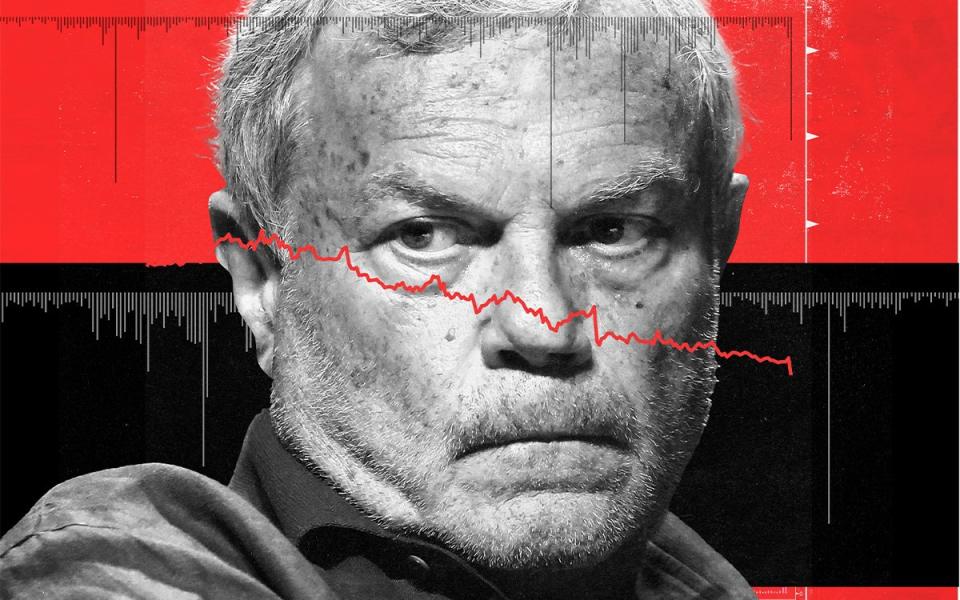

How Sir Martin Sorrell’s revenge company went wrong

It had been mere months since Sir Martin Sorrell acrimoniously left WPP, the advertising giant he built, and launched a rival outfit.

Yet the tycoon couldn’t resist a jibe after outbidding his former company for tech agency MediaMonks, claiming that his fledgling company — S4 Capital — posed no threat.

“We are a bigger animal now, but still to say a $20bn (£16.7bn) company can be frightened of a peanut or a coconut seems to be ridiculous,” he said in 2018.

While Sorrell insisted he wasn’t looking for payback for being ousted, the media mogul later told journalists that making S4 Capital a success would be “the best form of revenge”.

In the three years since, Sorrell has wasted no time in this pursuit — he has struck dozens of takeover deals that enlarged S4, bringing its market cap to £6.7bn by September 2021.

Boosted by a string of contracts with the likes of Google, Facebook, Netflix and Uber, he pitched tech-focused S4 as perfectly placed to capitalise on the growth of digital advertisements.

But if this was meant to be Sorrell’s triumphant revenge record, the mood music has turned sour. Sorrell’s breakneck expansion seems to have left his new company on the brink of disaster.

Shares tanked by more than 40pc following a profit warning on Thursday, taking S4’s value to just above £700m — an almost 100pc drop in just 10 months.

Investors were spooked by a trading update which said rising staff costs at S4’s content division had outpaced sales and profit growth, prompting bosses to institute a hiring freeze and trim profit forecasts from £154m-£165m to £120m. S4 has said its balance sheet remained strong.

It came just months after S4 was separately rocked by an embarrassing accounting fiasco, which forced it to delay annual results by a month.

Now shares are sitting more than 80pc below their peak, at 125p, with Sorrell facing questions over whether he can maintain the frenetic growth he has promised investors.

The 77-year-old, however, points to a prediction that S4 will still hit its target of 25pc growth in like-for-like gross profits and net revenues.

Sorrell insists the reduction in forecasts was “prudent”, and based on a judgement that the content division’s predictions were a tad too optimistic, adding: “How many companies do you know that are growing by 25pc year-on-year?”

“We started at zero. The company is still worth £700m,” he says. “Stocks go up and stocks go down, that is the market.”

Yet not all contemporaries are convinced. One industry source who has worked with Sorrell says S4’s sagging share price could prove problematic.

“The problem he has is that his strategy is buy and build,” they say, pointing to the number of mergers he has struck that use his company’s shares as payment.

“All those people who sold their businesses to him when the shares were way above the current price are going to be seriously unhappy campers,” they add.

“He might have to go for organic growth now, but investors may not be happy with that.”

Sorrell launched S4 as a shell company in the summer of 2018, just weeks after quitting WPP — the advertising giant he founded more than 30 years prior — in a storm of controversy.

He had been accused of using company money to pay for a prostitute, which he has always denied.

Soon, he had rustled up a new cast of backers and a war chest for S4 to snap up technology-focused marketing businesses, in a bid to ride the wave of digital ads.

The foundations were sealed when he acquired Silicon Valley-based data and media business MightyHive and the Dutch digital production firm MediaMonks, which he has since merged into a single brand named Media.Monks.

This reinvention was in some ways a repeat of his strategy at WPP, which he similarly built through a relentless string of takeovers — including one year where he bought 50 rivals.

Sorrell has continued to clash publicly with WPP, in which he retains a stake, claiming new boss Mark Read, a former protege, should quit “before he is pushed”.

One one instance, after WPP refused to pay him bonuses following claims he had leaked information to the press while chief executive, Sorrell accused it of acting in “blind rage”.

Yet there was trouble brewing at his own business that would soon prove more concerning.

At the end of March, S4 was forced to admit it was delaying its annual results after auditors were unable to sign them off — just hours before it was due to publish.

The group subsequently lost one third of its market value and Sorrell later remarked the fiasco was “unacceptable and embarrassing”.

It was later blamed on a combination of poor internal financial processes, staff turnover and a failure of proper documentation as S4 rapidly expanded, prompting promises of more robust arrangements going forwards.

But Thursday’s profit warning seemed to spook investors once again, with shares tanking by 44pc. WPP’s, by comparison, were up 1.8pc.

One senior analyst said there were two ways to read the update: “The bull case is that they have spotted this because of better controls, and that these things will soon fade away.

“The bear case is the question of whether other things are now going to come out.”

In a note to clients, analysts at Citi said they were not “too worried” about S4’s profit warning and put it down to simple “growing pains”.

As for Sorrell, he rejects any notion that his company is struggling with its rate of growth and suggested his record growing WPP speaks for itself.

Given his talent for reinvention, it would be brave to count him out just yet. But for now, it seems, vengeance will have to wait a little longer.

Yahoo Finance

Yahoo Finance