Is Sky plc (LON:SKY) A Smart Choice For Dividend Investors?

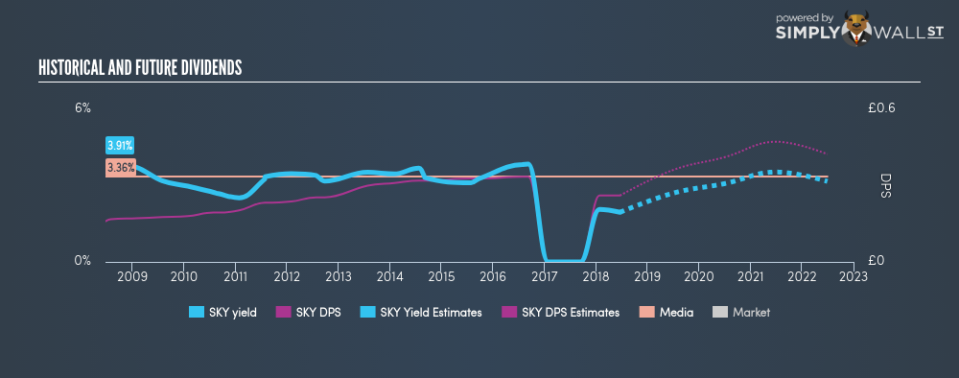

A large part of investment returns can be generated by dividend-paying stock given their role in compounding returns over time. In the past 10 years Sky plc (LON:SKY) has returned an average of 3.00% per year to investors in the form of dividend payouts. Let’s dig deeper into whether Sky should have a place in your portfolio. See our latest analysis for Sky

5 checks you should do on a dividend stock

If you are a dividend investor, you should always assess these five key metrics:

Is its annual yield among the top 25% of dividend-paying companies?

Does it consistently pay out dividends without missing a payment of significantly cutting payout?

Has it increased its dividend per share amount over the past?

Is its earnings sufficient to payout dividend at the current rate?

Will it be able to continue to payout at the current rate in the future?

How well does Sky fit our criteria?

The company currently pays out 27.18% of its earnings as a dividend, according to its trailing twelve-month data, meaning the dividend is sufficiently covered by earnings. In the near future, analysts are predicting a higher payout ratio of 51.72%, leading to a dividend yield of around 2.85%. However, EPS is forecasted to fall to £0.48 in the upcoming year. Therefore, although payout is expected to increase, the fall in earnings may not equate to higher dividend income.

If dividend is a key criteria in your investment consideration, then you need to make sure the dividend stock you’re eyeing out is reliable in its payments. Although SKY’s per share payments have increased in the past 10 years, it has not been a completely smooth ride. Shareholders would have seen a few years of reduced payments in this time.

Compared to its peers, Sky produces a yield of 1.95%, which is on the low-side for Media stocks.

Next Steps:

With this in mind, I definitely rank Sky as a strong dividend stock, and makes it worth further research for anyone who likes steady income generation from their portfolio. Given that this is purely a dividend analysis, I recommend taking sufficient time to understand its core business and determine whether the company and its investment properties suit your overall goals. There are three key aspects you should further examine:

Future Outlook: What are well-informed industry analysts predicting for SKY’s future growth? Take a look at our free research report of analyst consensus for SKY’s outlook.

Valuation: What is SKY worth today? Even if the stock is a cash cow, it’s not worth an infinite price. The intrinsic value infographic in our free research report helps visualize whether SKY is currently mispriced by the market.

Other Dividend Rockstars: Are there better dividend payers with stronger fundamentals out there? Check out our free list of these great stocks here.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance