Sinopharm Group Leads Three Premier Dividend Stocks In Hong Kong

As global markets navigate through varied economic signals, Hong Kong's stock market has shown resilience, with the Hang Seng Index recently marking a notable uptick. In this context, understanding the appeal of dividend stocks becomes particularly pertinent for investors looking for potential stability and steady returns amidst fluctuating market conditions.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

China Construction Bank (SEHK:939) | 7.77% | ★★★★★★ |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.51% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 8.97% | ★★★★★★ |

Consun Pharmaceutical Group (SEHK:1681) | 8.35% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 9.00% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.92% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.51% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 3.92% | ★★★★★☆ |

China Overseas Grand Oceans Group (SEHK:81) | 8.47% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.55% | ★★★★★☆ |

Click here to see the full list of 84 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Sinopharm Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sinopharm Group Co. Ltd., operating in the People's Republic of China, focuses on the wholesale and retail of pharmaceuticals, medical devices, and healthcare products, with a market capitalization of approximately HK$70.37 billion.

Operations: Sinopharm Group Co. Ltd. generates its revenue primarily through the sale of pharmaceuticals, medical devices, and healthcare products.

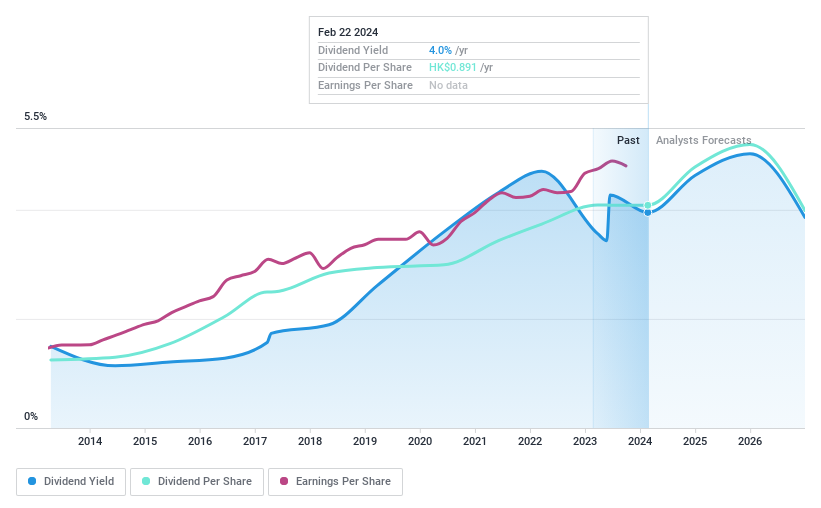

Dividend Yield: 3.9%

Sinopharm Group Co. Ltd. reported a slight decline in net income to CNY 1,420.14 million in Q1 2024 from CNY 1,590.34 million a year earlier, despite a sales increase to CNY 147,265.8 million from CNY 145,517.77 million. The company's dividends appear sustainable with a low cash payout ratio of 31.8% and have been stable over the past decade; however, its dividend yield of 3.92% is relatively low compared to top Hong Kong dividend payers at 7.52%. Sinopharm proposed a final dividend of RMB 0.87 per share for FY2023.

Consun Pharmaceutical Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Consun Pharmaceutical Group Limited, operating in the People's Republic of China, focuses on researching, developing, manufacturing, and selling Chinese medicines and medical contrast medium products with a market capitalization of approximately HK$5.72 billion.

Operations: Consun Pharmaceutical Group Limited generates revenue primarily through two segments: the Yulin Pharmaceutical Segment, which brought in CN¥395.06 million, and the Consun Pharmaceutical Segment, with revenues of CN¥2.20 billion.

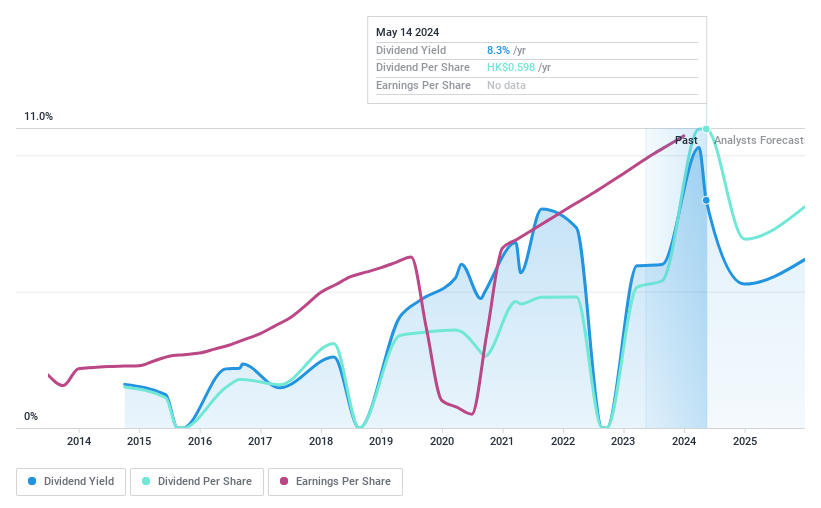

Dividend Yield: 8.3%

Consun Pharmaceutical Group Limited, despite a volatile dividend history over the past decade, has maintained a reasonable cash payout ratio of 57.7%, ensuring dividends are covered by cash flows. The company's earnings coverage is also solid with a payout ratio of 41.2%. Recently, Consun proposed an annual dividend of HKD 0.45 per share for FY2023, about 42% of its profit, payable on June 21 pending shareholder approval at the AGM on May 31.

Jiangxi Copper

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangxi Copper Company Limited operates in the exploration, mining, smelting, and refining of copper across Mainland China, Hong Kong, and internationally with a market cap of approximately HK$85.71 billion.

Operations: Jiangxi Copper Company Limited generates its revenue primarily through the exploration, mining, smelting, and refining of copper.

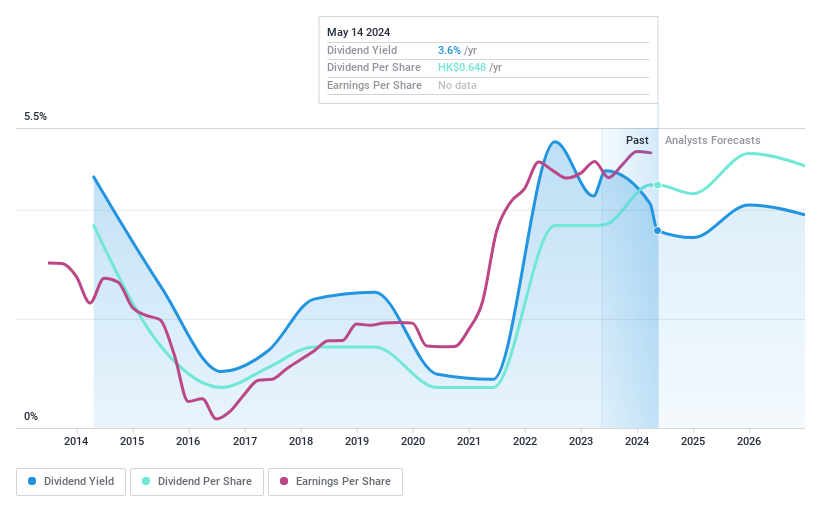

Dividend Yield: 3.6%

Jiangxi Copper's dividend stability is questionable with significant fluctuations over the past decade, despite a reasonable earnings coverage (payout ratio: 32.1%) and cash flow support (cash payout ratio: 79.8%). The dividend yield of 3.62% is modest relative to Hong Kong's top performers. Recent executive turnovers, including a CFO resignation, could impact operational continuity. However, the company's valuation remains attractive with a P/E ratio of 8.9x, below the market average of 9.9x.

Taking Advantage

Click this link to deep-dive into the 84 companies within our Top Dividend Stocks screener.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1099 SEHK:1681 and SEHK:358.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance