Was The Smart Money Right About Embracing Caesars Entertainment, Inc. (CZR)?

While the market driven by short-term sentiment influenced by the accommodative interest rate environment in the US, virus news and stimulus talks, many smart money investors are starting to get cautious towards the current bull run since March and hedging or reducing many of their long positions. Some fund managers are betting on Dow hitting 30,000 to generate strong returns. However, as we know, big investors usually buy stocks with strong fundamentals that can deliver gains both in bull and bear markets, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Caesars Entertainment, Inc. (NASDAQ:CZR).

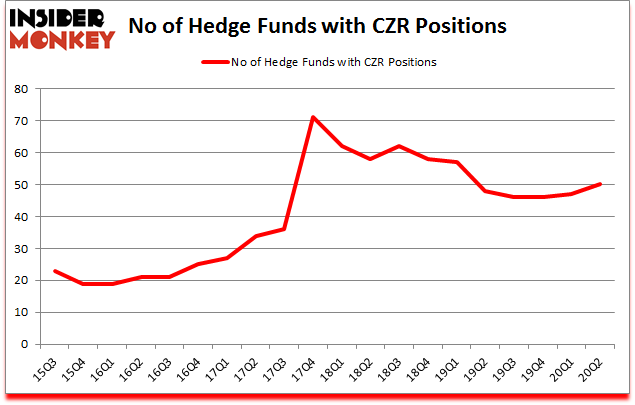

Caesars Entertainment, Inc. (NASDAQ:CZR) has seen an increase in activity from the world's largest hedge funds in recent months. Caesars Entertainment, Inc. (NASDAQ:CZR) was in 50 hedge funds' portfolios at the end of June. The all time high for this statistics is 71. Our calculations also showed that CZR isn't among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Today there are many gauges stock market investors put to use to size up stocks. Two of the most innovative gauges are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the top picks of the best fund managers can beat the S&P 500 by a superb amount (see the details here).

Joshua Friedman of Canyon Capital Advisors

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than quadrupled this year. We are trying to identify other EV revolution winners, so we are checking out this under-the-radar lithium stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. With all of this in mind let's take a glance at the recent hedge fund action regarding Caesars Entertainment, Inc. (NASDAQ:CZR).

How have hedgies been trading Caesars Entertainment, Inc. (NASDAQ:CZR)?

At Q2's end, a total of 50 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 6% from the previous quarter. The graph below displays the number of hedge funds with bullish position in CZR over the last 20 quarters. With the smart money's capital changing hands, there exists an "upper tier" of key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

According to Insider Monkey's hedge fund database, Carl Icahn's Icahn Capital LP has the biggest position in Caesars Entertainment, Inc. (NASDAQ:CZR), worth close to $1.3859 billion, comprising 7% of its total 13F portfolio. Sitting at the No. 2 spot is Joshua Friedman and Mitchell Julis of Canyon Capital Advisors, with a $328.8 million position; the fund has 11% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that are bullish consist of Simon Davies's Sand Grove Capital Partners, Ben Levine, Andrew Manuel and Stefan Renold's LMR Partners and Howard Marks's Oaktree Capital Management. In terms of the portfolio weights assigned to each position Sand Grove Capital Partners allocated the biggest weight to Caesars Entertainment, Inc. (NASDAQ:CZR), around 46.21% of its 13F portfolio. Beryl Capital Management is also relatively very bullish on the stock, dishing out 34.48 percent of its 13F equity portfolio to CZR.

As one would reasonably expect, specific money managers have jumped into Caesars Entertainment, Inc. (NASDAQ:CZR) headfirst. LMR Partners, managed by Ben Levine, Andrew Manuel and Stefan Renold, assembled the biggest position in Caesars Entertainment, Inc. (NASDAQ:CZR). LMR Partners had $185.3 million invested in the company at the end of the quarter. Farallon Capital also made a $97.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Anand Parekh's Alyeska Investment Group, Clint Carlson's Carlson Capital, and Andrew Weiss's Weiss Asset Management.

Let's now take a look at hedge fund activity in other stocks similar to Caesars Entertainment, Inc. (NASDAQ:CZR). We will take a look at MGM Resorts International (NYSE:MGM), Carnival Corporation & plc (NYSE:CUK), Pinnacle West Capital Corporation (NYSE:PNW), Everest Re Group Ltd (NYSE:RE), Phillips 66 Partners LP (NYSE:PSXP), Ionis Pharmaceuticals, Inc. (NASDAQ:IONS), and Albemarle Corporation (NYSE:ALB). This group of stocks' market values resemble CZR's market value.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position MGM,32,1006863,-18 CUK,14,72014,5 PNW,25,753260,0 RE,29,585163,2 PSXP,6,29854,1 IONS,23,387779,1 ALB,25,66986,1 Average,22,414560,-1.1 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $415 million. That figure was $3912 million in CZR's case. MGM Resorts International (NYSE:MGM) is the most popular stock in this table. On the other hand Phillips 66 Partners LP (NYSE:PSXP) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Caesars Entertainment, Inc. (NASDAQ:CZR) is more popular among hedge funds. Our overall hedge fund sentiment score for CZR is 79.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 30% in 2020 through October 23rd but still managed to beat the market by 21 percentage points. Hedge funds were also right about betting on CZR as the stock outperformed the market by an even larger margin since the end of the second quarter. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Get real-time email alerts: Follow Caesars Holdings Inc. (NASDAQ:CZR)

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

Yahoo Finance

Yahoo Finance