SIX Swiss Exchange Spotlight On Growth Companies With High Insider Ownership In June 2024

As the Swiss market experiences modest fluctuations, with the SMI showcasing slight gains amidst cautious investor sentiment ahead of key policy announcements, it becomes increasingly important to spotlight characteristics that might hint at resilience and potential growth. In this context, companies with high insider ownership often suggest a commitment from those who know the business best, potentially aligning well with investors looking for stability in uncertain times.

Top 10 Growth Companies With High Insider Ownership In Switzerland

Name | Insider Ownership | Earnings Growth |

Stadler Rail (SWX:SRAIL) | 14.5% | 23.4% |

VAT Group (SWX:VACN) | 10.2% | 21.2% |

Straumann Holding (SWX:STMN) | 32.7% | 21% |

Swissquote Group Holding (SWX:SQN) | 11.4% | 14.0% |

Temenos (SWX:TEMN) | 17.4% | 14.7% |

Sonova Holding (SWX:SOON) | 17.7% | 9.9% |

Gurit Holding (SWX:GURN) | 30.2% | 35.4% |

SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

Sensirion Holding (SWX:SENS) | 20.7% | 79.9% |

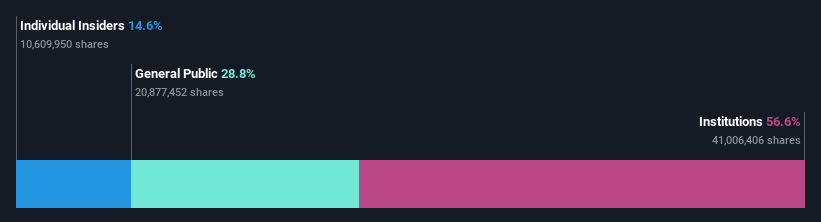

Arbonia (SWX:ARBN) | 28.8% | 100.1% |

Let's uncover some gems from our specialized screener.

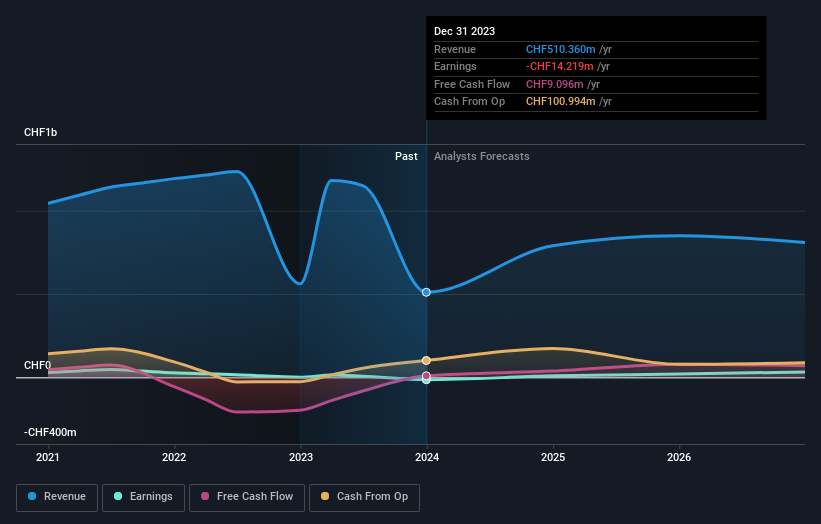

Arbonia

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Arbonia AG is a company that supplies building components in Switzerland, Germany, and other international markets, with a market capitalization of approximately CHF 891.86 million.

Operations: The company's revenue is primarily generated from its Doors segment, which includes sanitary equipment, contributing CHF 501.56 million.

Insider Ownership: 28.8%

Earnings Growth Forecast: 100.1% p.a.

Arbonia, a Swiss company, is set to become profitable within the next three years with anticipated earnings growth of 100.06% annually, outpacing the average market. Although its revenue growth at 9% per year exceeds Switzerland's average (4.4%), this rate remains below the high-growth benchmark of 20%. Insider ownership remains stable with no significant buying or selling recently reported. The forecasted return on equity is low at 3.8%, suggesting potential challenges in generating shareholder value efficiently.

Click here to discover the nuances of Arbonia with our detailed analytical future growth report.

Our valuation report here indicates Arbonia may be overvalued.

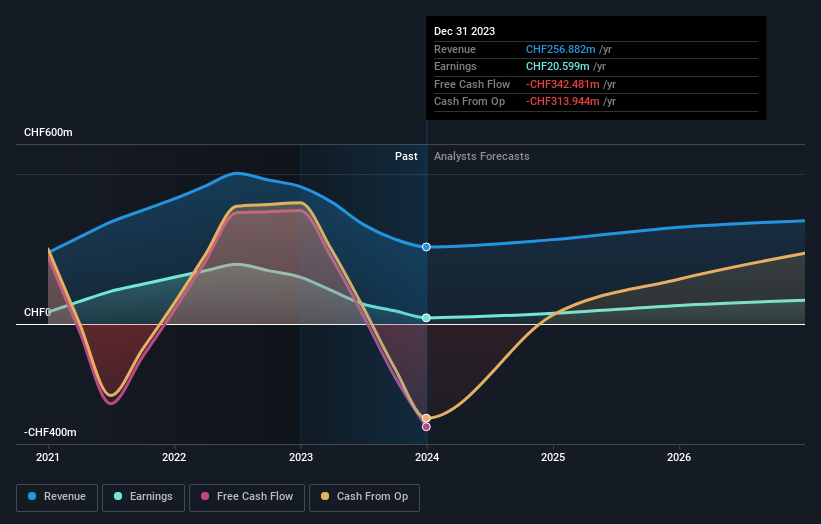

Leonteq

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Leonteq AG, with a market capitalization of CHF 409.07 million, specializes in offering structured investment products and long-term savings and retirement solutions across Switzerland, Europe, and Asia, including the Middle East.

Operations: The company generates CHF 256.88 million in revenue from its brokerage services.

Insider Ownership: 12.7%

Earnings Growth Forecast: 26.4% p.a.

Leonteq, a Swiss firm, is expected to see its earnings grow by 26.4% annually over the next three years, significantly outpacing the Swiss market's 8.2%. Despite trading at 77.8% below its estimated fair value and showing promising revenue growth of 10.1% per year—faster than the market average—challenges persist. Profit margins have declined from last year's 34.2% to 8%, and debt coverage by operating cash flow is weak. Recent executive changes include Hans Widler's appointment as CFO, following Antoine Boublil’s departure.

Temenos

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG is a global provider of integrated banking software systems, serving financial institutions worldwide, with a market capitalization of approximately CHF 4.45 billion.

Operations: The firm's revenue is derived from the sale of integrated banking software systems to financial institutions globally.

Insider Ownership: 17.4%

Earnings Growth Forecast: 14.7% p.a.

Temenos, a Swiss growth company with significant insider ownership, is currently valued at 26.2% below its fair value, making it an attractive prospect. Despite a highly volatile share price recently, Temenos is poised for robust growth with earnings expected to increase by 14.7% annually, outstripping the Swiss market's 8.2%. However, it carries a high level of debt which could pose risks. Recent strategic moves include a CHF 200 million share buyback program and advancements in sustainable cloud solutions that enhance operational efficiency and reduce carbon footprint, aligning with broader environmental goals.

Take a closer look at Temenos' potential here in our earnings growth report.

Our valuation report here indicates Temenos may be undervalued.

Seize The Opportunity

Investigate our full lineup of 16 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership right here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SWX:ARBNSWX:LEON SWX:TEMN and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance