SkyWest Inc (SKYW) Surpasses Q1 Analyst Earnings and Revenue Forecasts

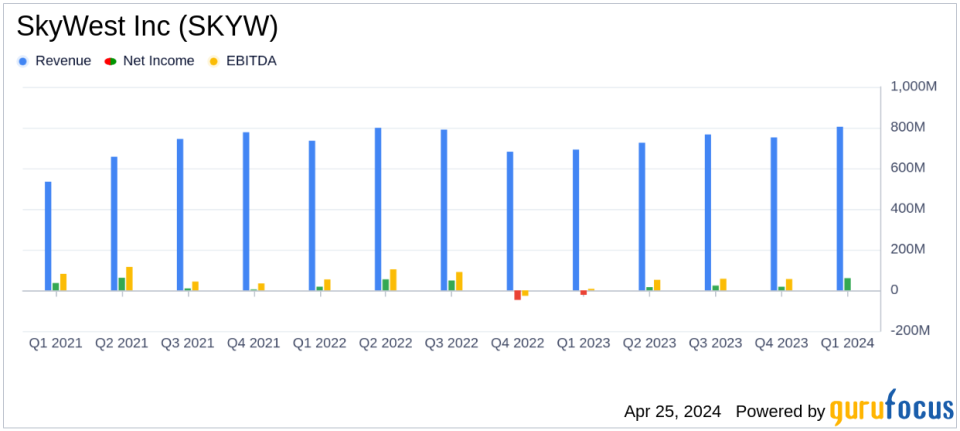

Net Income: Reported at $60 million, a significant recovery from a net loss of $22 million in Q1 2023, surpassing the estimate of $50.30 million.

Earnings Per Share (EPS): Achieved $1.45 per diluted share, exceeding the estimated $1.23.

Revenue: Totaled $804 million, marking a 16% increase from $692 million in Q1 2023, and slightly surpassing the estimate of $800.15 million.

Operating Expenses: Increased marginally to $704 million from $697 million in Q1 2023, driven by a 5% rise in block hour production.

Capital and Liquidity: Ended the quarter with $821 million in cash and marketable securities, a slight decrease from $835 million at the end of 2023.

Share Repurchase: Repurchased 136,000 shares for $8.7 million under the ongoing share repurchase program, with $82 million still available for future buybacks.

Fleet Updates: Scheduled to operate a total of 278 E175 aircraft by the end of 2026, reflecting ongoing fleet expansion and updates.

SkyWest Inc (NASDAQ:SKYW) released its 8-K filing on April 25, 2024, detailing a robust financial performance for the first quarter of 2024. The company reported a net income of $60 million, or $1.45 per diluted share, a significant turnaround from a net loss of $22 million, or $0.45 loss per share, in the same quarter the previous year. These results notably exceeded the analyst estimates which had projected earnings of $1.23 per share and a net income of $50.30 million.

Revenue for the quarter stood at $804 million, up 16% from $692 million in Q1 2023, surpassing the estimated $800.15 million. This increase was attributed to a 5% rise in block hour production, reflecting improved captain availability and operational efficiency despite challenging winter conditions.

Company Overview

SkyWest Inc operates primarily through its subsidiaries, SkyWest Airlines and SkyWest Leasing. The company provides regional air travel and aircraft leasing services across the United States, Canada, Mexico, and the Caribbean. SkyWest Airlines partners with major carriers like United Airlines, Delta Air Lines, American Airlines, and Alaska Airlines, facilitating over 38 million passenger trips in 2023. The airline's fleet includes approximately 500 aircraft, connecting passengers to over 240 destinations.

Operational Highlights and Future Outlook

CEO Chip Childs highlighted the company's enhanced capability to meet partner demands and the commendable performance under adverse weather conditions. Looking ahead, SkyWest is coordinating with major airline partners to optimize the timing of upcoming fleet deliveries, expecting to operate a total of 278 E175 aircraft by the end of 2026.

Despite a slight decrease in cash and marketable securities from $835 million at the end of 2023 to $821 million, SkyWest has maintained a strong liquidity position. The company also continued its share repurchase program, buying back 136,000 shares for $8.7 million during the quarter.

Financial and Operational Metrics

The detailed earnings report shows that total operating expenses were $704 million, a modest increase from $697 million in Q1 2023. This was primarily due to the increased block hour production, offset by lower aircraft rent expenses resulting from early lease buyouts executed in 2023. The company's strategic management of operating costs and capital expenditure, which amounted to $38 million for the quarter, reflects its prudent approach to financial stewardship.

SkyWest's operational efficiency is also evident in its performance metrics, with an adjusted flight completion rate of 99.9% and a passenger load factor of 80.8%, indicating strong operational execution and customer demand.

Conclusion

Overall, SkyWest Inc's Q1 2024 performance has set a positive tone for the year. With strategic fleet expansions and robust partnerships, the company is well-positioned to capitalize on the growing demand for regional air travel. Investors and stakeholders may look forward to continued growth and operational enhancements in the upcoming quarters.

For detailed insights and further information, refer to SkyWest's full earnings report and join their upcoming conference call scheduled for today at 2:30 p.m. Mountain Time.

Explore the complete 8-K earnings release (here) from SkyWest Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance