Lending seized up in the second quarter: Morning Brief

Wednesday, August 5, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET.

The Fed can only do so much to help the economy.

Bank lending collapsed in the second quarter.

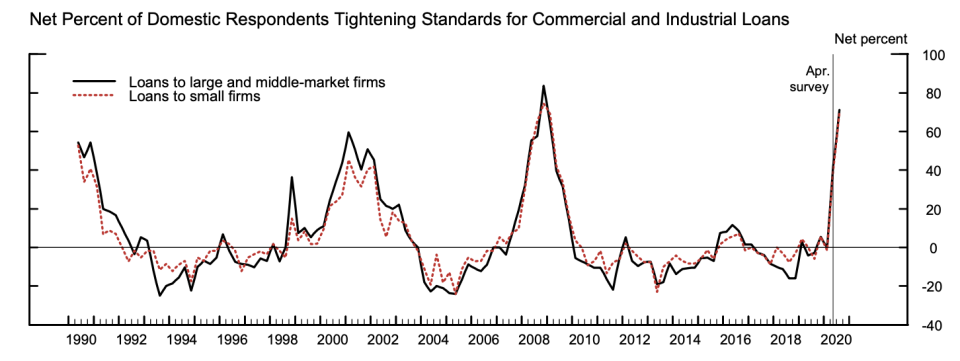

According to the latest Senior Loan Officer Opinion Survey — or SLOOS report — from the Federal Reserve published Monday, bank lending during Q2 tightened by the most since the financial crisis.

Across all parts of the commercial lending business and all ares of consumer lending except housing, banks tightened standards and saw demand plunge during the months covering the most acute phase of the pandemic crisis.

Only residential real estate, essentially the mortgage market, has seen increased demand, though standards still rose sharply during the last few months. This increase in lending is consistent with the strong housing market data we’ve tracked through the summer.

“Overall, the results of the July SLOOS are consistent with a much more uncertain economic outlook as businesses and households pull back on borrowing and lending standards tighten,” said Lewis Alexander, chief U.S. economist at Nomura.

“The results suggest stronger headwinds for business investment, although the resilience of [residential real estate] loan demand suggests an uneven impact across consumers.”

And the pullback in the commercial side showed worries about the business sector come from all directions.

“Major net shares of banks that reported reasons for tightening lending standards or terms cited a less favorable or more uncertain economic outlook, worsening of industry-specific problems, and reduced tolerance for risk as important reasons for doing so,” the SLOOS report said.

“Significant net shares of banks also mentioned deterioration in the bank’s current or expected capital position; less aggressive competition from other banks or nonbank lenders; decreased liquidity in the secondary market for C&I loans; and increased concerns about the effects of legislative changes, supervisory actions, or changes in accounting standards.”

In short, just about any macro, industry-specific, or regulatory concern that banks address when extending credit was cited as a concern when it came to business lending. And while banks tend to ease standards quickly when recessions end, the second quarter shows lenders were still very much on recession footing. Even though many economists see the second quarter as the trough of the current drop in activity.

And this report also reminds investors that while Fed policy may help heal financial markets to some degree, the real economy is driven by fiscal policy not monetary policy. Consumers did get a boost from extra unemployment benefits and one-time stimulus payments through the CARES Act, but outside of homeowners refinancing mortgages are still not seeing a huge impact from what’s happening at the Fed.

“The pandemic is a fiscal policy problem rather than a central bank policy problem,” said UBS strategist Paul Donovan in a note to clients on Tuesday.

“Lockdowns meant government policy took away peoples' incomes. Fiscal policy needed to replace those incomes. The Federal Reserve's Senior Loan Officers' survey emphasized the limits on what central bank policy can do – credit conditions tightened, signaling that banks are cautious about transmitting policy to the economy.”

Cash transfers can keep consumers spending and meeting some (but not all) of their obligations. This at least keeps the economy sputtering along.

But bank lending — and the curtailment of this credit extension — is where we see signs of just how sharply the economy contracted, how aggressively lenders have hunkered down, how fast borrowers dried up, and how long the road ahead is to get the economy back to full strength.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him at @MylesUdland

What to watch today

Economy

7:00 a.m. ET: MBA mortgage applications, week ended July 31 (-0.8% prior week)

8:15 a.m. ET: ADP employment change, July (1.2 million expected, 2.369 million in June)

8:30 a.m. ET: Trade balance, June (-$50.2 billion expected, -$54.6 billion in May)

9:45 a.m. ET: Markit US services PMI, July final (49.6 expected, 49.6 prior)

9:45 a.m. ET: Markit US composite PMI, July final (50.0 prior)

10:00 a.m. ET: ISM non-manufacturing index, July (55.0 expected; 57.1 in June)

Earnings

Pre-market

6:30 a.m. ET: CVS (CVS) is expected to report adjusted earnings of $1.91 per share on revenue of $64.23 billion

6:30 a.m. ET: Nielsen Holdings (NLSN) is expected to report adjusted earnings of 31 cents per share on revenue of $1.49 billion

6:30 a.m. ET: Regeneron Pharmaceutical (REGN) is expected to report adjusted earnings of $5.88 per share on revenue of $1.74 billion

7:00 a.m. ET: Discovery (DISCA) is expected to report adjusted earnings of 71 cents per share on revenue of $2.5 billion

7:00 a.m. ET: Wayfair (W) is expected to report adjusted earnings of 93 cents per share on revenue of $4.1 billion

7:00 a.m. ET: The New York Times (NYT) is expected to report adjusted earnings of 1 cent per share on revenue of $387.2 million

7:00 a.m. ET: Moderna (MRNA) is expected to report an adjusted loss of 33 cents per share on revenue of $27.5 million

7:30 a.m. ET: Sinclair Broadcast Group (SBGI) is expected to report adjusted earnings of $4.88 per share on revenue of $1.43 billion

Post-market

4:00 p.m. ET: Roku (ROKU) is expected to report an adjusted loss of 54 cents per share on revenue of $314.8 million

4:05 p.m. ET: Sonos (SONO) is expected to report an adjusted loss of 13 cents on revenue of $235.71 million

4:05 p.m. ET: Etsy (ETSY) is expected to report adjusted earnings of 47 cents per share on revenue of $330 million

4:05 p.m. ET: Live Nation Entertainment (LYV) is expected to report an adjusted loss of $1.99 per share on revenue of $367.55 million

5:05 p.m. ET: Marathon Oil (MRO) is expected to report an adjusted loss of 64 cents per share on revenue of $544.29 million

Top News

Disney adjusted EPS top expectations, despite widespread theme park closures [Yahoo Finance]

Novavax coronavirus vaccine induces immune response in small study [Reuters]

U.S. to investigate Kodak's government loan deal, Trump says [Reuters]

Beyond Meat Q2 earnings meet expectations, CEO sees strong retail trends [Yahoo Finance]

Planet Fitness reports bigger quarterly loss than expected; CEO aims to get people safely back to gym [Yahoo Finance]

YAHOO FINANCE HIGHLIGHTS

Why experts doubt Trump's demand for a TikTok 'side payment' will hold water

Showdowns over the Postal Service loom as a union chief says Trump is ‘scapegoating’ members

Rental car cleaning undergoes massive overhaul amid pandemic

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay

Yahoo Finance

Yahoo Finance