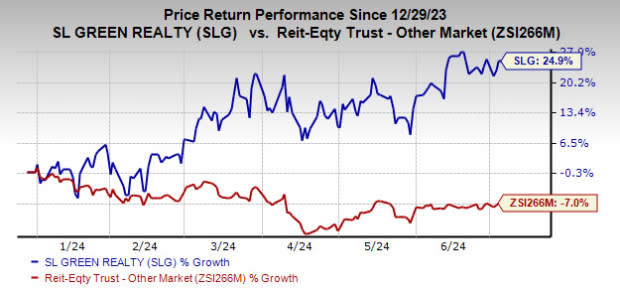

SL Green (SLG) Stock Rises 24.9% Year to Date: Here's How

Shares of SL Green Realty Corp. (SLG) have gained 24.9% in the year-to-date period against the industry’s decline of 7%.

This New York-based office real estate investment trust’s (REIT) portfolio of high-quality and well-amenitized office properties is well-poised to ride the growth curve. Its long-term leases, with a diverse tenant base, assure stable rental revenues. Its focus on an opportunistic investment policy is encouraging.

Image Source: Zacks Investment Research

Let us decipher the factors behind the surge in the stock price.

SLG is witnessing healthy leasing demand for its properties as tenants’ demand for premium office spaces continues to grow. In the first quarter, it signed 60 office leases for its Manhattan office portfolio, encompassing 633,660 square feet.

In April 2024, SL Green announced the signing of leases with three new tenants aggregating 104,110 square feet at One Madison Avenue. With encouraging leases executed over the past few quarters, several new names have been added to SL Green’s tenant roster.

Given that office space demand in the upcoming period is likely to be driven by de-densification to allow higher square footage per office worker and the need for high-quality, well-amenitized office properties, SLG remains well-positioned to capitalize on the favorable trend.

Moreover, this office REIT, carrying a Zacks Rank #3 (Hold), aims to maintain a diversified tenant base to hedge the risk associated with dependency on single-industry tenants.

As of Mar 31, 2024, except for Paramount Global, which accounted for 5.5% of the company’s share of annualized cash rent, no other tenant in the company’s portfolio accounted for more than 5% of its share of annualized cash rent, including its share of joint venture annualized cash rent.

With long-term leases from tenants with a strong credit profile, it is well-poised to generate stable rental revenues over the long term. Although, amid a choppy office real estate environment, we expect a decrease in the company’s net rental revenues in 2024 from the prior-year levels. The metric is likely to rise 3.4% in 2025.

SL Green has been following an opportunistic investment policy to enhance its overall portfolio quality. It divests mature and non-core assets and utilizes the proceeds to fund development projects and share buybacks. Such efforts highlight its prudent capital-management practices and will relieve pressure from its balance sheet.

In January 2024, SL Green closed the sale of a retail condominium, along with its partner, at 717 Fifth Avenue for $963 million. The transaction generated net proceeds of $27 million, which was used for corporate debt repayment.

Over the years, the large-scale sub-urban asset sale has helped it to narrow its focus on the Manhattan market, as well as retain premium and highest-growth assets in the portfolio.

However, the elevated supply of office properties in its markets remains a concern, and it could limit pricing power and hurt occupancy. The elevated interest rate environment adds to its woes.

Stocks to Consider

Some better-ranked stocks from the broader REIT sector are Alexandria Real Estate Equities ARE and Americold Realty Trust COLD, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for ARE’s 2024 FFO per share stands at $9.49, indicating an increase of 5.8% from the year-ago reported figure.

The Zacks Consensus Estimate for COLD’s 2024 FFO per share is pinned at $1.44, suggesting year-over-year growth of 13.4%.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

Americold Realty Trust Inc. (COLD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance