SK Hynix’s $24 Billion Rally Unraveling on US-China Tech War

(Bloomberg) -- SK Hynix Inc.’s $24 billion rally this year faces pressure as the South Korean chipmaker finds itself embroiled in an intensifying US-China tech war.

Most Read from Bloomberg

China Sows Fresh Confusion About Apple With Security Remarks

Luxury Cruise Ship Full of Australians Stuck in Greenland Arctic

Fed on Alert for One More Hike After ‘Disappointing’ Inflation

A key supplier to both Apple Inc. and Nvidia Corp., SK Hynix has ridden this year’s artificial intelligence boom to surge more than 60% through the end of August. Bulls brushed aside the chipmaker’s dismal quarterly loss and warnings related to US restrictions on China, making the stock the most expensive among Asian chip giants.

Now, a shocking revelation that its products were found inside Huawei Technologies Co.’s Mate 60 Pro is prompting a reality check. While SK Hynix said it has suspended doing business with the Chinese phonemaker since US curbs, traders were nonetheless on edge, with the shares slipping 4.1% Friday after the news hit. The incident serves as a reminder of the geopolitical risks facing Korean firms that have heavy business operations in China.

While the stock rebounded Monday along with a rising broader market, headwinds are building. China’s plan to broaden its ban on the use of iPhones to state firms and government agencies bode ill for suppliers in the region, including SK Hynix. Sales data for new iPhones, typically released every fall, is a key barometer of global demand for electronics devices that run on chips.

Recent share price moves reflected “the fear of potential US sanctions,” after SK Hynix chips were found in the Huawei smartphone, said An Hyungjin, chief executive officer at Billionfold Asset Management Inc. The news on China’s iPhone usage ban “poured cold water and raised concerns that iPhone sales may be weak,” An said.

The latest developments have brought geopolitical risks to the fore for the stock. SK Hynix last year told analysts that the Biden administration’s escalating restrictions could force the closure or sale of a major plant in China in an “extreme situation.” The company gets about a third of its revenue from China, according to data compiled by Bloomberg.

Investors are also focusing on SK Hynix’s third-quarter earnings due October, which may be worse than market expectations, according to Roh Jongwon, chief investment officer at Infinity Investment Advisory Co. Continued weak demand for memory chips used in mobile devices called NAND will weigh on the stock price over the short term, he said.

The chipmaker’s sales in the three months through June came in at just half of its revenue a year ago, while operating losses extended for the third straight quarter.

“For its NAND business to improve, we need to see overall improvement in the industry and demand, which seems far-fetched,” Roh said.

To be sure, few expect SK Hynix to have supplied its chips to Huawei in defiance of the US ban. SK Hynix is “strictly abiding by the US government’s export restrictions” and has “started an investigation to find out more details,” the Korean firm said.

One possibility is that Huawei may be tapping a stockpile of components it accumulated before the full set of US trade curbs had been imposed on it. But the concern is that the US government may further tighten its scrutiny on foreign partners’ business dealings with China.

“SK Hynix would not have sold that chip directly to Huawei. It is more of leftover inventory in China,” said Tom Kang, an analyst at Counterpoint Technology Market Research. “There will probably be no actions against Hynix, but the US government might probe the distribution channels.”

SK Hynix is also prone to profit taking as its rally has exceeded those of the rivals in Asia. Samsung Electronics Co. and Taiwan Semiconductor Manufacturing Co. have advanced a little more than 20% this year through August, roughly a third of SK Hynix’s gains during the period. SK Hynix supplies high-end memory devices for Nvidia, a key driver of the outperformance.

“Because SK Hynix’s share rose a lot, investors probably want to lock in profit,” Roh at Infinity Investment said.

Tech Chart of the Day

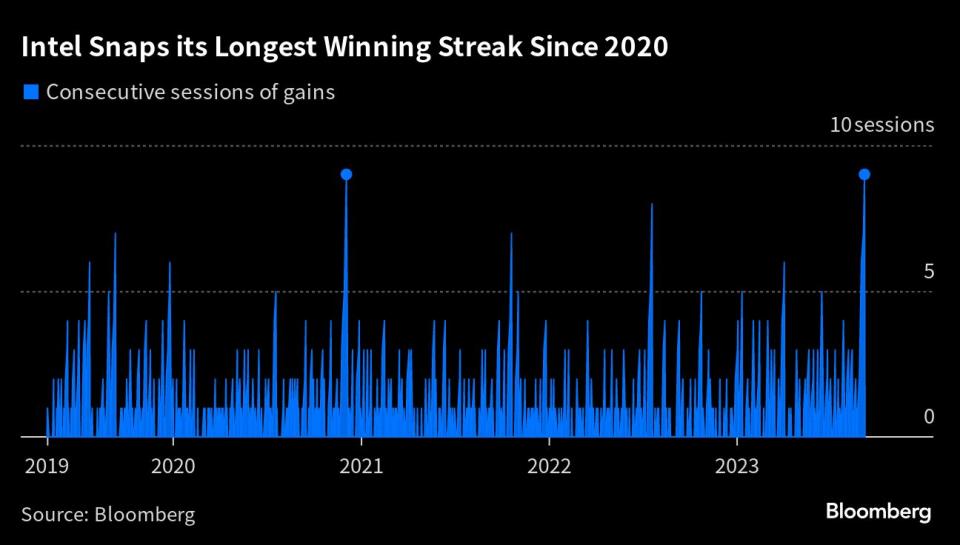

Intel Corp. closed down 0.5% on Friday, snapping a nine-day streak of gains. While this is still its longest winning run since December 2020, the stock was at one point on Friday poised for its longest such streak since May 2005. The rally boosted the shares by about 17% through Thursday’s close. Shares of the company were edging higher on Monday.

Top Tech Stories

Alibaba Group Holding Ltd.’s former chief Daniel Zhang has decided to quit just months after agreeing to lead its cloud division, introducing another layer of uncertainty to China’s largest e-commerce company just as it’s navigating a complicated breakup

Elon Musk’s X Corp. sued California to undo the state’s law aimed at exposing sources of hate speech and disinformation by requiring social media companies to explain how they moderate their content

Taiwan’s top envoy to the US said Taiwanese semiconductor firms are holding back from more investments in America because of “unreasonable and unfair” double taxation, and urged Congress to pass a deal to address the problem as soon as possible

Arm Holdings Ltd. is considering raising the price range of its initial public offering after meeting investors for what would be the world’s largest listing this year, according to people familiar with the matter

Indian edtech titan Byju’s has made a surprise repayment proposal to lenders, in which the firm has offered to pay back its entire $1.2 billion term loan in less than six months, according to people familiar with the situation

Earnings Due Monday

Postmarket

Oracle

--With assistance from Jeanny Yu, Jeffrey Hernandez, Yoolim Lee, Subrat Patnaik and David Watkins.

(Updates to add stock move in the Tech Chart of the Day section.)

Most Read from Bloomberg Businessweek

ADHD Drug Shortages Worsen as Makers Say Production Is Maxed Out

James Dolan’s $2.3 Billion Sphere Is Raising Eyebrows—in a Good Way

How Sam Bankman-Fried’s Elite Parents Enabled His Crypto Empire

©2023 Bloomberg L.P.

Yahoo Finance

Yahoo Finance