SL Green (SLG) Signs 104K Sq. Ft New Leases at One Madison Avenue

SL Green Realty Corp. SLG recently announced the signing of leases with three new tenants aggregating 104,110 square feet at One Madison Avenue. This reflects the solid demand for this property.

Among these deals is a new 11-year lease with a publicly traded financial services company for 67,208-square-foot on two tower floors.

A Mobile Sports-Tech Entertainment company, a subsidiary of Flutter Entertainment, signed a new 12-year lease totaling 35,898-square-foot on the entire 23rd floor.

Moreover, ALIDORO, an Italian specialty sandwich store, signed a new 12-year lease for a portion of the ground floor covering 1,004-square-foot. This lease is part of a curated retail market strategy that aims to add authentic New York food and beverage providers to serve the building’s tenants.

One Madison Avenue is a new office tower covering 1.4 million square feet in Manhattan’s Midtown South submarket. The tower is now 63.6% leased, with the lease-up of all tower floors completed.

Additionally, SL Green unveiled additions, namely, Le Jardin sur Madison and La Tête d’Or by Daniel, that promise to elevate the culinary experience in the heart of Manhattan.

Located on the building’s 28th floor, Le Jardin sur Madison is a 6,200-square-foot event space together with a lushly landscaped 5,000-square-foot rooftop garden. In day time, in Le Jardin sur Madison, One Madison tenants can have access to conduct meetings, while the rooftop will be available in the evening for private parties and a variety of events.

On the other hand, blended with the classic Parisian dining scene, La Tête d’Or by Daniel, will feature a 150-person main dining area, a cocktail bar in a lounge, a private dining room and an exclusive private omakase steak and seafood table for one-of-a-kind dining experience. This new restaurant is scheduled to open in November 2024, to the public.

Although overall demand for office spaces in some markets is likely to remain subdued in the near term, given tenants’ healthy demand for premier office spaces with class-apart amenities, SL Green is well-poised for growth over the long term.

SL Green owns a portfolio of high-quality and well-amenitized office properties in New York City. For its Manhattan portfolio, SL Green signed 160 office leases encompassing 1,776,414 square feet of space in 2023. For the same period, the mark-to-market on signed Manhattan office leases was 0.8%, higher than the previous fully escalated rents on the same spaces. As of Dec 31, 2023, its Manhattan same-store office occupancy, including 177,836 square feet of leases signed but not yet commenced, was 90.0%.

With encouraging leases executed over the past few quarters, the company remains well-positioned to navigate the challenging environment. Its long-term leases with a diverse tenant base, with a strong credit profile assure stable rental revenues.

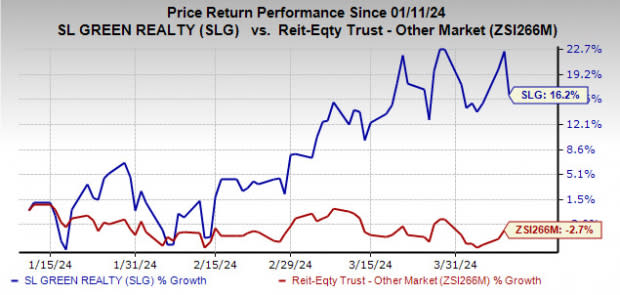

Over the past three months, shares of this Zacks Rank #2 (Buy) company have rallied 16.2% against the industry’s decline of 2.7%.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks from the broader REIT sector are OUTFRONT Media OUT and Welltower WELL, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for OUT’s 2024 funds from operations (FFO) per share has been raised marginally upward over the past month to $1.68.

The consensus estimate for WELL’s current-year FFO per share has moved marginally northward over the past week to $4.03.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SL Green Realty Corporation (SLG) : Free Stock Analysis Report

OUTFRONT Media Inc. (OUT) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance