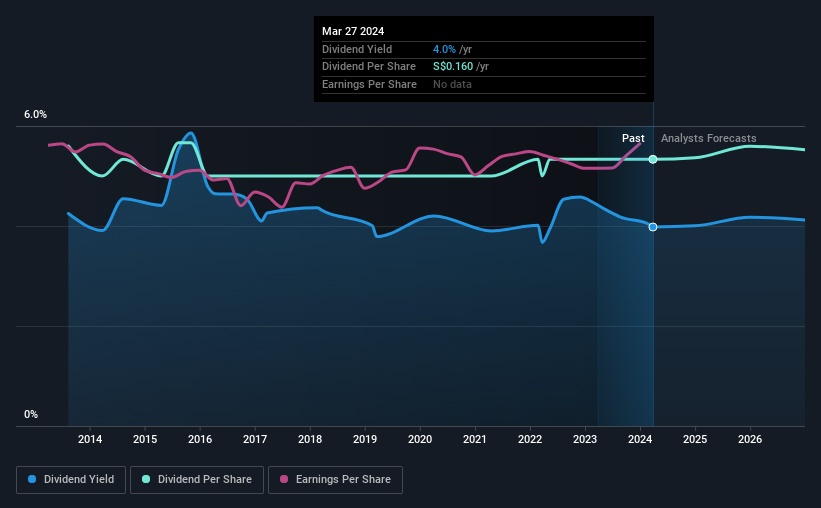

Singapore Technologies Engineering Ltd's (SGX:S63) investors are due to receive a payment of SGD0.04 per share on 14th of May. This means the annual payment is 4.0% of the current stock price, which is above the average for the industry.

Check out our latest analysis for Singapore Technologies Engineering

Singapore Technologies Engineering's Dividend Is Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. Based on the last payment, Singapore Technologies Engineering's profits didn't cover the dividend, but the company was generating enough cash instead. Generally, we think cash is more important than accounting measures of profit, so with the cash flows easily covering the dividend, we don't think there is much reason to worry.

Over the next year, EPS is forecast to expand by 46.8%. Under the assumption that the dividend will continue along recent trends, we think the payout ratio could be 69% which would be quite comfortable going to take the dividend forward.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The annual payment during the last 10 years was SGD0.168 in 2014, and the most recent fiscal year payment was SGD0.16. Payments have been decreasing at a very slow pace in this time period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Dividend's Growth Prospects Are Limited

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Earnings per share has been crawling upwards at 3.5% per year. With anaemic earnings growth, it's not confidence inspiring to see Singapore Technologies Engineering paying out more than double what it is earning. Meaning that on balance, the dividend is more likely to fall in the future than to grow.

Our Thoughts On Singapore Technologies Engineering's Dividend

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Singapore Technologies Engineering's payments, as there could be some issues with sustaining them into the future. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We don't think Singapore Technologies Engineering is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. To that end, Singapore Technologies Engineering has 2 warning signs (and 1 which is concerning) we think you should know about. Is Singapore Technologies Engineering not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance