Skydance Merger Talks and CEO Exit Loom Over Paramount Q1 Earnings

Paramount Global is set to report its quarterly earnings on Monday with an unexpected level of drama surrounding the struggling Hollywood entertainment company.

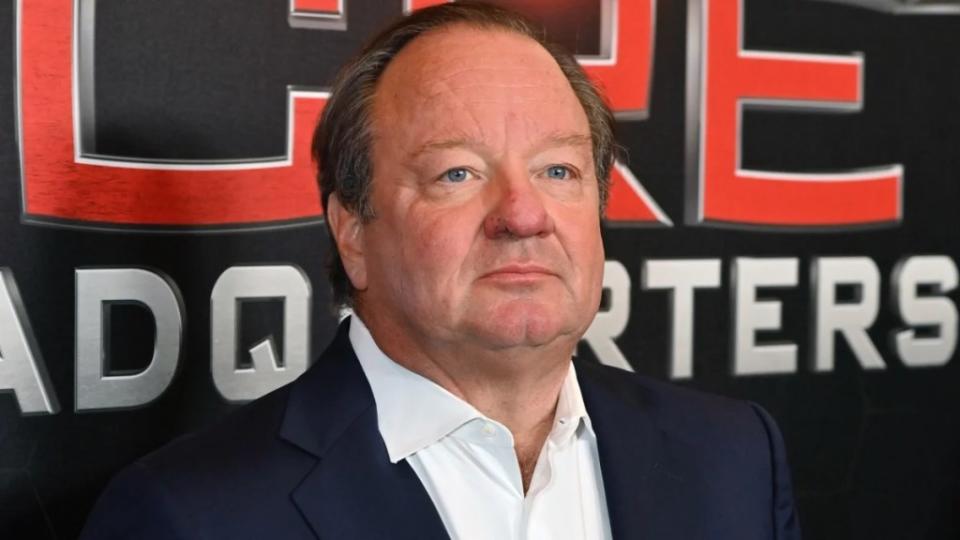

As TheWrap reported on Saturday, insiders at Paramount say the board is prepared to remove CEO Bob Bakish. Investors are clamoring for clarity on the state of Paramount’s conversations with Skydance Media over a possible deal amid reports that Sony is discussing joining Apollo Global Management in a potential joint counterbid.

With the 30-day period of exclusive talks for Skydance to negotiate with Paramount due to end on May 3, “there is considerable uncertainty around Paramount’s future,” Third Bridge senior analyst Jamie Lumley told TheWrap.

“Making a deal sooner rather than later makes sense because the company’s valuation has been on a long slide,” added Insider Intelligence analyst Ross Benes.

Analysts surveyed by Zacks Investment Research expect the company to report earnings of 34 cents per share on revenue of $7.68 billion. As of Friday’s market close, shares of Paramount were trading at $11.91, slightly above its 52-week low of $10.12 hit earlier this month. Paramount’s market capitalization sits at $8.3 billion and it reported $14.6 billion in long-term debt as of the end of 2023.

Paramount shares are up 11% in the past six months, but have fallen 48.4% in the past year and 17% year-to-date.

Bakish Out

Bakish is set to exit his role as CEO on Monday, two insiders familiar with the matter told TheWrap. News of his departure comes after Paramount revealed earlier this month that four of its board members — including three who were on the independent special committee evaluating bids — will not seek reelection at its June 4 annual meeting.

According to The Wall Street Journal, Paramount will establish an “Office of the CEO,” composed of the company’s division heads, to replace Bakish on an interim basis. One of the insiders said that Bakish has already pre-recorded his remarks for the call.

Management will likely look to divert investors’ attention on the call from mergers and acquisitions to Paramount’s efforts to drive earnings growth, reach streaming profitability and reduce debt on its balance sheet.

During its fourth-quarter earnings call, Bakish said the company was on track to reach profitability in its U.S. direct-to-consumer division in 2025. While Paramount’s DTC losses peaked earlier than expected last year, the unit still lost $1.6 billion over the last 12 months. Lumley expects that subscriber growth for Paramount+ will be muted to start the year, emphasizing the “dearth in quality content” since the release of “Top Gun: Maverick” on the service in 2022.

“We think it’s critical that Paramount+ cements itself as one of the winners among streaming platforms and stops being such a weight on the total company,” Morningstar analyst Matthew Dolgin told TheWrap.

“With that said, Paramount’s overall results are still driven by its traditional businesses, so I’ll be looking for some improvement in the TV and film segments. Results have been atrocious in each of those areas in recent quarters, and our contention is that things won’t be this bad forever, which is why we see Paramount as so undervalued,” Dolgin said.

Barclays analyst Kannan Venkateshwar expects Paramount’s licensing revenue to see pressure in the first half of the year and that it’s unlikely to return to pre-strike levels.

“Even though productions are back to normal, the company’s cash flow headwinds have forced licensing volumes to be pared, potentially resulting in lower volumes structurally,” Venkateshwar said. “Also, there is likely to be limited margin upside from licensing going forward because the high margin library shows for the most part have been licensed already while new shows in the licensing pipeline tend to come with much lower margins.”

On the linear side, Dolgin expects Q1 to be a weaker quarter for TV advertising despite the impact of the Super Bowl on CBS, but he anticipates an improvement later in 2024.

S&P Global analyst Scott Robson anticipates a sequential advertising revenue decline of about 10% and will be paying close attention to an update on its carriage renewal negotiations with Charter, an important driver of its affiliate fee revenue moving forward. Paramount “has a lot of networks that are vulnerable to being dropped,” he said. The deadline for those negotiations ends Tuesday.

“Overall, we are not expecting anything that will move the needle, but continued slow and steady progress and an upbeat outlook for 2024 and beyond consistent with the comments from the last few quarters,” Matrix Asset Advisors chief investment officer David Katz told TheWrap.

Skydance vs. Sony-Apollo

An individual familiar with the exclusive negotiations between Skydance and Paramount previously told TheWrap that it is unlikely that a possible deal would close before May 3, though it’s unclear if that window will get extended.

Details surrounding the current offer have angered many shareholders, who argue that it prioritizes the interests of controlling shareholder Shari Redstone and would dilute their own holdings. They’ve urged the Paramount board’s independent special committee to pursue talks with other bidders like Apollo, which was reportedly rebuffed due to concerns around the financing of its $26 billion bid. The private equity firm has since entered talks with Sony about potentially making a new joint bid, though no offer has formally been made.

“The combination of Apollo+Sony is a potential merger partner that can bring much more to the table than Skydance can, and must be considered as a viable and attractive alternative to the sub-optimal Skydance deal being studied during this excessively restrictive period of exclusivity,” Katz wrote in a letter to Paramount’s board on Friday.

Katz urged the board to let exclusive talks with Skydance expire without an agreement and give Apollo and Sony, or other bidders, a fair chance to make a competing offer.

“A cash deal that provides a significant premium to all shareholders now, which better reflects the value that Paramount has built over its long, storied history and the future growth of that value, is far superior to a massively dilutive deal that at best may recover the initial diminution in value at some uncertain point in the distant future,” Katz added.

Any deal for Paramount would need to be approved by the board’s special committee. It would need to appease Redstone, whose National Amusements controls 77% of Paramount’s voting stock. She has suggested a preference for a deal from Skydance that keeps the company’s portfolio of assets together rather than breaking them up.

Redstone has agreed to let the company’s non-voting, minority shareholders have a say on whether any transaction should be approved, an individual familiar with the matter tells TheWrap

Skydance is valued at over $4 billion and has a history with Paramount as a coproducer on projects such as “Top Gun: Maverick” and the “Mission: Impossible” franchise. Under a potential deal, the company would look to recapitalize Paramount, infusing between $4.5 and $5 billion of fresh capital – $2 billion of which would be used to buy out Redstone’s majority stake through National Amusements, while another portion would be used to pay down debt, an individual familiar with negotiations told TheWrap.

Skydance and its consortium of investors, including RedBird Capital Partners and KKR, would have a nearly 50% ownership stake, while the rest of the company would be owned by common shareholders and remain publicly traded. Former NBCUniversal CEO Jeff Shell and Skydance’s Chief Creative Officer Dana Goldberg and President Jesse Sisgold are all expected to have major roles in the combined company, which would be valued at around $5 billion, the individual said.

Skydance’s advantage over Sony and Apollo may be that the board and Redstone see the transaction with Ellison as less risky.

In a note to clients, Wells Fargo analyst Steve Cahall said that foreign ownership of CBS and its owned and operated stations would likely require a review by the FCC and that Apollo’s ownership of the Cox Media group could increase the agency’s scrutiny of a deal. He estimated that Skydance’s deal could imply $13.50 per share and $800 million in pro-forma 2025 merger free cash flow, based on Skydance’s financials disclosed by the Journal, and that multiple expansion is possible if management signals asset sales.

“If the board can justify Skydance, comparable to the CBS-Viacom merger, alternative bids may be wasted breath,” Cahall added.

But Katz argues that Paramount’s current strategy “appears to be progressing” and that forcing Bakish out would be a “meaningful step backward in leadership quality.” The “go-it-alone-and-stay-the-course” option would be better for shareholders than going with Skydance, he added.

While acknowledging that a merger with either Skydance or Sony would make Paramount a “studio powerhouse,” Lumley believes Paramount+ could be an interesting asset for Sony, which has stayed out of the streaming wars to date.

“Although it would reshape its role as a content provider to the rest of the industry, Sony picking up a streaming platform would allow the company to avoid the steep upfront losses necessary to scale the platform and supercharge the service with a broader range of content,” he said.

However, Lumley argued that neither option fully answers the question of what happens to Paramount’s non-studio assets.

“At the end of the day, few companies want to be tasked with running a TV network, cable channels, or money-losing streaming business,” he added.

Making a deal sooner rather than later makes sense because the company’s valuation has been on a long slide.

Insider Intelligence analyst Ross Benes

In a note to clients, Barclays analyst Venkateshwar argued that a merger with Skydance is “unlikely to address any of the core problems” facing the company.

“The ideal solution needs to be a refactoring at an industry level,” he wrote. “An efficient way to accomplish this could be by having a private equity firm as an intermediary in the process to combine assets from different media companies to enable better cash extraction and in salvaging remaining value.”

There’s also a third alternative: nothing changes. In that scenario, Paramount Global would continue on with its current strategy. But Begley said the company will need to get more capital and invest more aggressively if it is going to become a top streaming player.

“The problem for Paramount is that if you lean into trying to grow streaming and reach scale, which is essential, it’s repelling to trying to strengthen your balance sheet and vice versa. It’s very hard to do both at the same time unless you bring in new capital or you sell assets,” Moody’s Ratings senior vice president Neil Begley told TheWrap.

To make the full transition to streaming, Paramount needs to speed up its international expansion and invest more in content ahead of new market launches, Begley said. He added that the company should continue to leverage the free cash flow from its cable and broadcast networks to invest in the transition and offset losses associated with new market launches. Focusing more on an ad-supported model can also help narrow the margin differential between streaming and linear, he said.

“They need to be more aggressive or you have to be prepared to kiss goodbye to the revenues and profits you’ve gotten from your television business and become a straight-up arms dealer,” Begley said.

The post Skydance Merger Talks and CEO Exit Loom Over Paramount Q1 Earnings appeared first on TheWrap.

Yahoo Finance

Yahoo Finance