Single pensioners need £400,000 more than couples to afford ‘comfortable retirement’

Single pensioners need £400,000 more in their pension pot than couples to afford a comfortable retirement, analysis shows.

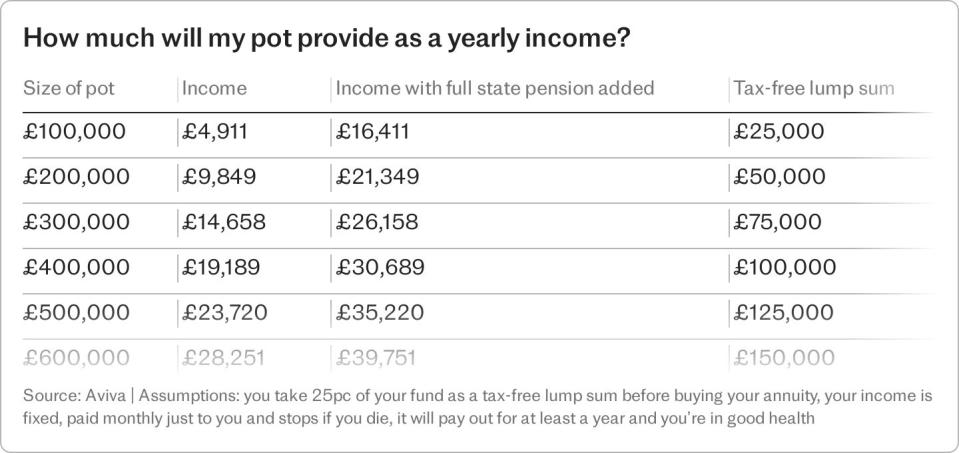

To achieve a comfortable standard of living, single pensioners would need to accumulate pension savings of around £890,000.

But pensioner couples would need £985,000 between them, or just £492,500 each – meaning a single pensioner would need to save an additional £397,500 to achieve the same lifestyle as a couple.

The analysis by insurer Standard Life is is based on calculations by the Pensions and Lifetime Savings Association, a trade body, and shows the impact of rising living costs on retirement.

A comfortable lifestyle – which allows for an annual three-week foreign holiday, £1,500 for clothing and footwear and a kitchen and bathroom replacement every 10-15 years – now requires a post-tax income of £43,000 a year for a single retiree, up from £37,300 last year.

A retired couple would need £59,000 between them, up from £54,500 in 2023.

Dean Butler, of Standard Life, said: “Whether single by choice or by circumstance, single people must front a whole host of expenses on their own – from mortgage or rent payments, utility bills and council tax, to broadband, holidays and TV subscriptions – and unfortunately these aren’t automatically half the amount that couples pay.

“It’s similar when it comes to pension savings too. Couples can pool their finances for retirement, and single pensioners need to amass a significantly bigger pension pot to achieve the same standard of living as pensioner couples.”

It comes amid fears that many workers have not built up sufficient private savings to help fund their desired retirement.

Around 3.5 million private sector employees do not pay anything into a pension in a given year, according to researcher the Institute for Fiscal Studies.

The International Longevity Centre think tank has said that Britain’s 14 million members of “Generation X” – born between 1965 and 1980 – save just £200 a month into their pension pot on average, and that a third of this group were at high risk of retiring on insufficient income.

Becky O’Connor, of retirement savings app PensionBee, said: “Single people are all too familiar with the ‘single penalty’, which is evident on everything from ready meals to housing costs.

“Unfortunately, another hidden but arguably more financially pernicious penalty for not having a partner is the extra amount you need to save to achieve the same standard of living in retirement.

“Being in a couple means benefiting from economies of scale, particularly on the high fixed costs required to support daily life: housing, energy and food.

“This disparity between single people and those in a couple has become even more pronounced during the cost of living crisis, as many of these basic components of spending have risen in cost dramatically, affecting everyone, but affecting single people to a greater degree.

“For those trying to build a decent pension pot to live as a single person when they stop work, this penalty is like a double whammy – it costs you more throughout working life to build that pension pot up, meaning more sacrifice on your disposable income and then retirement itself costs more.”

Yahoo Finance

Yahoo Finance