Smaller banks will lose out as big lenders bounce back, claims RBS boss

Britain’s challenger banks will struggle to compete against the resurgent big six lenders, RBS chief Ross McEwan has said ahead of a contest for an £833m competition fund stumped up by the bank.

Mr McEwan played down the threat posed by the growing band of challenger banks during a “fireside chat” at an event in the City today.

The boss of the taxpayer-owned bank said small lenders would struggle as larger rivals such as RBS picked up speed after a decade of hefty restructuring and misconduct costs following the financial crisis.

“Everyone said the new challengers will do it. I think the big banks create the competition,” he told the Bank of America Merrill Lynch annual financial CEO conference.

Mr McEwan said challenger banks would struggle to compete now the big six were “fully capitalised with plenty of liquidity and it’s creating competition”.

“I think it makes it more difficult for smaller players at that point in time,” he said. “I’m not trying to be unfair, but for the last 10 years we’ve had two hands tied behind our back being bashed up in this marketplace because we’ve had issues to sort out for ourselves.

“All of a sudden you’re seeing players that have had to fix themselves back into this marketplace with liquidity. We’re not the only one.

For the last 10 years we’ve had two hands tied behind our back being bashed up in this marketplace because we’ve had issues to sort out for ourselves

Ross McEwan, RBS CEO

“That’s creating a very competitive marketplace and the losers out of that I suspect will be those who are smaller banks.”

The UK banking market is still dominated by just six banks - including Barclays, Lloyds, HSBC, Santander and Nationwide - despite repeated efforts by politicians and regulators to shake up the market.

The comments come at an awkward time for RBS as challenger banks prepare to be briefed tomorrow on the details of a contest for £833m of its funding designed to boost competition in business banking.

Regulators have forced RBS to carve out the money as the price of keeping subsidiary Williams & Glyn.

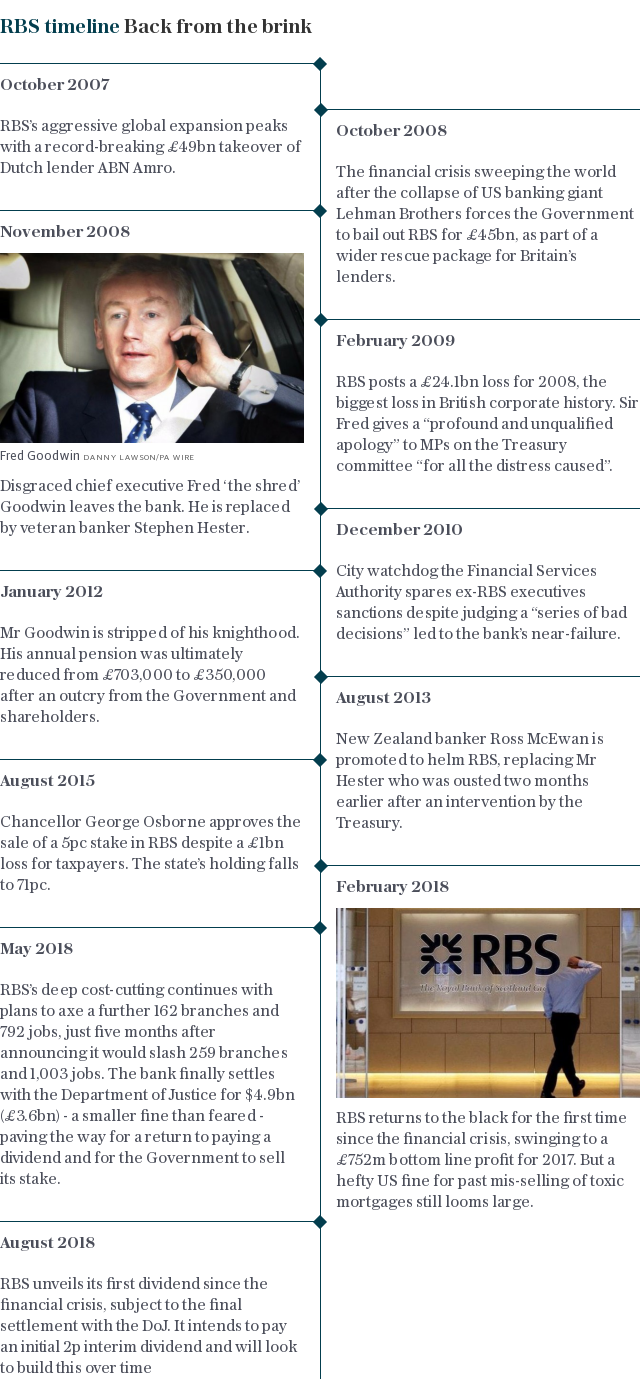

Brussels had originally demanded that RBS spin out 300 branches because the bank received a £45bn bailout during the financial crisis, but the plan proved too technically demanding.

Smaller banks including TSB and Clydesdale have outlined their plans for the cash in recent weeks should they win part of the fund.

Mr McEwan also noted many smaller lenders had borrowed large chunks of cheap Bank of England funding relative to their balance sheet size under the £127bn Term Funding Scheme that closed earlier this year.

He suggested this would put additional “pressures” on those banks as they had to repay the funds over the next four years.

Mr McEwan also told the event cyber attacks and fraud were now the “number one risk for the bank” and it had to keep its “guard up” against hackers.

Figures from bank trade body UK Finance showed customers lost more than £500m from scams in the first half of this year alone.

The RBS boss confirmed the bank was keen to use surplus capital to increase its dividend and was working on a share buyback to help reduce the Government’s remaining 62pc stake.

But he said the bank would proceed cautiously. “We remember what we did 10 years ago so we’re not going to rush around throwing capital all over the place,” he said.

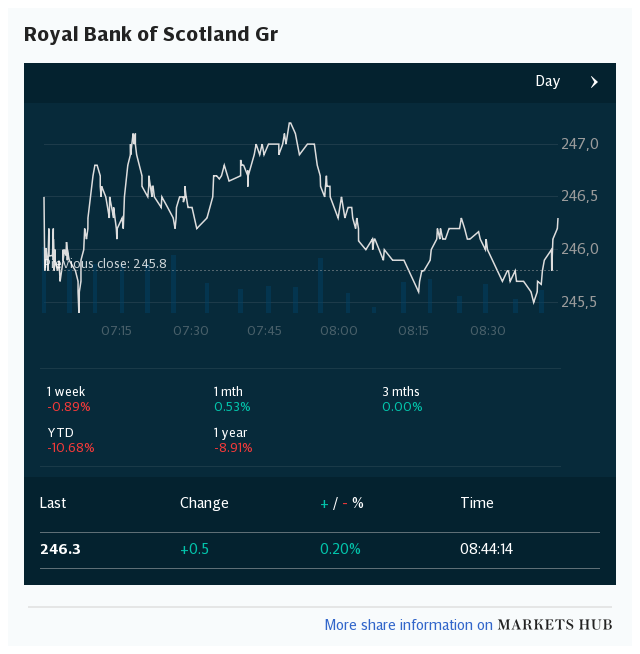

Yahoo Finance

Yahoo Finance