SNAP Might Cease Development of Pixy Flying Selfie Drone

Snap Inc. SNAP is shutting down the production of Pixy, a drone-powered camera that can record videos and photos for sharing on Snapchat, just four months after its launch, per a Wall Street Journal report.

Snap, which calls itself a camera company on its website, has been trying to break into hardware, most notably through several iterations of Spectacles sunglasses with built-in cameras.

The Pixy selfie drone was designed to float around and capture footage, set to a pre-determined flight path. The 3.6-ounce device measures 131.7mm x 106mm x 17.6mm and includes a rechargeable lithium-ion battery.

The Pixy’s $230 entry price includes a bumper, battery, carrying strap, a battery, and USB-C cable. A $250 bundle includes two additional batteries, and each battery holds 5-8 flights using the default flight modes.

Pixy remains available for purchase in the United States and France, presumably until inventory runs out.

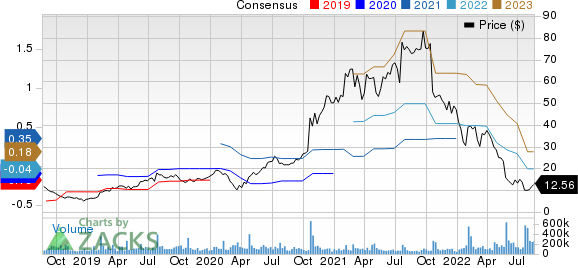

Snap Inc. Price and Consensus

Snap Inc. price-consensus-chart | Snap Inc. Quote

Snap Battles Poor Ad Revenues, Challenging Macro Environment

SNAP second-quarter results reflected a decrease in advertising demand as advertisers continue to face supply-chain disruptions and labor shortages amid steady user growth. Shares of the company have fallen 72.7% in the year-to-date period compared with the Zacks Internet-Software industry’s decline of 53.3% and the Zacks Computer and Technology sector’s decrease of 32.3% in the said time frame.

The company is also reportedly planning a wave of layoffs as part of broader cost-cutting efforts. As of the end of June 2022, the social messaging and media company had 6,446 full-time employees, up 38% year over year.

This development comes after IT companies, crypto exchanges and financial firms cut out jobs and slowed down the hiring process due to slow global economic growth caused by higher interest rates, rising inflation and an energy crisis in Europe.

Several tech companies recently announced hiring freezes and layoffs, such as Facebook’s parent company, Meta Platforms META, Twitter TWTR and Microsoft MSFT

Meta is limiting its intake of new employees to cut costs due to weak revenue forecasts. Meta expects total revenues between $26 billion and $28.5 billion for the third quarter of 2022. Unfavorable forex is expected to hurt year-over-year top-line growth by 6%. Facebook's parent company is pausing or slowing down hiring for most mid-to-senior level positions after announcing a strategy to expand into the metaverse. The social media giant has 83,553 employees worldwide.

Last month, Twitter announced the layoff of 30% of employees from its recruitment team amid the $44 billion takeover by Elon Musk. The micro-blogging platform had earlier announced halting most hiring processes across various divisions as part of a broader attempt to cut costs.

Microsoft is slowing down hiring for its Office, Windows, and Teams groups to better prepare itself for the coming fiscal year and contend with the current economic environment. Microsoft’s fourth-quarter earnings were negatively impacted by a sharp slowdown in its cloud business, declining videogame sales and the effects of a strong dollar.

In May, Snap also issued a profit warning due to a worsening macroeconomic environment. This Zacks Rank #4 (Sell) company will significantly slow hiring, invest in its advertising business and find new sources of revenues in order to grow at a faster pace in the near term.

Snap has found early success with its paid subscription service Snapchat+, which has reached 1 million subscribers since its launch on Jun 29. The company is focused on introducing several features to retain existing users and attract new ones to its platform.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Twitter, Inc. (TWTR) : Free Stock Analysis Report

Snap Inc. (SNAP) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance