SkyWest (SKYW) Benefits From Air-Travel Demand Despite Expenses

SkyWest, Inc. (SKYW) is benefiting from an improvement in air-travel demand. The buoyant air-travel demand is helping SkyWest carry more passengers. As a result, the passenger load factor (percentage of seats filled by passengers) is rising.

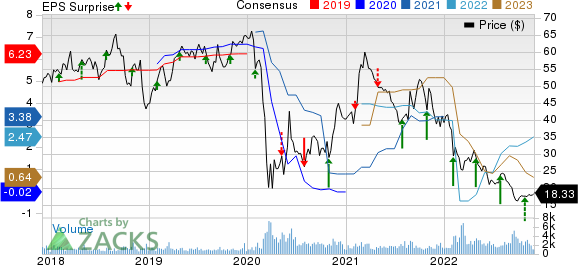

The company recently reported third-quarter 2022 earnings of 96 cents per share, which beat the Zacks Consensus Estimate of 72 cents but declined 34% from the year-ago quarter.

Revenues of $789.4 million missed the Zacks Consensus Estimate of $829.5 million but improved 6% year over year. The uptick was backed by the addition of 33 E175 aircraft to its operations since third-quarter 2021 and the elimination of the COVID-19 partner revenue concessions from third-quarter 2021.

SkyWest, Inc. Price, Consensus and EPS Surprise

SkyWest, Inc. price-consensus-eps-surprise-chart | SkyWest, Inc. Quote

How is SkyWest Doing?

SkyWest's fleet-modernization efforts are commendable. In a bid to modernize its fleet, the company entered an agreement with Delta to purchase and operate 16 E175 aircraft in August. Seven planes were delivered in the third quarter of 2022. Four aircraft are expected to be delivered in fourth-quarter 2022. Three aircraft are expected to get delivered in 2023 and 2024. SkyWest has agreements with most other leading airlines.

With an improvement in air-travel demand, SkyWest had 18.4% more passengers in the first nine months of 2022 compared with the year-ago level. As a result, the passenger load factor expanded 10.9 percentage points to 82.9% in the first nine months of 2022. With air-travel demand continuing to improve, the load factor is likely to be impressive in the remaining quarters of 2022.

On the flip side, rising operating expenses raise concerns for SkyWest. In the first nine months of 2022, expenses on salary, wages and benefits increased 24.7% year over year. Aircraft fuel costs increased 9.6% in the first nine months of 2022, with oil prices moving north. Due to the increase in the components, total operating costs (up 24.5% in the first nine months of 2022) are escalating and limiting bottom-line growth. The fact that more planes are in operation to meet the spike in demand for air travel also contributed to the rise in fuel expenses.

Zacks Rank and Stocks to Consider

Currently, SkyWest carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks from the broader Zacks Transportation sector are Air Transport Services Group (ATSG), Ryder Systems (R) and Teekay Tankers Ltd. (TNK), each currently carrying a Zacks Rank #2 (Buy).

ATSG has an expected earnings growth rate of 34.34% for the current year. ATSG delivered a trailing four-quarter earnings surprise of 17.78%, on average.

The Zacks Consensus Estimate for ATSG’s current-year earnings has improved 5.2% over the past 90 days. Shares of ATSG have gained 7.9% over the past year.

Ryder has an expected earnings growth rate of 67.12% for the current year. R delivered a trailing four-quarter earnings surprise of 30.13%, on average.

The Zacks Consensus Estimate for R’s current-year earnings has improved 6.9% over the past 90 days. Shares of R have gained 12.7% over the past year.

Teekay Tankers has an expected earnings growth rate of 214.91% for the current year. TNK delivered a trailing four-quarter earnings surprise of 42.23%, on average. Teekay Tankers has a long-term expected growth rate of 3%.

The Zacks Consensus Estimate for TNK’s current-year earnings has improved 95% over the past 90 days. Shares of TNK have soared 190% over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryder System, Inc. (R) : Free Stock Analysis Report

Air Transport Services Group, Inc (ATSG) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

Teekay Tankers Ltd. (TNK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance