A Sliding Share Price Has Us Looking At Goodwin PLC's (LON:GDWN) P/E Ratio

Unfortunately for some shareholders, the Goodwin (LON:GDWN) share price has dived 36% in the last thirty days. The recent drop has obliterated the annual return, with the share price now down 28% over that longer period.

Assuming nothing else has changed, a lower share price makes a stock more attractive to potential buyers. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). So, on certain occasions, long term focussed investors try to take advantage of pessimistic expectations to buy shares at a better price. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). A high P/E ratio means that investors have a high expectation about future growth, while a low P/E ratio means they have low expectations about future growth.

View our latest analysis for Goodwin

How Does Goodwin's P/E Ratio Compare To Its Peers?

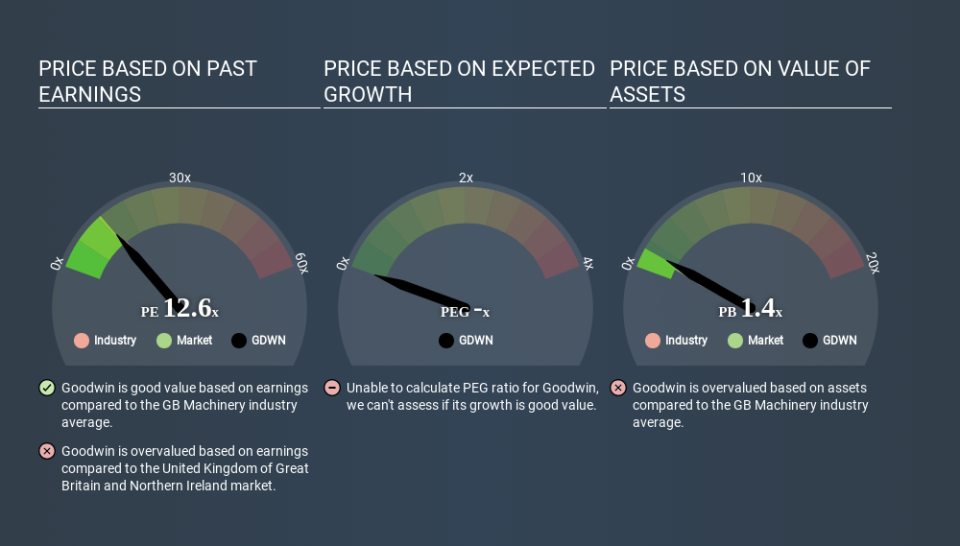

Goodwin has a P/E ratio of 12.61. As you can see below Goodwin has a P/E ratio that is fairly close for the average for the machinery industry, which is 13.5.

Goodwin's P/E tells us that market participants think its prospects are roughly in line with its industry. So if Goodwin actually outperforms its peers going forward, that should be a positive for the share price. Further research into factors such as insider buying and selling, could help you form your own view on whether that is likely.

How Growth Rates Impact P/E Ratios

Earnings growth rates have a big influence on P/E ratios. Earnings growth means that in the future the 'E' will be higher. That means even if the current P/E is high, it will reduce over time if the share price stays flat. So while a stock may look expensive based on past earnings, it could be cheap based on future earnings.

Goodwin increased earnings per share by an impressive 17% over the last twelve months. And earnings per share have improved by 13% annually, over the last three years. So one might expect an above average P/E ratio. In contrast, EPS has decreased by 10%, annually, over 5 years.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

Don't forget that the P/E ratio considers market capitalization. In other words, it does not consider any debt or cash that the company may have on the balance sheet. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

Goodwin's Balance Sheet

Goodwin's net debt is 13% of its market cap. That's enough debt to impact the P/E ratio a little; so keep it in mind if you're comparing it to companies without debt.

The Bottom Line On Goodwin's P/E Ratio

Goodwin's P/E is 12.6 which is about average (12.7) in the GB market. When you consider the impressive EPS growth last year (along with some debt), it seems the market has questions about whether rapid EPS growth will be sustained. What can be absolutely certain is that the market has become significantly less optimistic about Goodwin over the last month, with the P/E ratio falling from 19.8 back then to 12.6 today. For those who don't like to trade against momentum, that could be a warning sign, but a contrarian investor might want to take a closer look.

Investors should be looking to buy stocks that the market is wrong about. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. Although we don't have analyst forecasts you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with modest (or no) debt, trading on a P/E below 20.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance