Snap-on (SNA) Q4 Earnings Surpass Estimates, Sales Miss

Snap-on Incorporated SNA reported earnings of $3.08 per share in fourth-quarter 2019, in line with the Zacks Consensus Estimate. However, the figure was up 1.7% from the year-ago adjusted earnings of $3.03 per share.

Earnings benefited from Snap-on’s robust business model and effectiveness of its value-creation processes. Improved sales in U.S. operations and overall organic sales growth boosted the company’s quarterly performance.

Net sales inched up 0.3% to $955.2 million but lagged the Zacks Consensus Estimate of $963.3 million. The year-over-year increase can be attributed to 0.6% organic sales growth and $3.5-million contribution from acquisitions. However, the growth was offset by $6.3-million adverse impact from foreign currency translations.

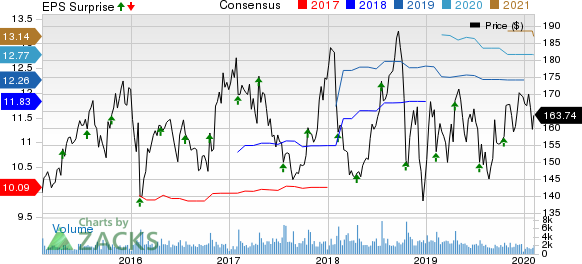

Snap-On Incorporated Price, Consensus and EPS Surprise

Snap-On Incorporated price-consensus-eps-surprise-chart | Snap-On Incorporated Quote

Further, the company’s operating earnings before financial services totaled $171.4 million, down 5.9% from $182.1 million in the prior-year quarter.

Consolidated operating earnings of $233.6 million were down 1.9% from the prior-year quarter. Additionally, operating earnings margin contracted 50 basis points to 22.5%.

Segmental Details

Sales at Commercial & Industrial Group improved 2.7% from the prior-year quarter to $352.9 million, backed by organic sales growth of 3.5% and contribution of $0.9 million from acquisition-related sales. Robust sales at the division’s power tools and Asia Pacific operations aided organic sales. Notably, higher sales to customers in critical industries also contributed to the increase. The upside was somewhat offset by $3.5-million adverse impact from foreign currency.

The Tools Group segment’s sales rose 1.1% year over year to $411.7 million, driven by 1.3% growth in organic sales, offset by $1-million impact of currency headwinds. Organic sales benefited from robust sales in the U.S. van network, partially negated by a decline in the segment’s international operations.

Sales at Repair Systems & Information Group declined 1.4% year over year to $335 million. Moreover, organic sales at the segment dipped 1.5% from the year-ago quarter, owing to lower sales to OEM dealerships, offset by rise in sales of undercar equipment, and higher sales of diagnostics and repair information products to independent repair shop owners and managers. Further, unfavorable currency rates hurt top-line growth to the tune of $2.3 million. However, sales of $2.6 million from buyouts aided growth.

Meanwhile, the Financial Services business reported revenues of $83.9 million, up from $82.7 million in the year-ago quarter.

Financials

At the end of 2019, Snap-on’s cash and cash equivalents totaled $184.5 million compared with $140.9 million as of Dec 29, 2018.

Looking Ahead

In 2020, which is its 100th anniversary year, the company expects to deliver coherent growth and leverage capabilities demonstrated in the automotive repair arena. It also expects to develop and expand the professional customer base in the automotive repair business, as well as in adjacent industries, additional geographies and other areas like critical industries. Backed by these initiatives, the company expects capital expenditure within $90-$100 million for 2020.

Further, its effective income tax rate for 2020 is projected in the range of 23-24%.

Price Performance

In the past three months, shares of this Zacks Rank #3 (Hold) company have declined 1.9% against the industry's 1.6% growth.

3 Better-Ranked Consumer Discretionary Stocks

The Toro Company TTC has an impressive long-term earnings growth rate of 10%. Currently, it holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

lululemon athletica inc LULU has an impressive long-term earnings growth rate of 18.9% and a Zacks Rank #2.

NIKE, Inc. NKE has an expected long-term earnings growth rate of 13.9% and a Zacks Rank #2, at present.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

NIKE, Inc. (NKE) : Free Stock Analysis Report

Snap-On Incorporated (SNA) : Free Stock Analysis Report

Toro Company (The) (TTC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance