Skechers USA Inc (SKX) Surpasses Analyst Revenue Forecasts with Record Q1 Sales

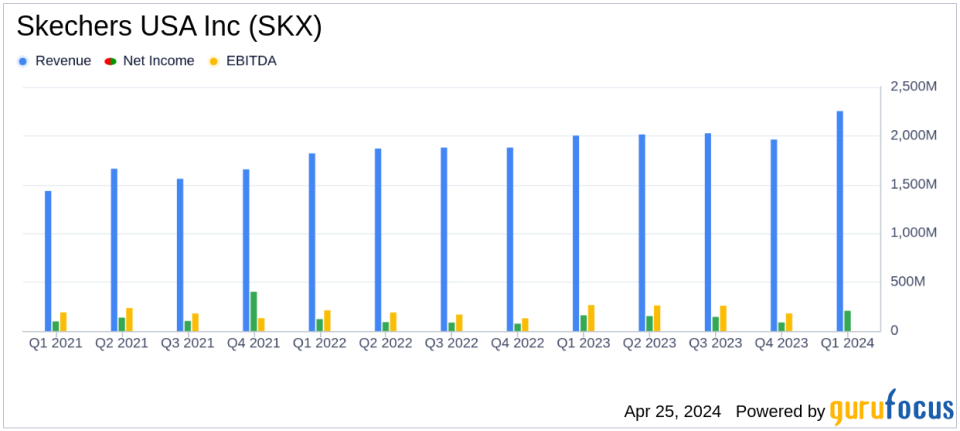

Revenue: Reported $2.25 billion, up 12.5% year-over-year, surpassing estimates of $2.20 billion.

Earnings Per Share (EPS): Achieved $1.33, a 30.4% increase from the previous year, exceeding estimates of $1.10.

Net Income: Reached $206.6 million, a 28.8% increase from the previous year, surpassing estimates of $176.11 million.

Gross Margin: Improved to 52.5%, up 360 basis points year-over-year, driven by lower freight costs and higher selling prices.

Operating Margin: Increased to 13.3% from 11.2% last year, reflecting a 210 basis point improvement.

Direct-to-Consumer Sales: Grew by 17.3%, indicating strong consumer demand and effective market strategies.

Stock Repurchase: Repurchased $60.0 million of Class A common stock, demonstrating confidence in the company's financial health and future prospects.

Skechers USA Inc (NYSE:SKX) unveiled its 8-K filing on April 25, 2024, reporting a robust first quarter with record-breaking sales and earnings that exceeded analyst expectations. The company announced a significant 12.5% increase in sales to $2.25 billion, surpassing the estimated $2.20 billion. Diluted earnings per share (EPS) also outperformed, reaching $1.33 compared to the forecasted $1.10.

Skechers, a global leader in lifestyle and performance footwear, continues to expand its market presence through innovative product lines and strategic global marketing. The company's product offerings, including a diverse range of footwear and related accessories, are sold worldwide through various distribution channels, contributing to its substantial growth in both the Wholesale and Direct-to-Consumer segments.

Financial Highlights and Operational Achievements

The first quarter saw Skechers achieve a gross margin of 52.5%, a notable increase from the previous year, primarily due to lower unit costs and higher average selling prices. Operating expenses rose by 16.9% to $882.8 million, reflecting increased investments in marketing and operational expansion. Despite this, the company managed an impressive operating margin of 13.3%, up from 11.2% last year, leading to earnings from operations of $298.8 million, a 33.6% increase.

Net earnings attributable to Skechers USA Inc stood at $206.6 million, marking a 28.8% rise from the previous year. This financial strength is further highlighted by the company's strategic share repurchases, with $60.0 million spent on buying back shares during the quarter.

Strategic Initiatives and Market Expansion

CEO Robert Greenberg highlighted the company's successful marketing initiatives, including a memorable Super Bowl commercial and partnerships with prominent sports figures, which have significantly enhanced brand visibility and consumer engagement. The company's commitment to innovation is evident in its product development, particularly in the Skechers Hands Free Slip-ins, which have become a leading product in many markets.

The company's balance sheet remains robust with $1.25 billion in cash and investments, despite a slight decrease due to share repurchases and capital expenditures. Inventory levels were strategically reduced to $1.36 billion, aligning with current market demands and operational goals.

Outlook and Future Prospects

Looking ahead, Skechers anticipates continued growth with second-quarter sales expected to be between $2.175 billion and $2.225 billion and EPS between $0.85 and $0.90. For the full year, the company projects sales to reach between $8.725 billion and $8.875 billion, with EPS ranging from $3.95 to $4.10, aligning closely with the annual estimates.

With a clear strategy for global expansion and a focus on maintaining operational efficiency, Skechers is well-positioned to achieve its target of $10 billion in sales by 2026. The companys performance not only reflects its strong market position but also underscores its potential for sustained growth in the competitive footwear industry.

For detailed financial figures and future projections, investors and stakeholders are encouraged to view the full earnings report and join the upcoming earnings call, details of which are available on the Skechers Investor Relations website.

Explore the complete 8-K earnings release (here) from Skechers USA Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance